Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

4.2K Popularity

557.03K Popularity

60.8K Popularity

1.09K Popularity

533 Popularity

- Hot Gate FunView More

- MC:$3.61KHolders:30.53%

- MC:$3.47KHolders:10.00%

- MC:$3.46KHolders:10.00%

- MC:$3.52KHolders:10.00%

- MC:$3.6KHolders:20.48%

- Pin

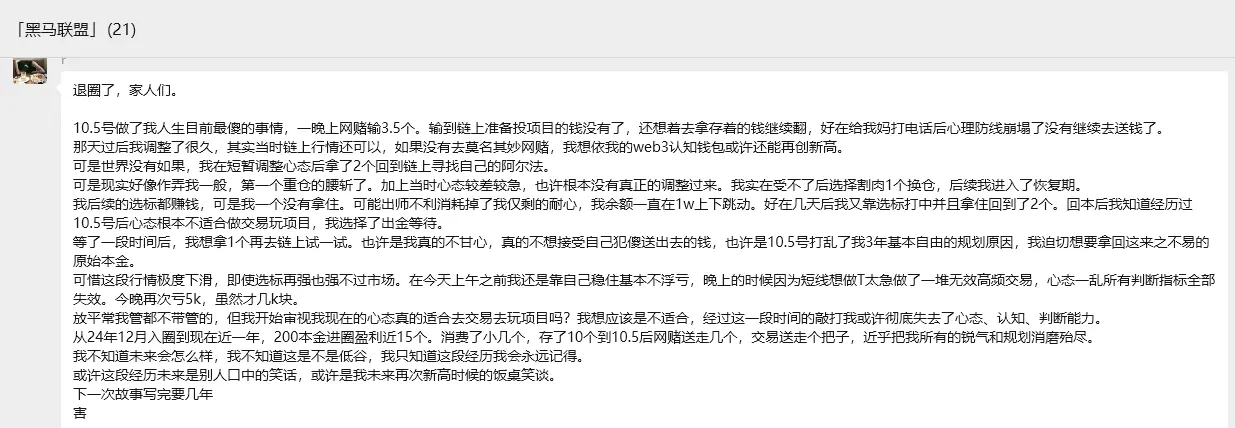

The college student I once had the highest hopes for: turned $200 into a monthly profit of 60k, then pushed it to 150k, but ultimately left the scene in tears, with nothing left but emotions.

I want to share a true story.

The protagonist isn’t me, but a newbie I mentored at the end of 2024.

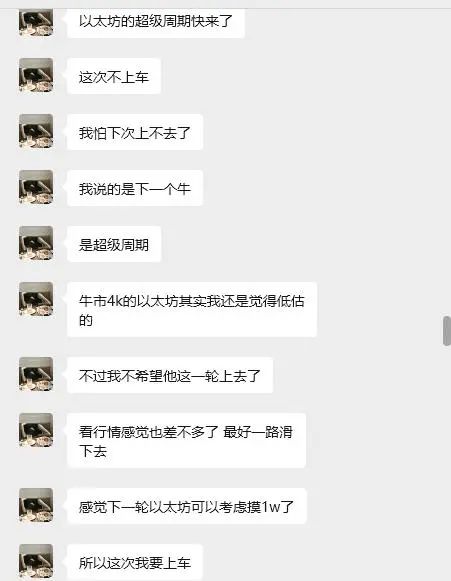

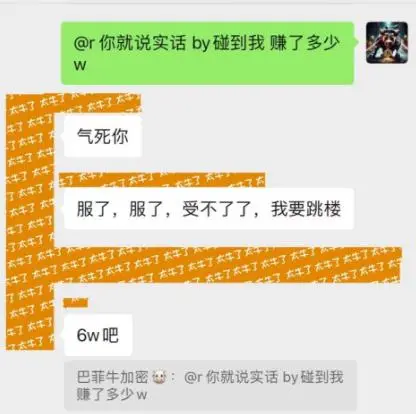

He got to know me through my By airdrop farming tutorial, and just by following it, he made 60,000.

