AxelAdlerJr

No content yet

AxelAdlerJr

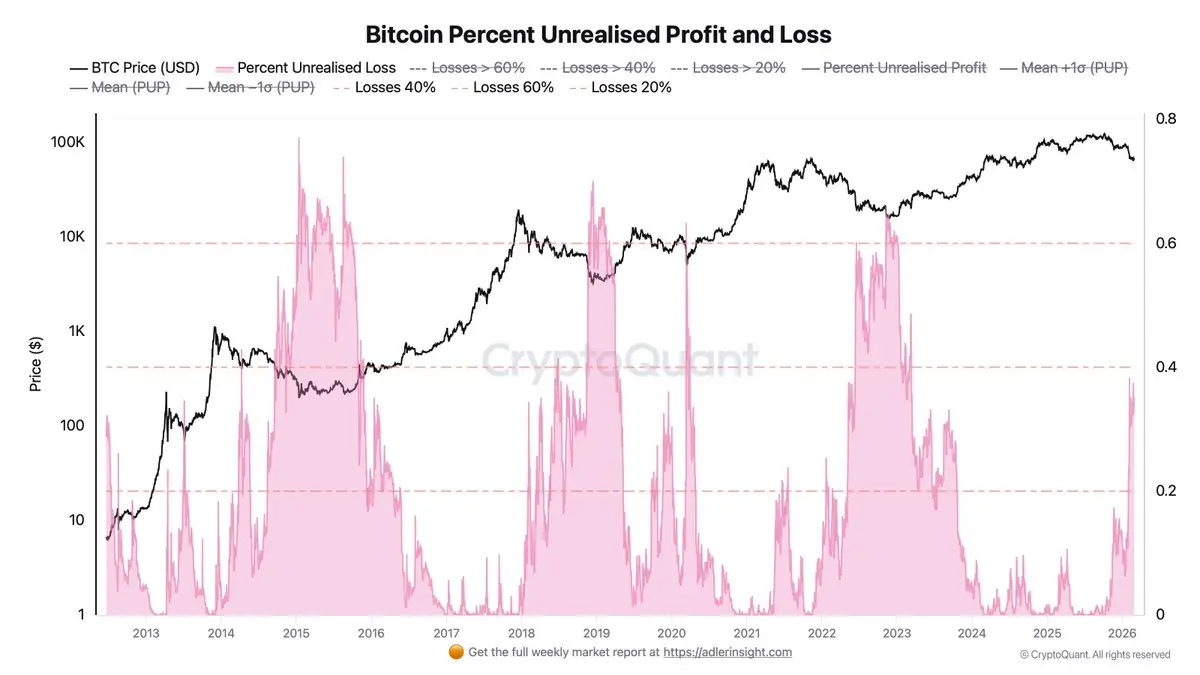

Painful? This is only the beginning of the test. Bitcoin's Percent Unrealised Loss has exceeded 39%. A significant portion of buyers are now sitting in unrealized losses. The market is entering a phase of active pressure - weak positions are gradually being flushed out. There is still room before a full-scale capitulation stage.

