LacolaCrypto

No content yet

LacolaCrypto

Market Update for Wednesday, January 28

- Gold and silver are seeking new highs. Bitcoin has increased slightly from $87,000 to $89,000, and altcoins are showing some improvement.

- The US dollar index has dropped to its lowest level in nearly four years following a surprising announcement from former President Trump.

- The Federal Reserve will announce its January interest rate decision at 2:00 AM tomorrow, with a 97.2% expectation that rates will remain unchanged.

ETF Spot Update as of January 27

- Bitcoin is down $44.6 million, with no data from BlackRock.

- Ethereum is down $4.6 million, w

- Gold and silver are seeking new highs. Bitcoin has increased slightly from $87,000 to $89,000, and altcoins are showing some improvement.

- The US dollar index has dropped to its lowest level in nearly four years following a surprising announcement from former President Trump.

- The Federal Reserve will announce its January interest rate decision at 2:00 AM tomorrow, with a 97.2% expectation that rates will remain unchanged.

ETF Spot Update as of January 27

- Bitcoin is down $44.6 million, with no data from BlackRock.

- Ethereum is down $4.6 million, w

- Reward

- like

- Comment

- Repost

- Share

Former President Trump made a surprising statement regarding the U.S. dollar, suggesting it may continue to lose value. When asked if he was concerned about the dollar's decline, Trump replied, "No, I think the dollar is doing very well."

This comment has intensified the dollar's recent downturn, which is experiencing its most significant sell-off since last weekend. The DXY index has fallen to its lowest level in nearly four years.

Reasons for the dollar's sharp decline include:

- Last week, the New York Fed unexpectedly conducted a currency swap operation involving the USD/JPY pair, fueling

This comment has intensified the dollar's recent downturn, which is experiencing its most significant sell-off since last weekend. The DXY index has fallen to its lowest level in nearly four years.

Reasons for the dollar's sharp decline include:

- Last week, the New York Fed unexpectedly conducted a currency swap operation involving the USD/JPY pair, fueling

- Reward

- like

- Comment

- Repost

- Share

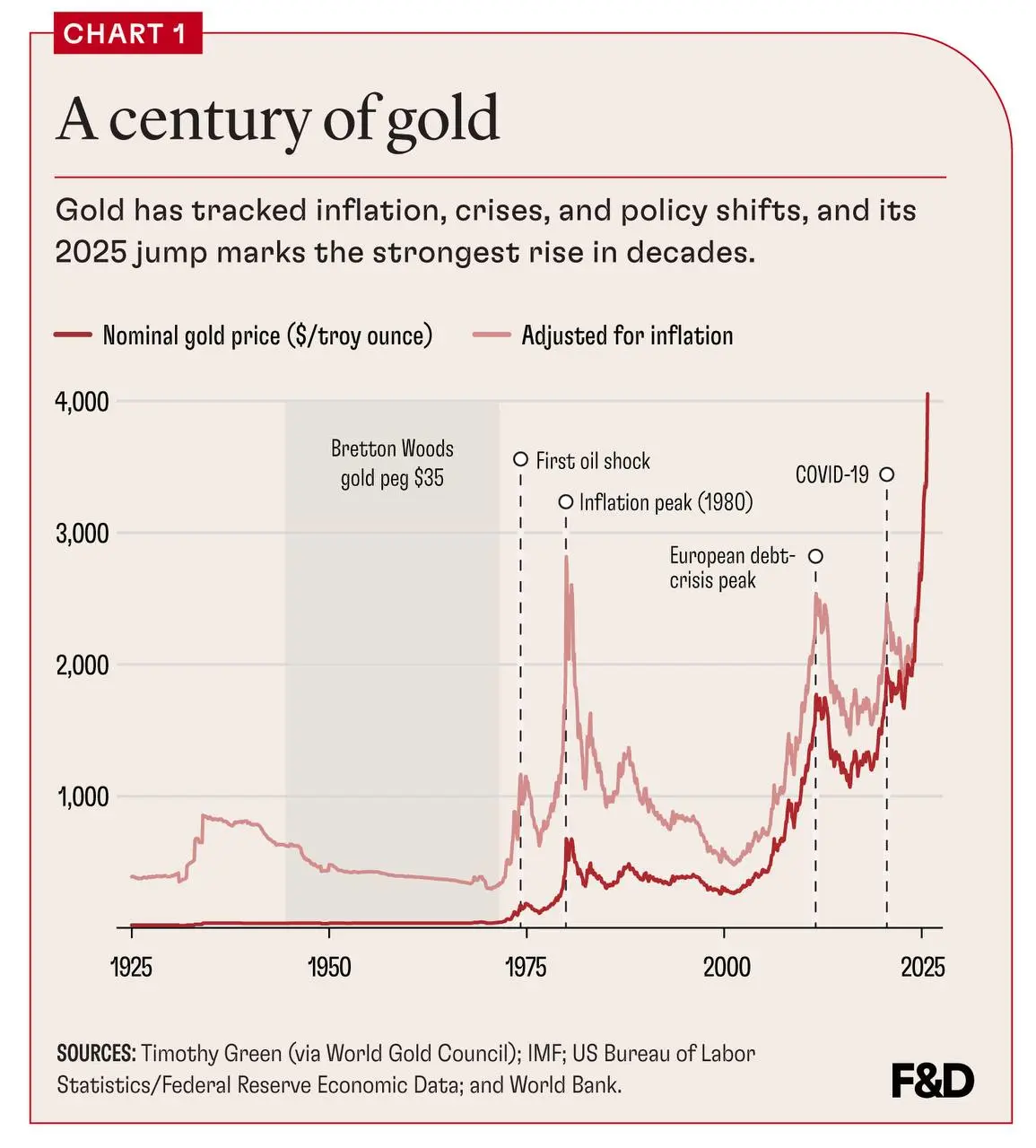

A historical analysis of gold's price growth reveals that it does not increase steadily but rather in bursts during periods of global financial instability.

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

- Reward

- like

- Comment

- Repost

- Share

Market Update - January 26

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Gold surpasses $5,000, Bitcoin drops to $87,000, and altcoins face significant losses amid geopolitical instability.

- The Netherlands plans to tax cryptocurrencies based on unrealized gains starting in 2028, prompting strong community backlash.

- Michael Saylor reveals plans to acquire more Bitcoin this week; his strategy currently holds 709,715 BTC, valued at approximately $62 billion.

- Foundry USA, the world's largest Bitcoin mining pool, reports a 60% decrease in hashrate to around 200 EH/s due to the ongoing mining winter in the U.S.

- Colombia's second-large

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More2.66K Popularity

65.65K Popularity

24.21K Popularity

8.58K Popularity

7.81K Popularity

Hot Gate Fun

View More- MC:$3.45KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.45KHolders:10.00%

- MC:$3.44KHolders:10.00%

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889