# MiddleEastTensionsEscalate

4.99K

Rising U.S.–Iran tensions have driven gold above the $5,000 milestone, while Bitcoin has pulled back and market sentiment turns cautious. Would you allocate to gold now, or look for a BTC dip?

HighAmbition

#MiddleEastTensionsEscalate

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

- Reward

- 15

- 17

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate

The early 2026 macro environment is presenting a stark divergence between traditional safe havens and digital assets. Gold has breached the $5,000 per ounce threshold, reaching highs not seen in decades, while Bitcoin languishes in the $85,000–$90,000 range.

This divergence is more than a market quirk it reflects a flight-to-safety mindset among both institutional and retail capital, driven by geopolitical uncertainty, maximum-pressure trade policies, and ongoing military posturing in the Middle East.

Investors now face a classic strategic dilemma:

Should one fav

The early 2026 macro environment is presenting a stark divergence between traditional safe havens and digital assets. Gold has breached the $5,000 per ounce threshold, reaching highs not seen in decades, while Bitcoin languishes in the $85,000–$90,000 range.

This divergence is more than a market quirk it reflects a flight-to-safety mindset among both institutional and retail capital, driven by geopolitical uncertainty, maximum-pressure trade policies, and ongoing military posturing in the Middle East.

Investors now face a classic strategic dilemma:

Should one fav

BTC0,22%

- Reward

- 8

- 12

- Repost

- Share

repanzal :

:

Watching Closely 🔍️View More

Bitcoin's pullback is not surrender; it's just allowing gold to finish its initial surge.

Many people see Bitcoin's correction and start to short, as if it has been knocked out by gold. But the reality is more like: the front lines are fighting, and the rear is resupplying.

Bitcoin hasn't lost the logic; it has only temporarily lost to the "risk aversion priority."

When the market is in a state of "potential major events at any time," the first choice for funds is never the most volatile asset, but the one that can best stabilize emotions. That's why gold is leading the pack, while BTC is expe

Many people see Bitcoin's correction and start to short, as if it has been knocked out by gold. But the reality is more like: the front lines are fighting, and the rear is resupplying.

Bitcoin hasn't lost the logic; it has only temporarily lost to the "risk aversion priority."

When the market is in a state of "potential major events at any time," the first choice for funds is never the most volatile asset, but the one that can best stabilize emotions. That's why gold is leading the pack, while BTC is expe

SOL1,29%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$3.56KHolders:1

0.00%

- Reward

- 4

- 3

- Repost

- Share

CoinRelyOnUniversal :

:

Hold on tight, we're about to take off 🛫View More

#MiddleEastTensionsEscalate

The recent escalation of tensions in the Middle East has captured global attention as geopolitical risks rise. Conflicts in this region not only have immediate security implications but also ripple through international markets, affecting oil prices, currency volatility, and investor sentiment worldwide. As the Middle East remains a critical hub for energy exports, any disruption in supply chains or trade routes directly impacts global commodity markets.

Oil and Energy Markets 🛢️

The Middle East is home to some of the largest oil-producing nations. Heightened tens

The recent escalation of tensions in the Middle East has captured global attention as geopolitical risks rise. Conflicts in this region not only have immediate security implications but also ripple through international markets, affecting oil prices, currency volatility, and investor sentiment worldwide. As the Middle East remains a critical hub for energy exports, any disruption in supply chains or trade routes directly impacts global commodity markets.

Oil and Energy Markets 🛢️

The Middle East is home to some of the largest oil-producing nations. Heightened tens

- Reward

- 4

- 5

- Repost

- Share

Yusfirah :

:

Ape In 🚀View More

🚀 XRP Price Prediction: Are Technicals Signaling a Run Toward $5.00?

XRP is once again stepping into the spotlight as technical indicators flash bullish signals, sparking renewed speculation about a potential breakout toward the $5.00 level.

📊 What the charts are showing:

Strong support holding above key demand zones

Momentum indicators turning positive

Volume gradually confirming buyer strength

⚖️ Fundamental tailwinds:

Ongoing progress in crypto regulation clarity

XRP’s positioning in cross-border payments

Growing relevance amid Middle East geopolitical tensions, where neutral, fast settle

XRP is once again stepping into the spotlight as technical indicators flash bullish signals, sparking renewed speculation about a potential breakout toward the $5.00 level.

📊 What the charts are showing:

Strong support holding above key demand zones

Momentum indicators turning positive

Volume gradually confirming buyer strength

⚖️ Fundamental tailwinds:

Ongoing progress in crypto regulation clarity

XRP’s positioning in cross-border payments

Growing relevance amid Middle East geopolitical tensions, where neutral, fast settle

XRP-0,47%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#MiddleEastTensionsEscalate

As tensions rise, gold pushes past $5,000 while BTC cools off under pressure.