BTC-4,37%

- Reward

- 1

- Comment

- Repost

- Share

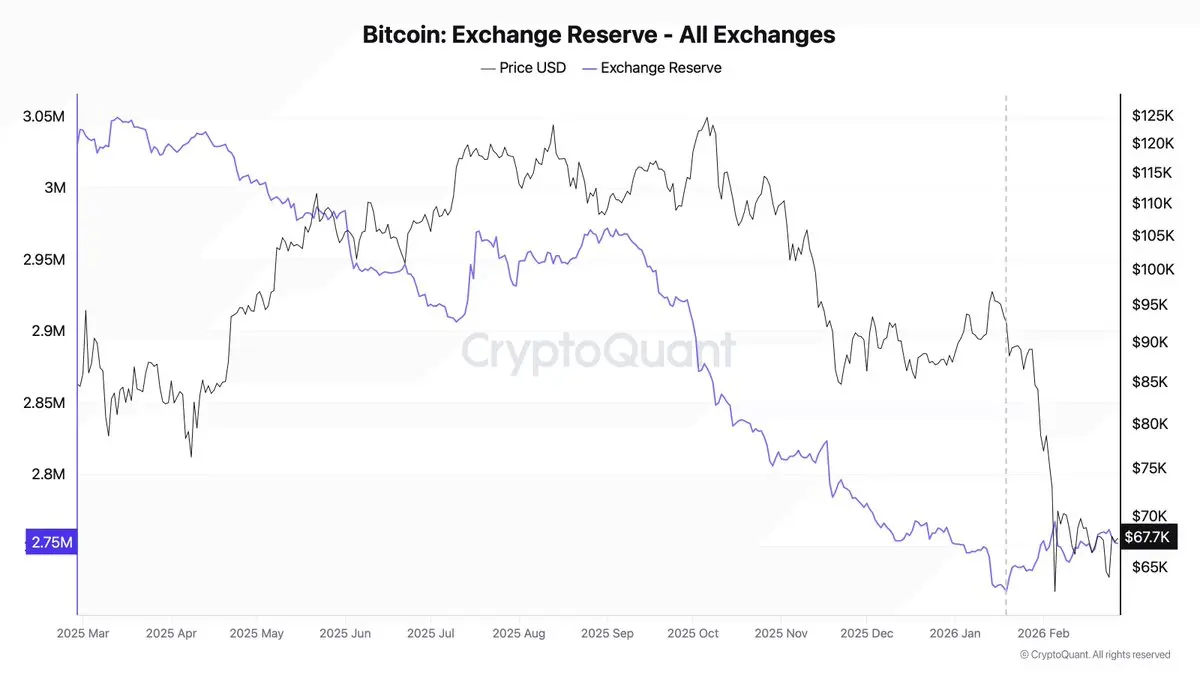

Exchange reserve up 28K BTC in 45 days. SMA(30) netflow turned positive for the first time in months. Two signals. One conclusion.

new ☕️ Adler AM 👇

new ☕️ Adler AM 👇

BTC-4,37%

- Reward

- 1

- Comment

- Repost

- Share

MVRV Z-Score is now deeper than the 2018 and 2022 bear market bottoms. But NUPL says: no capitulation yet.

Two indicators. Two conflicting signals. Full breakdown 👇

Two indicators. Two conflicting signals. Full breakdown 👇

- Reward

- like

- Comment

- Repost

- Share

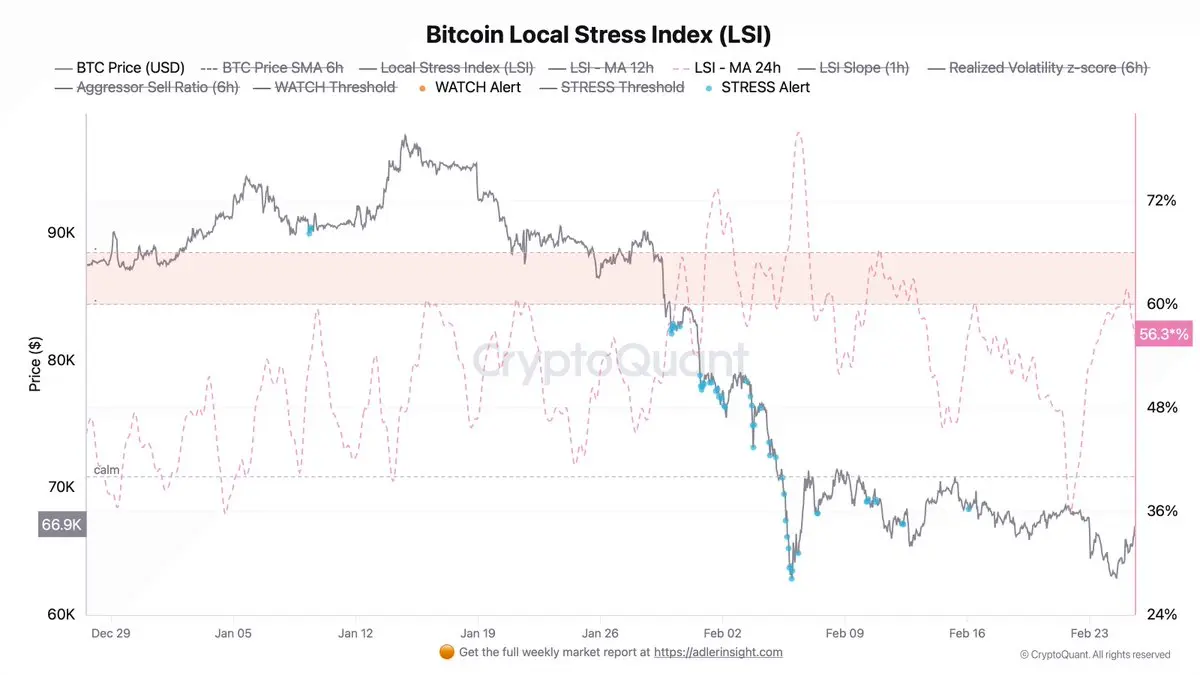

The market has moved through a stress wave around 63k. Right now, the Index (LSI) is de-escalating and turning downward. Short-term pressure has eased, allowing the price to climb higher; however, a value of 56+ on the MA24h indicates that the underlying background stress has not disappeared.

- Reward

- like

- Comment

- Repost

- Share

December 2022. Exchange outflow hits an all-time record. Most people saw panic and waited. The data was saying: this is accumulation.

The difference between "saw it but didn't understand" and "understood and bought" is one skill - knowing how to read exchange flows.

