Post content & earn content mining yield

placeholder

CryptoChampion

#BitcoinBouncesBack

A Strong Reminder of Crypto’s Resilience

Bitcoin has once again proven why it remains the undisputed leader of the cryptocurrency market. After a period of uncertainty, volatility, and cautious sentiment, Bitcoin’s recent rebound has reignited optimism across the crypto space. This bounce-back is not just another price movement it’s a powerful reminder of Bitcoin’s resilience, maturity, and long-term relevance in the global financial ecosystem.

Over the past few weeks, the market faced intense pressure from macroeconomic headwinds such as interest rate concerns, regulatory

A Strong Reminder of Crypto’s Resilience

Bitcoin has once again proven why it remains the undisputed leader of the cryptocurrency market. After a period of uncertainty, volatility, and cautious sentiment, Bitcoin’s recent rebound has reignited optimism across the crypto space. This bounce-back is not just another price movement it’s a powerful reminder of Bitcoin’s resilience, maturity, and long-term relevance in the global financial ecosystem.

Over the past few weeks, the market faced intense pressure from macroeconomic headwinds such as interest rate concerns, regulatory

BTC-2,59%

- Reward

- 3

- 3

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVBAQPBBA

View Original

- Reward

- like

- Comment

- Repost

- Share

WAW

织网

Created By@CzIsUnafraidToFight,FacingLife

Subscription Progress

0.00%

MC:

$0

Create My Token

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=UwJMVlhX

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AVNABLHE

View Original

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VlISVApc

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVCXUFLDCQ

View Original

- Reward

- like

- Comment

- Repost

- Share

$BTC / $USDT.D

What about that tether dominance?

Because we couldn't hold that 6.4% position (for a nice drop), we ended up with that surge to 9% which is the neckline of this IHS.

But what does that mean?

This means this formation should play out within this year. More Blood? Maybe. Any relief rally? Absolutely.

I can only assume that 2026 will be the right shoulder year, where we can see crypto bottoming and possibly surging again.

What about that tether dominance?

Because we couldn't hold that 6.4% position (for a nice drop), we ended up with that surge to 9% which is the neckline of this IHS.

But what does that mean?

This means this formation should play out within this year. More Blood? Maybe. Any relief rally? Absolutely.

I can only assume that 2026 will be the right shoulder year, where we can see crypto bottoming and possibly surging again.

BTC-2,59%

- Reward

- like

- Comment

- Repost

- Share

STONFI is the go-to decentralized

exchange (DEX) built natively on $TON, And it's perfect for super-fast token swaps, tiny fees, and a clean easy-to-use experience.

But it's way more than just another swap tool.

What really sets STONFI apart is that:

Non-custodial — You always keep full control of your funds (no handing over your keys to anyone).

On-chain liquidity pools — Everything is transparent and verifiable right on the blockchain.

Built for $TON from day one — Lightning speed and low costs, not some add-on fix from another chain.

Why take a minute to understand how it works before divin

exchange (DEX) built natively on $TON, And it's perfect for super-fast token swaps, tiny fees, and a clean easy-to-use experience.

But it's way more than just another swap tool.

What really sets STONFI apart is that:

Non-custodial — You always keep full control of your funds (no handing over your keys to anyone).

On-chain liquidity pools — Everything is transparent and verifiable right on the blockchain.

Built for $TON from day one — Lightning speed and low costs, not some add-on fix from another chain.

Why take a minute to understand how it works before divin

TON-3,83%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

88888888

钻石手

Created By@DiamondHandOfficial

Subscription Progress

0.00%

MC:

$0

Create My Token

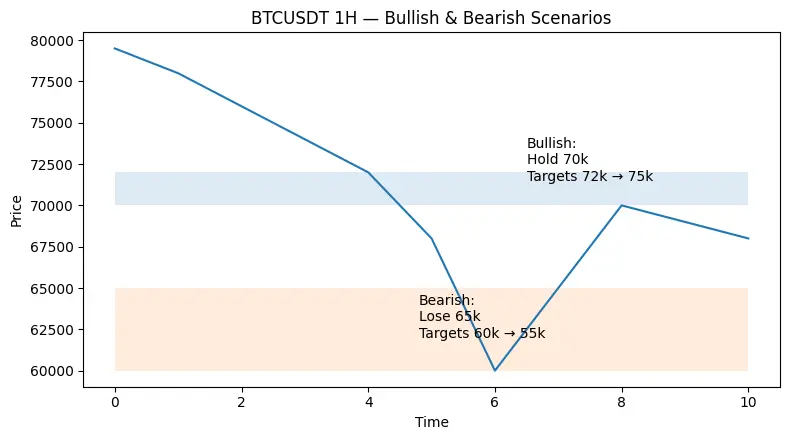

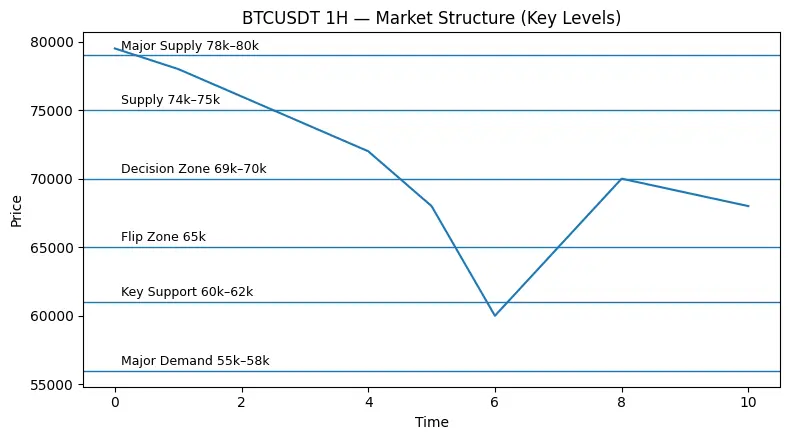

$BTC Market Is Shaking Weak Hands, Structure Is Still in Control

Price is moving, and emotions are loud, but the chart is clear if you take a moment to look closely. Bitcoin didn’t just drop randomly. It followed a pattern, swept liquidity, and is now reacting just as it should. Most people see red candles. I’m focused on where the price must hold or fail.

