Post content & earn content mining yield

placeholder

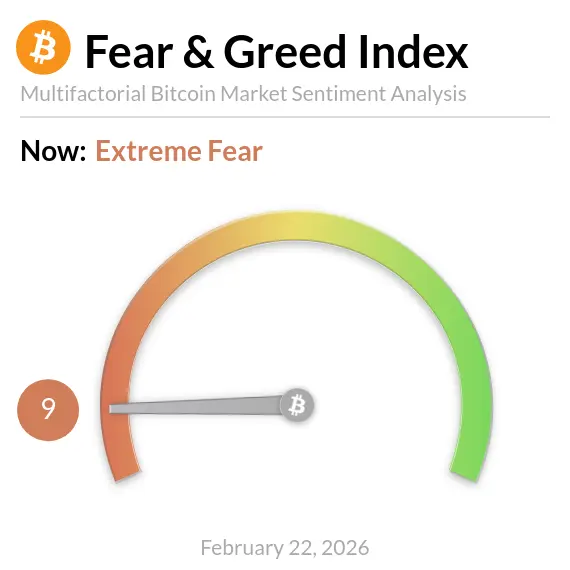

BitcoinFearandGreedIndex

- Reward

- 2

- Comment

- Repost

- Share

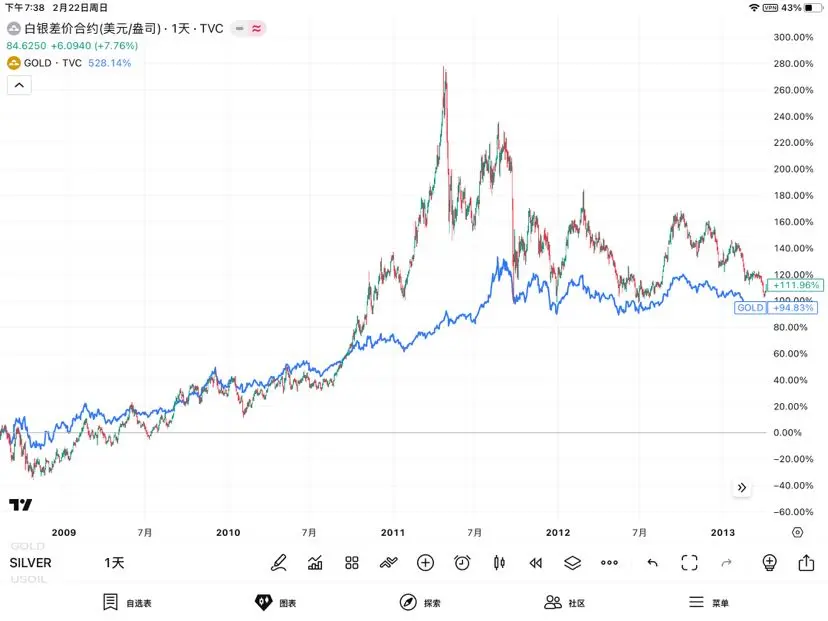

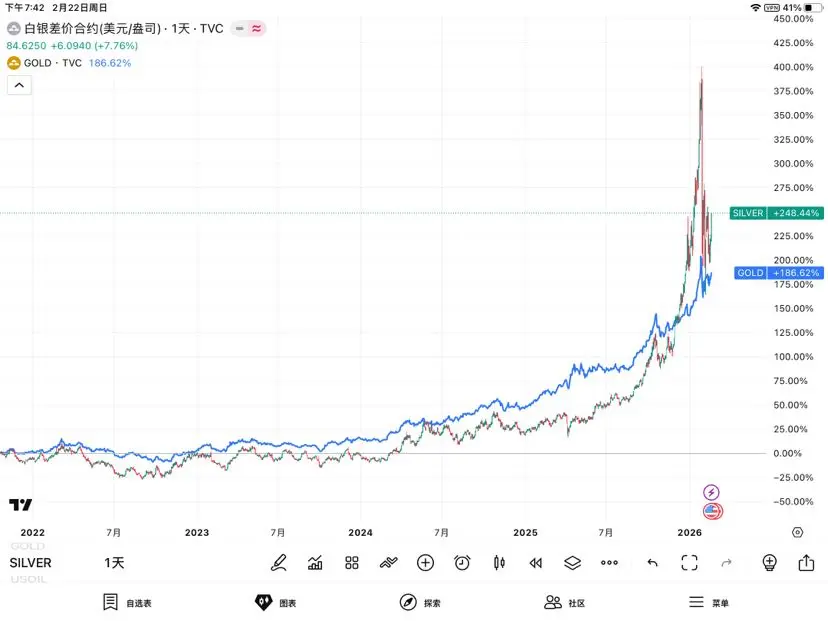

2010 Silver, almost identical to now

Many people think that the most dangerous time for silver is when it starts to decline. But historically, the real danger often occurs when it begins to accelerate upward.