On-Chain Fundamentals for Humans, part 8. Inflow. Outflow. Netflow. Learning not to miss moments like this. 👇

The difference between "saw it but didn't understand" and "understood and bought" is one skill - knowing how to read exchange flows.

On-Chain Fundamentals for Humans, part 8. Inflow. Outflow. Netflow. Learning not to miss moments like this. 👇

- Reward

- like

- Comment

- Repost

- Share

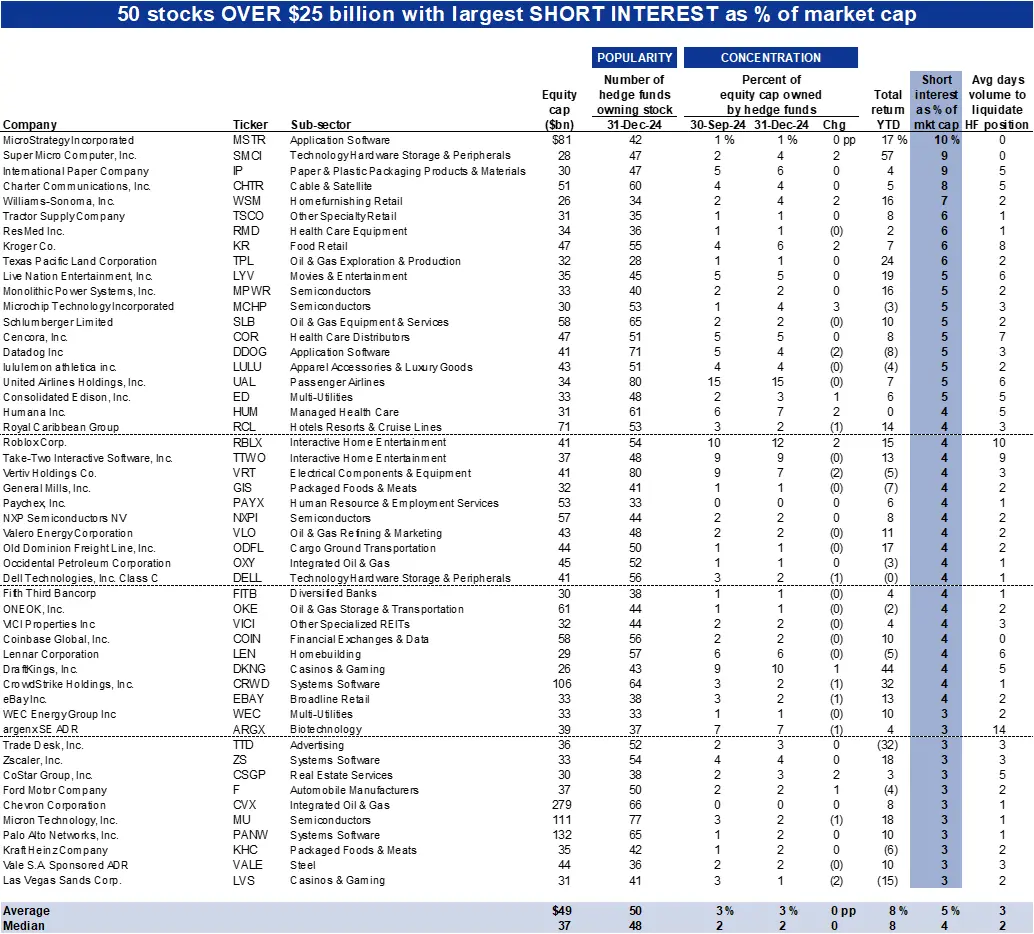

The most shorted large-cap stock right now? $MSTR

Source: Goldman Sachs Global Investment Research (Hedge Fund Trend Monitor)

Source: Goldman Sachs Global Investment Research (Hedge Fund Trend Monitor)