Current Market Structure (1H View)

Major Supply: 78k–80k

→ This is where distribution started. Smart money sold strength here.

Supply Zone: 74k–75k

→ There have been multiple rejections. Every push into this zone faced seller

Price is moving, and emotions are loud, but the chart is clear if you take a moment to look closely. Bitcoin didn’t just drop randomly. It followed a pattern, swept liquidity, and is now reacting just as it should. Most people see red candles. I’m focused on where the price must hold or fail.

Current Market Structure (1H View)

Major Supply: 78k–80k

→ This is where distribution started. Smart money sold strength here.

Supply Zone: 74k–75k

→ There have been multiple rejections. Every push into this zone faced seller

BTC-2,59%

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊They say that the Xiaonan Guo in Shanghai suddenly closed down, and a bunch of people who had reservations for New Year's Eve dinner are stunned. Is this true?

Going to Xiaonan Guo in Shanghai for New Year's Eve dinner has almost become a habit...

Back in elementary school, there was a restaurant called Xiaonan Guo that I passed by every day. My impression of it was that it was for rich people.

And today, it surprisingly just all ran away.

Before it was training centers running away, gyms running away,

Now it has reached the point where even restaurants are running away for New Year's Eve dinn

View OriginalGoing to Xiaonan Guo in Shanghai for New Year's Eve dinner has almost become a habit...

Back in elementary school, there was a restaurant called Xiaonan Guo that I passed by every day. My impression of it was that it was for rich people.

And today, it surprisingly just all ran away.

Before it was training centers running away, gyms running away,

Now it has reached the point where even restaurants are running away for New Year's Eve dinn

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLREUGHDUQ

View Original

- Reward

- like

- Comment

- Repost

- Share

#GateTransperencyReport Everyone read and follow it share this carefully and win exclusive rewards from the event the details are given in the image see and explore it with trading strategies thanks 👍

- Reward

- 2

- 5

- Repost

- Share

Tewfik :

:

Happy New Year! 🤑View More

#GateLive直播挖矿公测开启

📊 Core conclusion: ETH current price at 2016 (Monday), intra-day oscillating slightly bearish, short-term key range 1980-2040, resistance at 2040-2060, support at 1980-2000, mainly shorting on rebounds, light long positions after stabilization, with strict stop-loss.

1. Key Levels (USDT)

• Resistance: 2040-2060 (strong resistance), 2100, 2130

• Support: 1980-2000 (key), 1930-1950, 1860-1880

2. Market and Signals

• 24H: High of 2133, low of 1999.57, about 6.6% volatility, rebound with low volume, bears remain dominant.

• News: Institutional selling pressure remains, Fed rate

View Original📊 Core conclusion: ETH current price at 2016 (Monday), intra-day oscillating slightly bearish, short-term key range 1980-2040, resistance at 2040-2060, support at 1980-2000, mainly shorting on rebounds, light long positions after stabilization, with strict stop-loss.

1. Key Levels (USDT)

• Resistance: 2040-2060 (strong resistance), 2100, 2130

• Support: 1980-2000 (key), 1930-1950, 1860-1880

2. Market and Signals

• 24H: High of 2133, low of 1999.57, about 6.6% volatility, rebound with low volume, bears remain dominant.

• News: Institutional selling pressure remains, Fed rate

- Reward

- 1

- 1

- Repost

- Share

川渝平哥 :

:

Hold on tight, we're about to take off 🛫Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJNUG8LAA

#Gate春节红包赛马上线

View Original#Gate春节红包赛马上线

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVGVLOJUW

View Original

- Reward

- like

- Comment

- Repost

- Share

#BitcoinBouncesBack Bitcoin is proving once again why it’s the most resilient asset on the planet. After a heavy liquidation flush that saw prices touch $60K, we are seeing a strong reactive bounce back above $70,000.

Why the tide is turning:

Technical Floor: BTC found massive support at the $60K level, triggering a "relief rally."

Mining Efficiency: With difficulty dropping by 11%, the network has automatically adjusted, making it more profitable for active miners to secure the chain.

Institutional Hands: Despite the volatility, long-term bulls like Bernstein are reiterating targets of $150K

Why the tide is turning:

Technical Floor: BTC found massive support at the $60K level, triggering a "relief rally."

Mining Efficiency: With difficulty dropping by 11%, the network has automatically adjusted, making it more profitable for active miners to secure the chain.

Institutional Hands: Despite the volatility, long-term bulls like Bernstein are reiterating targets of $150K

BTC-2,59%

- Reward

- 1

- 3

- Repost

- Share

MoonGirl :

:

HODL Tight 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More185.6K Popularity

45.55K Popularity

7.86K Popularity

5.45K Popularity

3.87K Popularity

News

View MoreBitmine disclosed that it has pledged 2,897,459 ETH, valued at $6.2 billion.

3 m

Farcaster co-founder Varun Srinivasan announces joining the stablecoin chain Tempo

13 m

U.S. stocks open lower, Dow Jones down 0.14%, Google's parent company plans to issue bonds to raise $15 billion

34 m

A certain whale's two "buy high, sell low" ETH transactions resulted in a loss of over $370,000

46 m

Data: 27,082.47 SOL has been transferred out from Wintermute, with a total value of approximately $2.27 million USD.

47 m

Pin