Because that means the cycle has entered a deeper stage.

If you go back to 2010, you'll find that silver wasn't crazy from the start.

Before the real surge, it went through a complete process:

Gold had been rising for years and continuously hitting new highs.

Meanwhile, silver lagged noticeably, rising slowly, and was even ignored by the market at times.

Back then, many people trusted gol

View OriginalMany people think that the most dangerous time for silver is when it starts to decline. But historically, the real danger often occurs when it begins to accelerate upward.

Because that means the cycle has entered a deeper stage.

If you go back to 2010, you'll find that silver wasn't crazy from the start.

Before the real surge, it went through a complete process:

Gold had been rising for years and continuously hitting new highs.

Meanwhile, silver lagged noticeably, rising slowly, and was even ignored by the market at times.

Back then, many people trusted gol

- Reward

- 2

- Comment

- Repost

- Share

no more GM

just say hi! 😭

just say hi! 😭

- Reward

- like

- Comment

- Repost

- Share

18

Cartethyia

Created By@MightyMouseKing

Listing Progress

0.00%

MC:

$0.1

More Tokens

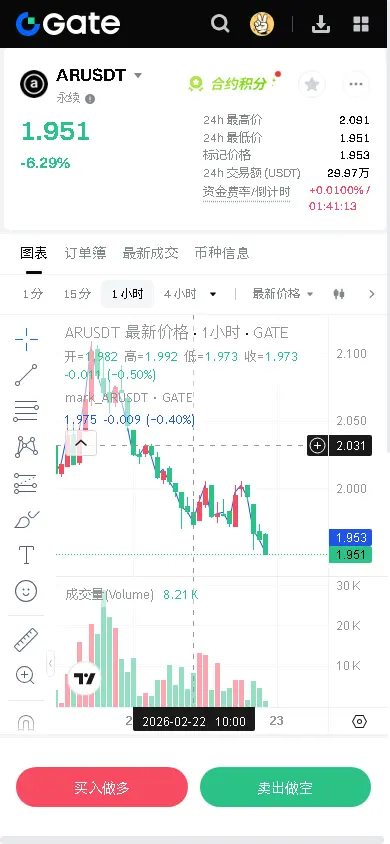

【$AR Signal】1H Oversold Rebound Play, Sniping the 4H Downtrend Channel Support

$AR The 1H timeframe has entered the oversold zone, with RSI dropping to 38. The price is initially supported around 1.96. The 4H timeframe is in a clear downtrend channel, but the current price has touched the lower boundary of the channel, and open interest remains stable with no signs of panic selling. There is a deep imbalance in buy orders on the 1H (14.27%), with accumulation below, indicating a technical rebound demand.

🎯Direction: Long (Playing the Oversold Rebound)

🎯Entry/Orders: 1.962 - 1.958 (Reason: 1H

View Original$AR The 1H timeframe has entered the oversold zone, with RSI dropping to 38. The price is initially supported around 1.96. The 4H timeframe is in a clear downtrend channel, but the current price has touched the lower boundary of the channel, and open interest remains stable with no signs of panic selling. There is a deep imbalance in buy orders on the 1H (14.27%), with accumulation below, indicating a technical rebound demand.

🎯Direction: Long (Playing the Oversold Rebound)

🎯Entry/Orders: 1.962 - 1.958 (Reason: 1H

- Reward

- like

- Comment

- Repost

- Share

AGLD might really be about to make a big move. The trading volume here is much larger than before, and this coin will be a key reference.