- Reward

- like

- Comment

- Repost

- Share

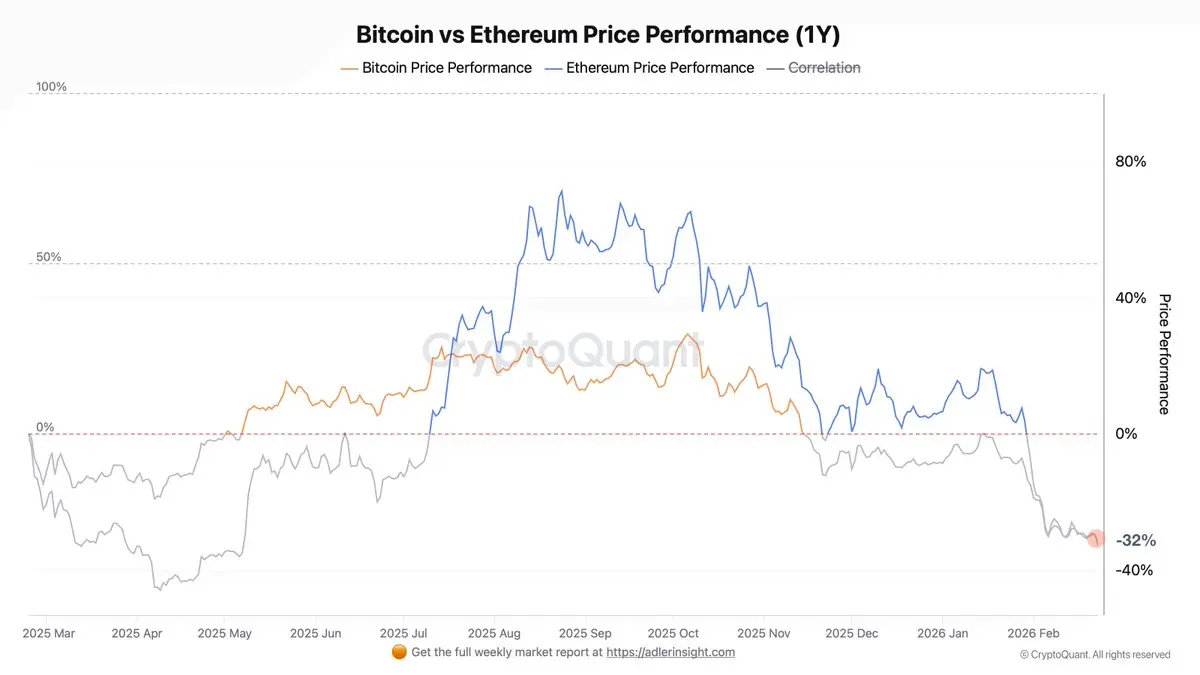

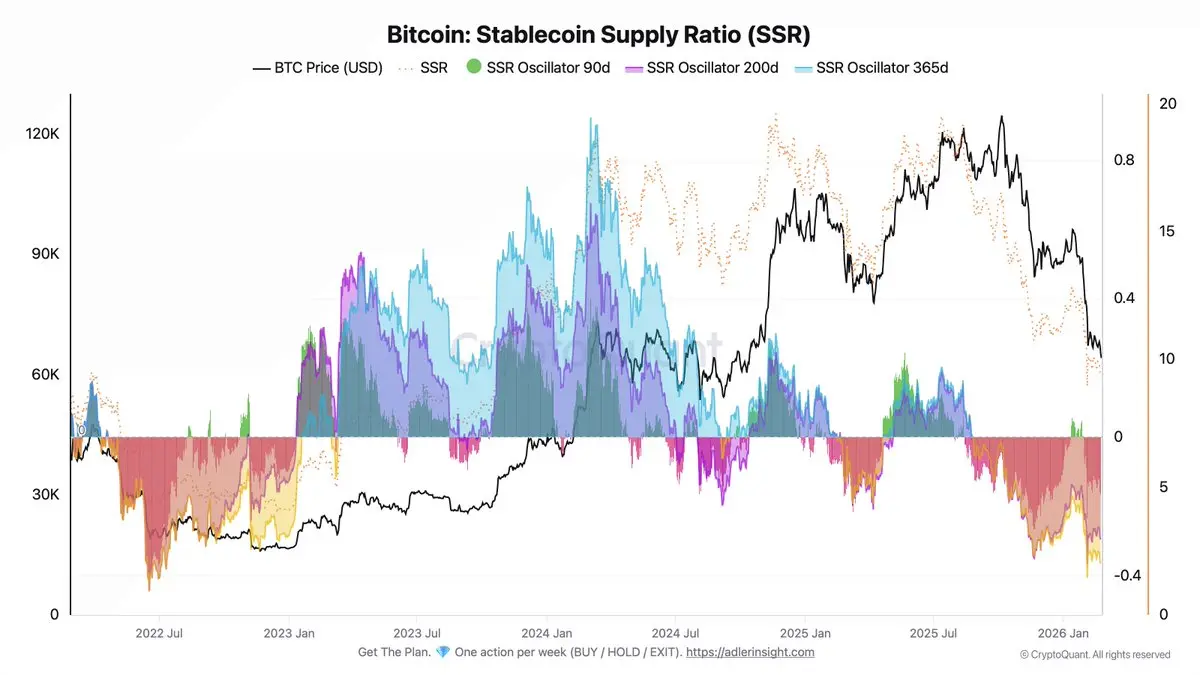

BTC -27% in a month. USDT MC negative for 34 straight days. ELR flat. Three metrics, one conclusion: no buyers.

☕️ Adler AM 113 👇

☕️ Adler AM 113 👇

BTC-4,37%

- Reward

- like

- Comment

- Repost

- Share

IEEPA tariffs ruled unlawful by the Supreme Court. Refund mechanism remains unclear. Markets may now reprice legal and fiscal uncertainty - watch VIX.