Classic risk-off behavior — capital hides in safety before returning to growth.

I’m watching whether this is a temporary fear spike or a longer geopolitical wave.

Gold strength vs BTC weakness is giving clear signals about sentiment.

If panic fades, BTC dips may become opportunity zones.

Are you allocating to gold here, or preparing to buy the BTC pullback?

As tensions rise, gold pushes past $5,000 while BTC cools off under pressure.

Classic risk-off behavior — capital hides in safety before returning to growth.

I’m watching whether this is a temporary fear spike or a longer geopolitical wave.

Gold strength vs BTC weakness is giving clear signals about sentiment.

If panic fades, BTC dips may become opportunity zones.

Are you allocating to gold here, or preparing to buy the BTC pullback?

BTC0,22%

- Reward

- 9

- 11

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#MiddleEastTensionsEscalate

As of 27 January 2026, the Middle East is witnessing a marked escalation in geopolitical tensions, with heightened military posturing, diplomatic friction, and energy market anxiety dominating headlines. Recent events in the region have included increased cross-border skirmishes, missile activity, and clashes among regional actors, signaling a rapid intensification of longstanding conflicts that had been simmering under fragile ceasefires. Analysts note that this escalation is not isolated, but rather part of a complex web of strategic rivalries, domestic political

As of 27 January 2026, the Middle East is witnessing a marked escalation in geopolitical tensions, with heightened military posturing, diplomatic friction, and energy market anxiety dominating headlines. Recent events in the region have included increased cross-border skirmishes, missile activity, and clashes among regional actors, signaling a rapid intensification of longstanding conflicts that had been simmering under fragile ceasefires. Analysts note that this escalation is not isolated, but rather part of a complex web of strategic rivalries, domestic political

