Only smart lobsters turn blue.

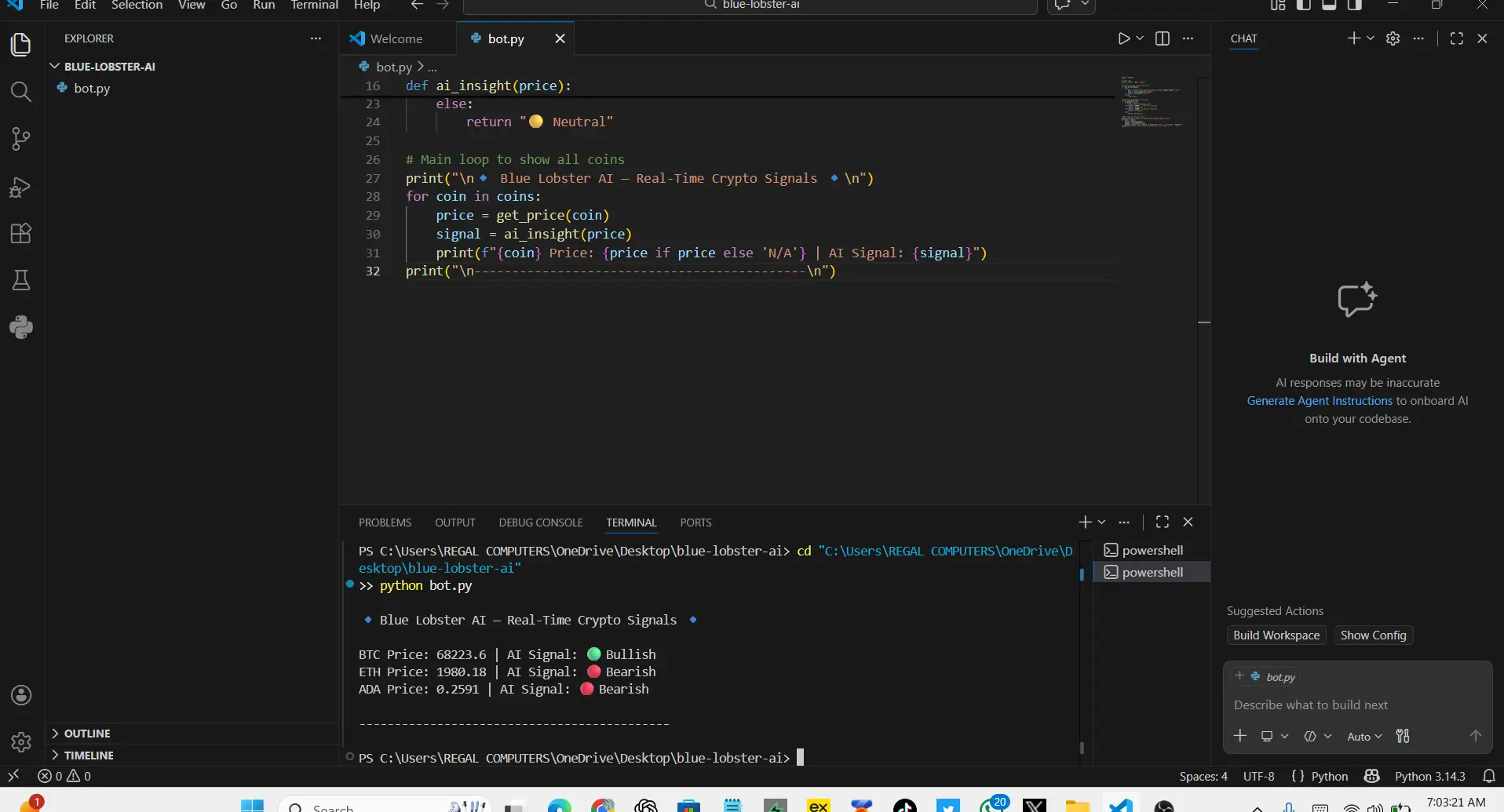