- Reward

- like

- Comment

- Repost

- Share

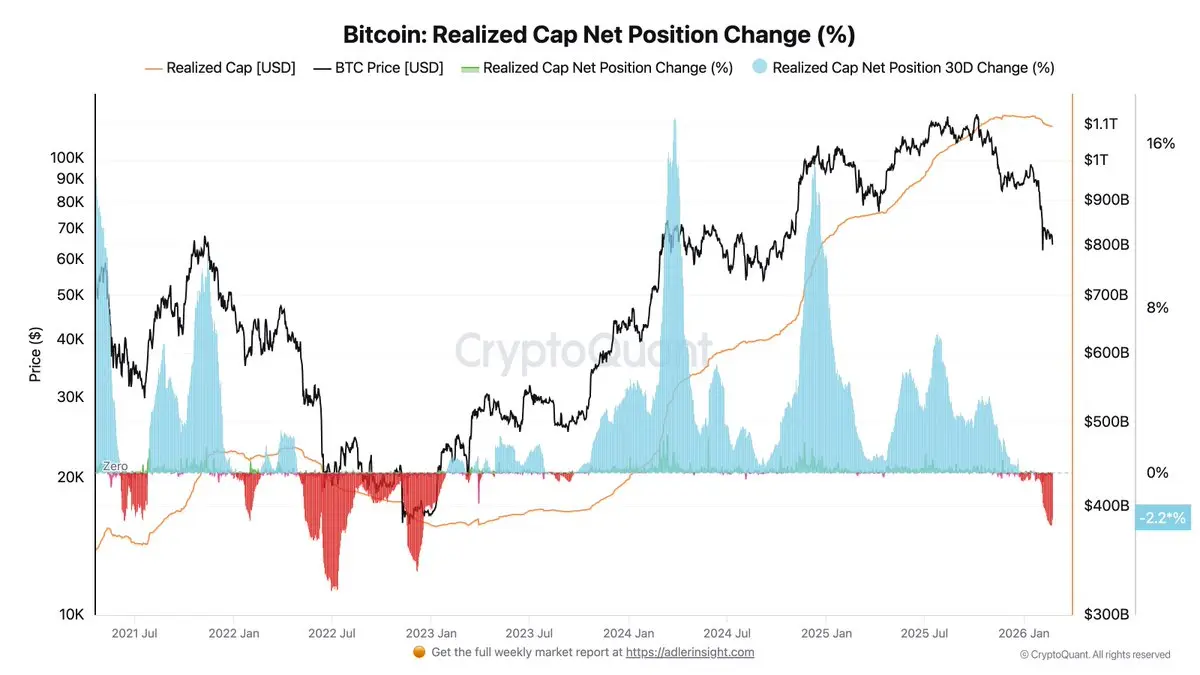

Capital has been leaving the network for two months straight. Holders are sitting on losing positions. No new buyers in sight.

Breaking it down → new ☕️ Adler AM 👇

Breaking it down → new ☕️ Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share