$AGLD #Gate廣場發帖領五萬美金紅包

$AGLD #Gate廣場發帖領五萬美金紅包

AGLD46,11%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VAcXUQpf

View Original

- Reward

- 2

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4097?ref=VLJMB14JUQ&ref_type=132

- Reward

- 7

- 7

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

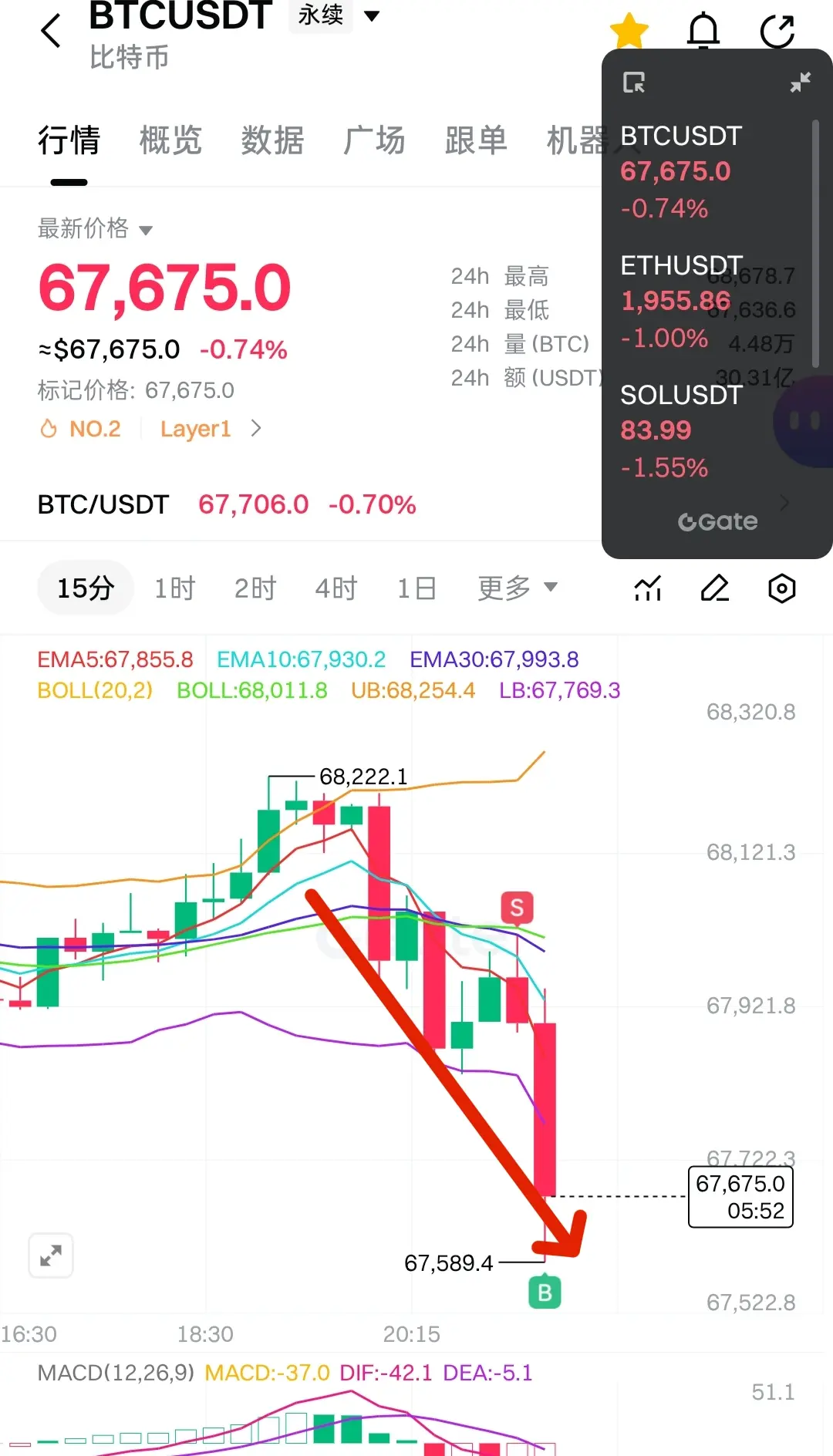

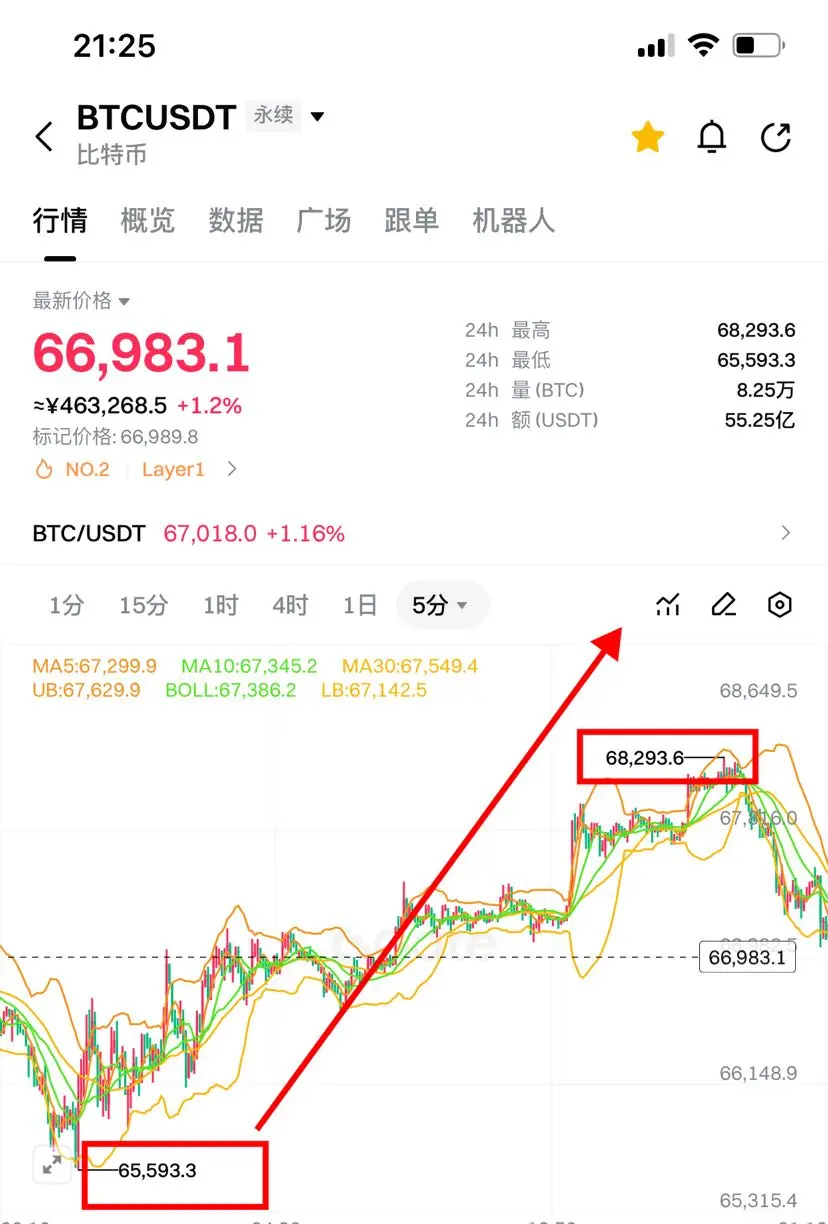

Short-Term BTC Price Behavior Explained

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJHVGWLAA

View Original

- Reward

- 2

- Comment

- Repost

- Share

#我在Gate广场过新年 🧧

I played a game of "Counting Money to Welcome Wealth" at Gate Plaza, and the system gave me a wealth score of 9986 for 2026. I find this number quite mysterious—perhaps Bitcoin worth 90,000 dollars is not far away.

Let me talk about my idea of "getting rich quickly with crypto": BTC (Bitcoin).

Why is it?

1️⃣ The cycle law is irreversible: The second year after the 2024 halving is often the strongest upward wave. History doesn't repeat exactly, but the rhythm is always similar.

2️⃣ Liquidity turning point: In 2026, the macro environment is likely to be more relaxed than now, and

I played a game of "Counting Money to Welcome Wealth" at Gate Plaza, and the system gave me a wealth score of 9986 for 2026. I find this number quite mysterious—perhaps Bitcoin worth 90,000 dollars is not far away.

Let me talk about my idea of "getting rich quickly with crypto": BTC (Bitcoin).

Why is it?

1️⃣ The cycle law is irreversible: The second year after the 2024 halving is often the strongest upward wave. History doesn't repeat exactly, but the rhythm is always similar.