- Reward

- 3

- 4

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

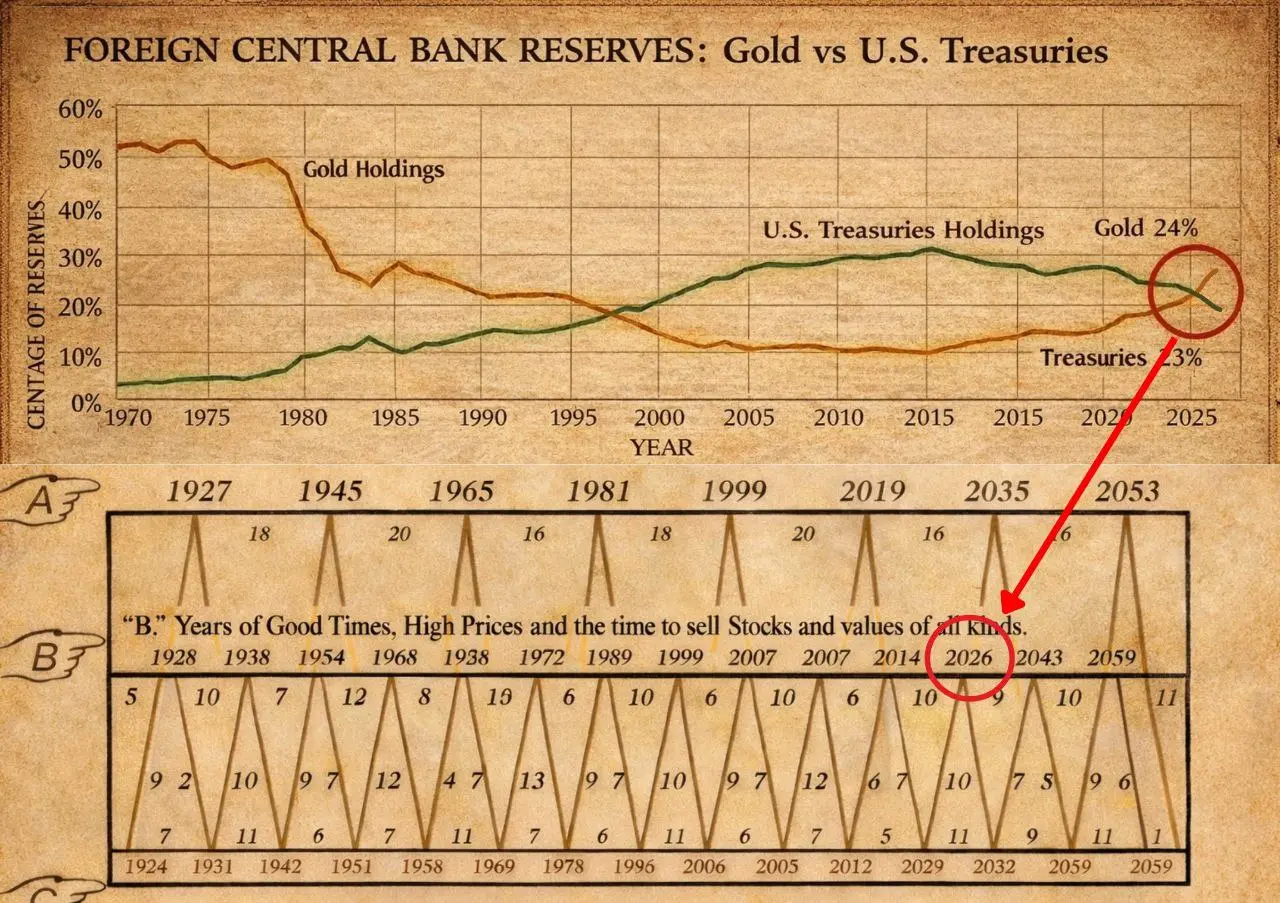

#GoldandSilverHitNewHighs

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 8

- 9

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

💥 Gold Hits $5,000 Amid U.S.–Iran Tensions — BTC Pulls Back

Rising U.S.–Iran geopolitical tensions have sent gold above $5,000/oz, marking a historic milestone. Investors are flocking to safe havens, while Bitcoin shows a pullback as risk sentiment turns cautious.

📊 Current Market Snapshot (Jan 27, 2026)

Gold: $5,020–$5,050/oz

Bitcoin: $38,800–$39,500

Volatility is rising in both precious metals and crypto markets.

🔹 What’s Driving Gold?

Flight-to-safety flows due to geopolitical uncertainty

Dollar weakness amplifying buying pressure

Institutional and retail hedging against macro risk

🔹 BT

Rising U.S.–Iran geopolitical tensions have sent gold above $5,000/oz, marking a historic milestone. Investors are flocking to safe havens, while Bitcoin shows a pullback as risk sentiment turns cautious.

📊 Current Market Snapshot (Jan 27, 2026)

Gold: $5,020–$5,050/oz

Bitcoin: $38,800–$39,500

Volatility is rising in both precious metals and crypto markets.

🔹 What’s Driving Gold?

Flight-to-safety flows due to geopolitical uncertainty

Dollar weakness amplifying buying pressure

Institutional and retail hedging against macro risk

🔹 BT

BTC0,22%

- Reward

- 6

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Global risks are being re-priced

If you interpret this round of market movement as a "short-term disturbance caused by geopolitical conflicts," then you might be underestimating one thing the market is doing: re-evaluating risk pricing.

Gold breaking 5000 is not a prediction of war, but a direct pricing of "global instability."

High debt levels, repeated overextension of monetary credit, and uncontrollable geopolitical tensions are not issues that will be resolved in a day or two. Gold is just the first asset to reflect these problems in its price.

Why hasn't Bitcoin risen in tandem? Because

If you interpret this round of market movement as a "short-term disturbance caused by geopolitical conflicts," then you might be underestimating one thing the market is doing: re-evaluating risk pricing.

Gold breaking 5000 is not a prediction of war, but a direct pricing of "global instability."

High debt levels, repeated overextension of monetary credit, and uncontrollable geopolitical tensions are not issues that will be resolved in a day or two. Gold is just the first asset to reflect these problems in its price.

Why hasn't Bitcoin risen in tandem? Because

BTC0,22%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$3.56KHolders:1

0.00%

- Reward

- 3

- 3

- Repost

- Share

CoinRelyOnUniversal :

:

New Year Wealth Explosion 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

42.15K Popularity

4.99K Popularity

4.2K Popularity

2.42K Popularity

2.34K Popularity

2.43K Popularity

1.86K Popularity

1.91K Popularity

68.5K Popularity

111.19K Popularity

77.54K Popularity

19.45K Popularity

44.33K Popularity

37.18K Popularity

193.03K Popularity

News

View MoreMeta plans to pay Corning up to $6 billion for AI data center fiber optic cables

3 m

Euro against the US dollar rises 0.3% to 1.192, reaching a new high in 2021

18 m

The Bitcoin to silver exchange rate drops to approximately 780, approaching the bottom range level of Bitcoin in November 2022.

23 m

Arizona State Legislature Advances Proposal to Exempt Cryptocurrency Assets from Property Tax

24 m

Data: 16,762,100 1INCH tokens transferred out from TrustedVolumes, routed through intermediaries, and flowed into HitBTC.

25 m

Pin