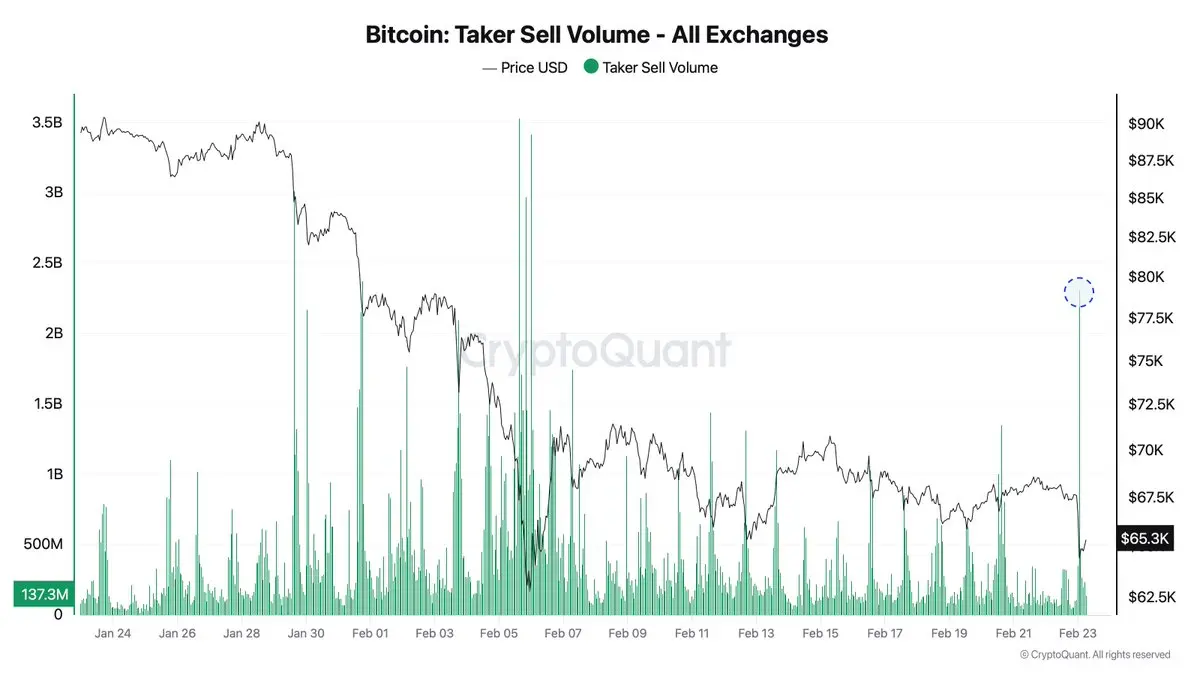

🔴 While everyone was asleep - someone hit the button.

$2.3B taker sell. 1,247 BTC liquidated.

Monday already set the tone.

What's next - inside → ☕️ Morning Brief #111 👇

$2.3B taker sell. 1,247 BTC liquidated.

Monday already set the tone.

What's next - inside → ☕️ Morning Brief #111 👇

BTC-4,37%

- Reward

- 1

- Comment

- Repost

- Share

I like bear markets in Bitcoin. They don’t destroy the asset - they reset expectations.

BTC-4,37%

- Reward

- 2

- Comment

- Repost

- Share

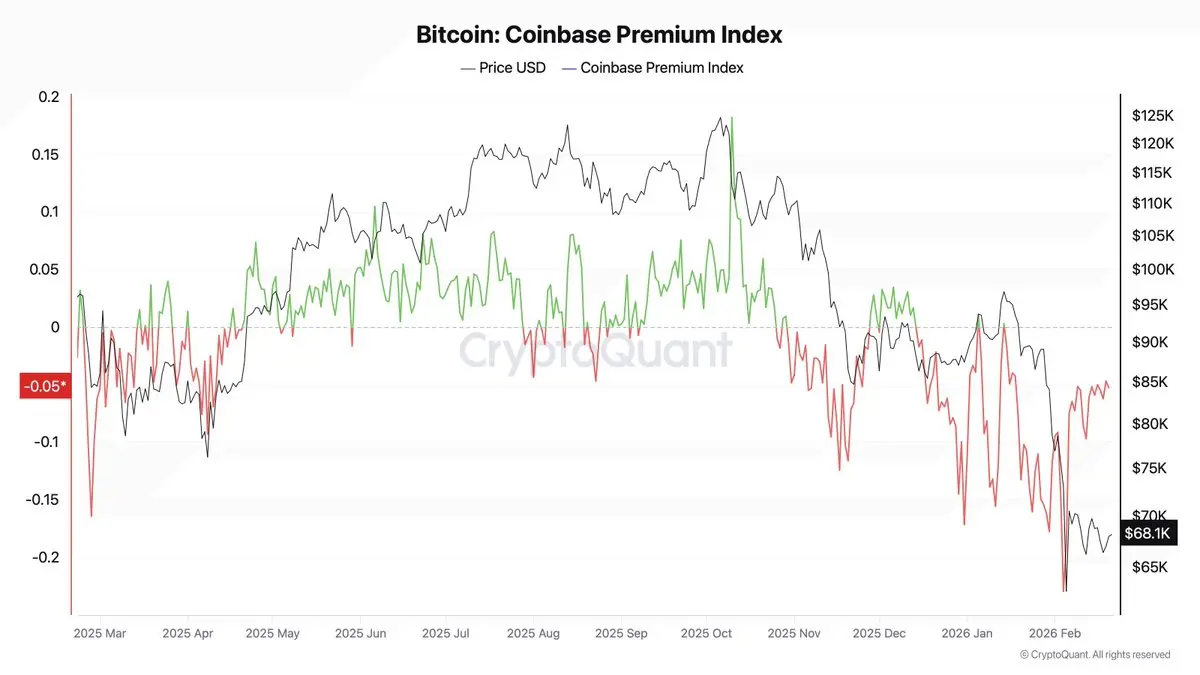

Bitcoin Coinbase Premium Index has been red since December 13, except for two days - January 5 and January 14. 🩸