He could have gone much further, but he stumbled because of a seemingly insignificant impulsive decision.

What happened next showed me the cruelest, most greedy, and foolish side of human nature.

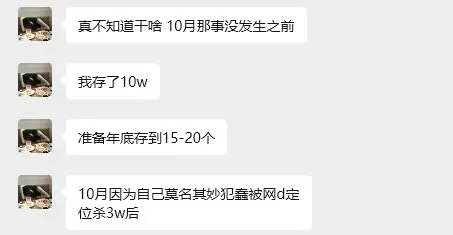

———————————————————————— 01|The night of 10.5 changed the entire course of his year

That night, he did the dumbest thing of his life:

Gambling online, losing 35,000 in just a few hours.

That was the money he had set aside to invest in on-chain projects.

Blinded by his losses, he even thought about dipping into his savings to “make it back.”

Thankfully, as soon as he called his family, his psychological defenses completely collapsed, and he stopped before digging in deeper.

But from that night on, his rhythm on-chain was never the same.

He said if it hadn’t been for that emotional breakdown, with his on-chain knowledge and the market environment at the time, his wallet could’ve hit a new high.

But there’s no “if”—#gambling is a one-way road.

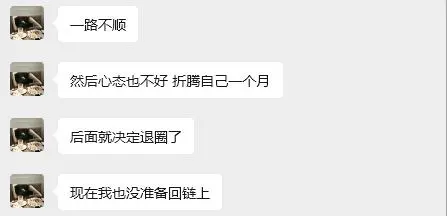

———————————————————————— 02|Returning on-chain with a broken mindset only pulls you in deeper

After a short break, he went back on-chain with 20,000 to keep doing projects.

The first trade he made was cut in half.

Without a real recovery in his mindset, this was just salt in the wound.

He rushed to swap positions, cut another 10,000, and entered a cycle of “urgency, chaos, and trying to break even.”

Ironically, most of the projects he picked afterward made money,

But he couldn’t hold onto any of them.

His balance just kept oscillating around 10,000.

Luckily, after a few rebounds, he managed to get back to 20,000,

That’s when he finally realized:

“After 10.5, I was in no shape to keep trading.”

So he chose to cash out and take a break.

———————————————————————— 03|The most fatal thing is ‘unwillingness to accept defeat’

After a while, he still came back with 10,000 to try one more time.

Not because the market gave a signal,

But because he couldn’t accept it—

He couldn’t accept the money he lost that night,

He couldn’t accept that his ‘freedom within reach’ plan was ruined.

But the market at the time was terrible.

Even the best indicators couldn’t withstand the overall environment.

He managed to avoid losses in the morning,

But at night, his short-term trading mentality collapsed again,

A string of useless high-frequency trades cost him 5,000.

He said his old self wouldn’t have cared about such swings,

But now he realized:

He had lost his mindset, judgment, and perspective.

———————————————————————— 04|In less than a year, from $200 principal → 150,000 → mentality reset to zero

From December 2024 until now, less than a year:

💥Turned $200 into nearly 150,000 💥Spent some 💥Saved 100,000 💥Lost a few tens of thousands on the night of 10.5 💥Lost more through chaotic trading afterward

Almost all his sharpness, rhythm, and planning for the year were worn away.

He said he doesn’t know if this is rock bottom.

But he knows he’ll remember this experience forever.

———————————————————————— 05|As a bystander, I want to say one thing

I watched him go from being a “#college student newbie making 60,000 a month,”

To having all his future plans disrupted by one out-of-control decision.

The hardest thing in life isn’t making money,

It’s controlling your emotions.

I’m sharing his story not to sigh in regret,

But hoping that you, reading this, can avoid making the same detour.

Making money relies on knowledge, losing money on mentality. One moment of losing control can send you right back to square one.

This year, the only thing he’s learned is: save money, take loans, and DCA into spot positions in a bear market. $ETH — when it drops below 1500, that’s when he’ll make his comeback.