2️⃣ Liquidity turning point: In 2026, the macro environment is likely to be more relaxed than now, and

BTC-1,65%

- Reward

- 2

- Comment

- Repost

- Share

FHORSE

火马

Created By@0xd1b5...a733

Listing Progress

0.00%

MC:

$2.48K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLJEUL8MAA

View Original

- Reward

- 2

- Comment

- Repost

- Share

Gold is close to the trend resistance on an ounce basis. If $5228 is broken, it could first reach $5600 and then $6500. There is no political or economic reason preventing this. Next week, we may see a clearer picture regarding the direction. #Altın #XAUUSD $XAU

⚠️ #advertisement or investment advice is not provided. The analysis reflects my personal opinion. It does not guarantee certainty.

⚠️ #advertisement or investment advice is not provided. The analysis reflects my personal opinion. It does not guarantee certainty.

View Original

- Reward

- 2

- Comment

- Repost

- Share

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=VGBCBF8NVG&ref_type=132

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin Key Levels & Price Reaction Explained

- Reward

- like

- Comment

- Repost

- Share

Today, Bitcoin short positions entered as expected, precisely capturing the market rhythm and successfully earning around 500 points.

In terms of operations, first reduce positions to lock in profits, then follow up with remaining positions to break even and set stop-losses, protecting the gains on hand. No hesitation, no stubborn battles.

Subsequently, hold positions in line with the trend, allowing profits to continue running. Maintain a clear mindset and steady pace throughout.

Avoid chasing highs or acting blindly. Follow the trend and steadily seize each wave of the market. Consistent pro

In terms of operations, first reduce positions to lock in profits, then follow up with remaining positions to break even and set stop-losses, protecting the gains on hand. No hesitation, no stubborn battles.

Subsequently, hold positions in line with the trend, allowing profits to continue running. Maintain a clear mindset and steady pace throughout.

Avoid chasing highs or acting blindly. Follow the trend and steadily seize each wave of the market. Consistent pro

BTC-1,65%

- Reward

- 1

- 13

- Repost

- Share

GateUser-9321f91f :

:

So it's really the banks that are responsible for this sudden drop...View More

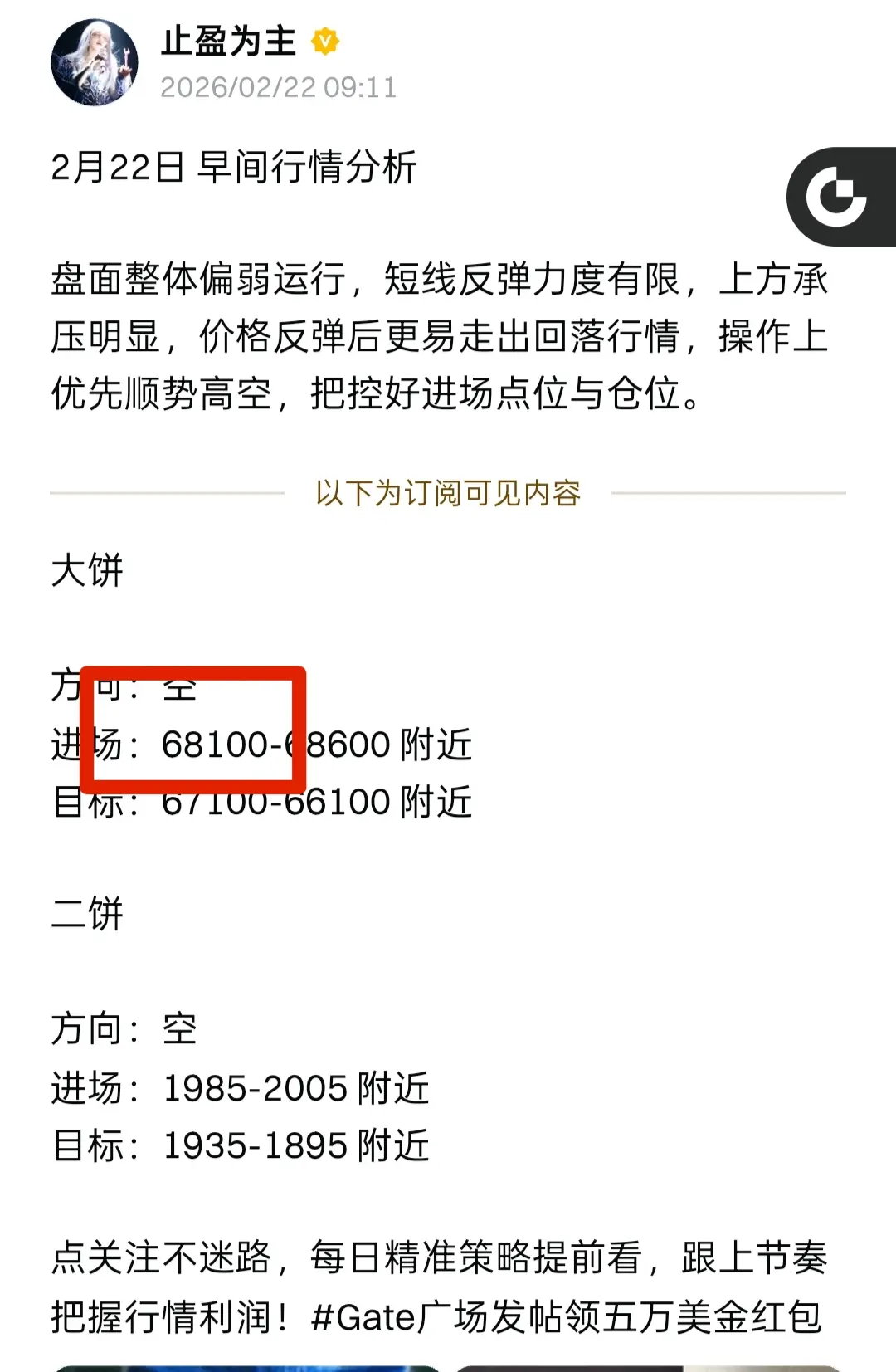

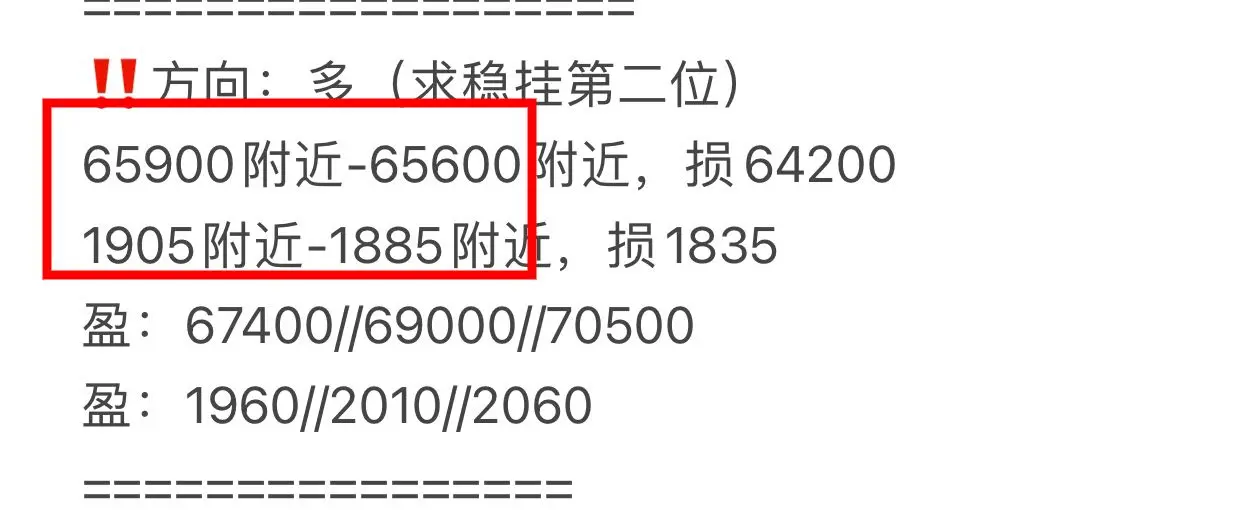

‼️Second order👇

‼️Direction: Short

==============

Around 69,500 - 69,800, stop loss at 71,200

Around 2,035 - 2,055, stop loss at 2,105

Profit: 68,000 // 66,800 // 65,600

Profit: 1,980 // 1,920 // 1,870#Gate广场发帖领五万美金红包

View Original‼️Direction: Short

==============

Around 69,500 - 69,800, stop loss at 71,200

Around 2,035 - 2,055, stop loss at 2,105

Profit: 68,000 // 66,800 // 65,600

Profit: 1,980 // 1,920 // 1,870#Gate广场发帖领五万美金红包

- Reward

- 2

- Comment

- Repost

- Share

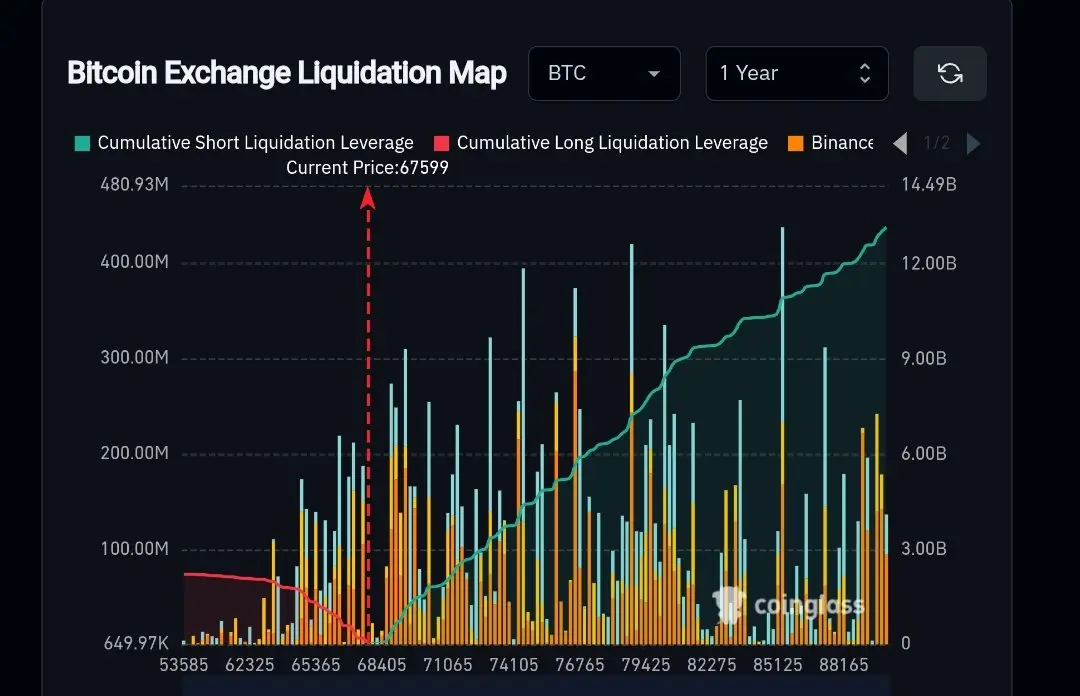

Around $8.5 Billion in $Bitcoin shorts are stacked above near $80K.

Below, only about $2.5 Billion in longs

sit vulnerable around $53K.

Doesn’t mean price must go up.

But it clearly shows where the larger

potential liquidation cascade sits and where the biggest pressure zone currently lies.

Below, only about $2.5 Billion in longs

sit vulnerable around $53K.

Doesn’t mean price must go up.

But it clearly shows where the larger

potential liquidation cascade sits and where the biggest pressure zone currently lies.

BTC-1,65%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More337.81K Popularity

111.18K Popularity

424.46K Popularity

8.4K Popularity

124.02K Popularity

Hot Gate Fun

View More- MC:$2.45KHolders:10.00%

- MC:$2.47KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.46KHolders:10.00%

- MC:$2.48KHolders:10.00%

News

View MoreThe value of Strategy assets is approximately six times the liabilities, with cash reserves sufficient to pay dividends for over 30 months.

5 m

U.S. Trade Representative: After the Supreme Court's tariff ruling, U.S. bilateral trade agreements remain valid

16 m

Analysis: Even if NVIDIA's upcoming earnings report next week is impressive, it may not boost the stock price (Jin10 Data APP)

19 m

US media: If Iran submits the nuclear plan soon, US-Iran talks are expected to be held on Friday

1 h

U.S. Treasury Secretary: The tariff refund issue will be decided by a lower court

1 h

Pin