BTC-4,37%

- Reward

- like

- Comment

- Repost

- Share

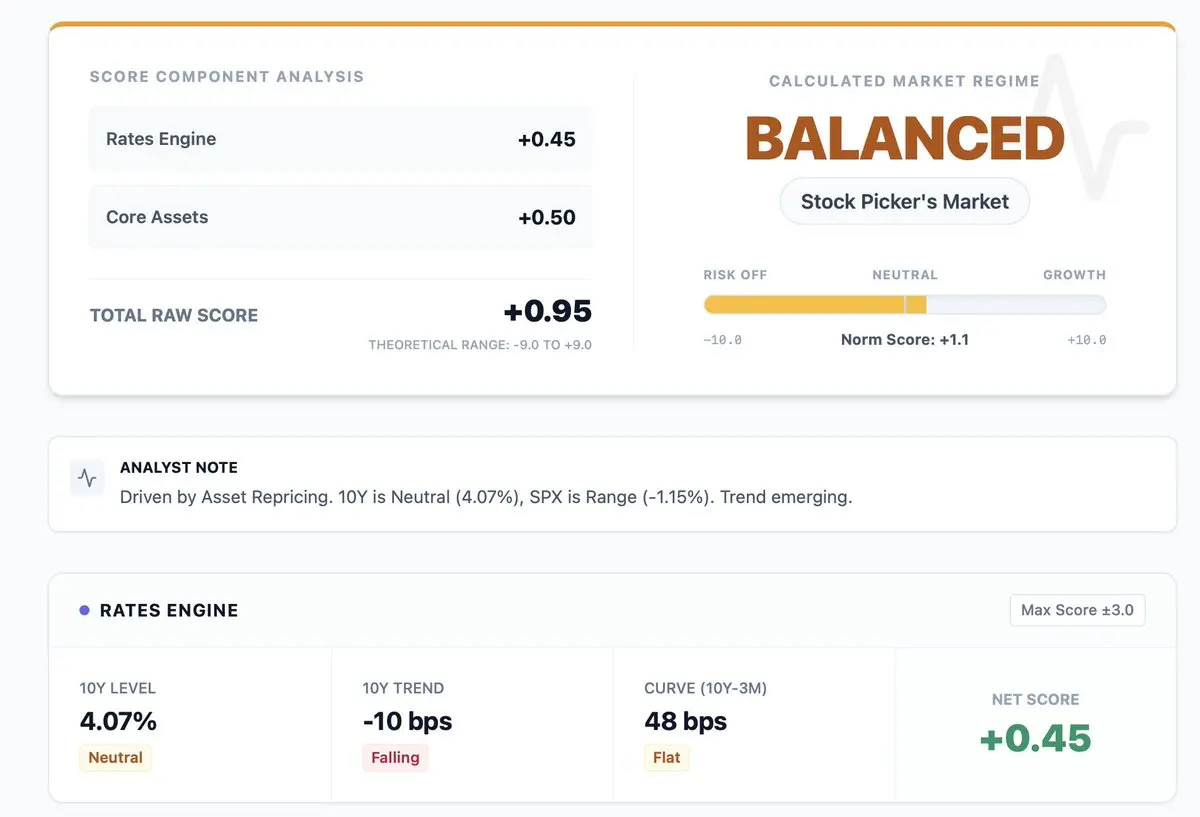

Today’s market regime may fully depend on the U.S. Supreme Court’s decision on Trump’s tariff authority under the IEEPA. Whether the justices uphold the power to impose aggressive tariffs could determine the direction of trading as early as today.

- Reward

- 1

- Comment

- Repost

- Share

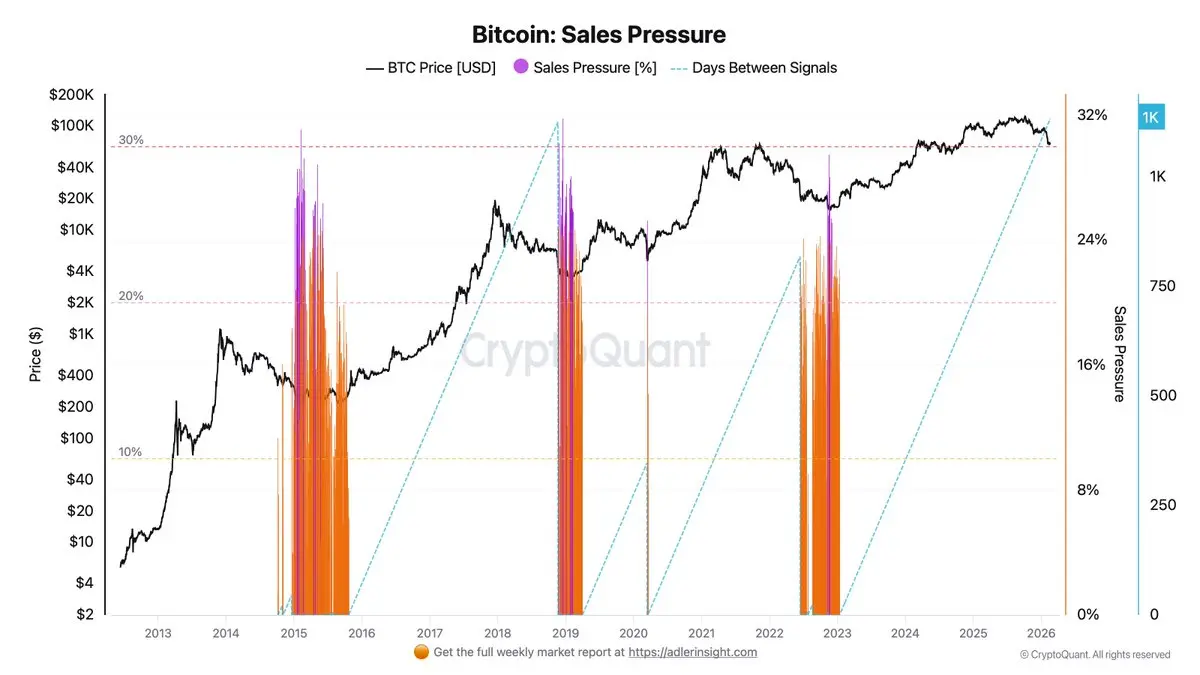

1133 days without a Sales Pressure signal. The last time the market entered this regime was in January 2023 - during the final phase of the bear cycle.

What is changing now - covered in ☕️ Adler AM #110 👇

What is changing now - covered in ☕️ Adler AM #110 👇

- Reward

- 1

- Comment

- Repost

- Share

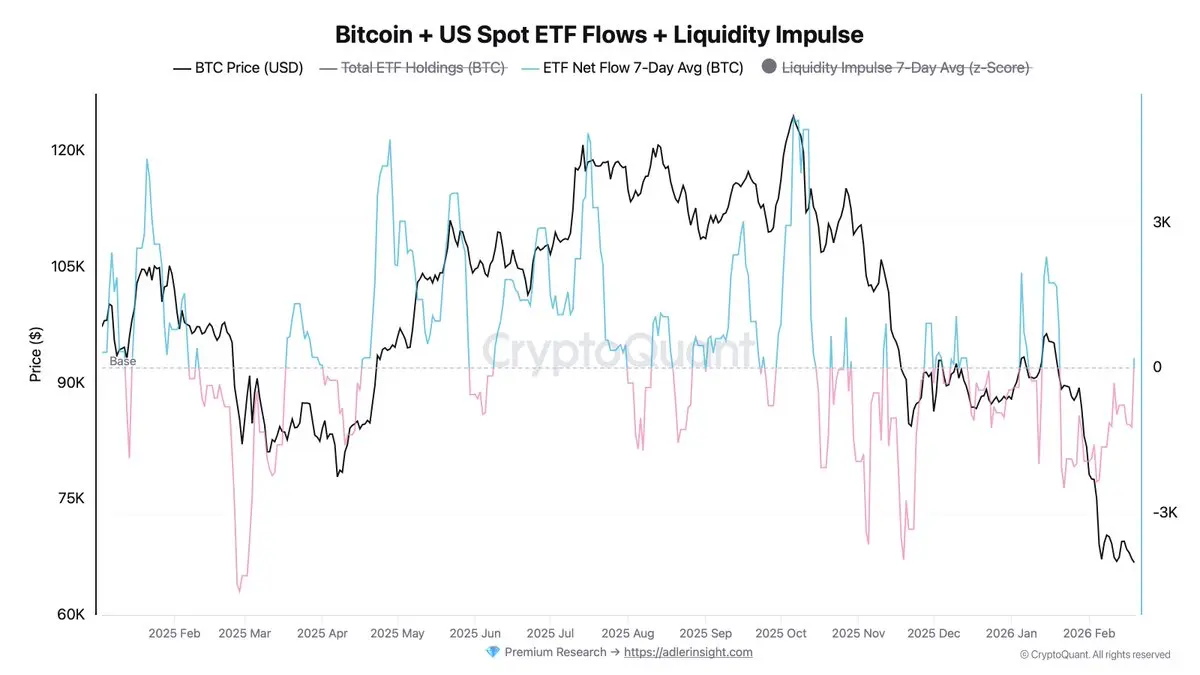

Institutions aren't buying. They're selling. −11,042 BTC left ETFs in 7 days. Exchanges are flooded with supply.

Full breakdown in ☕️ Morning Brief 109 👇

Full breakdown in ☕️ Morning Brief 109 👇

BTC-4,37%

- Reward

- like

- Comment

- Repost

- Share

In November 2022, 78% of all Bitcoin was held by Long-Term Holders. That was the bottom.

Today that number is 49%. What does this mean for the current market?

SQL of the Week #015: HODL Waves - age structure of supply, SQL for BigQuery and interpretation of the current state.

🔗

Today that number is 49%. What does this mean for the current market?

SQL of the Week #015: HODL Waves - age structure of supply, SQL for BigQuery and interpretation of the current state.

🔗

BTC-4,37%

- Reward

- like

- Comment

- Repost

- Share

The🩸bear market spares no one - I hope the guys make it through this cycle.

- Reward

- like

- Comment

- Repost

- Share