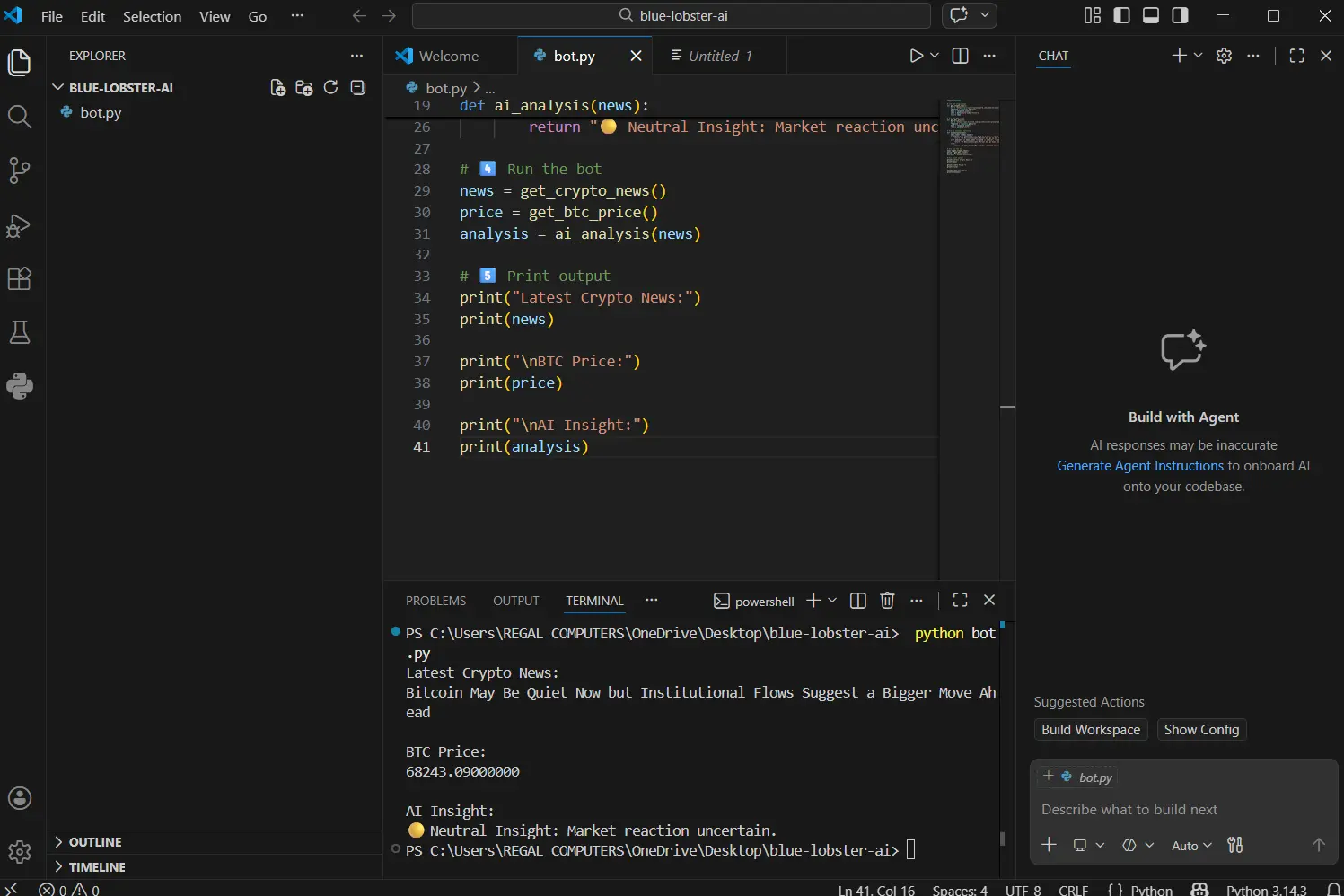

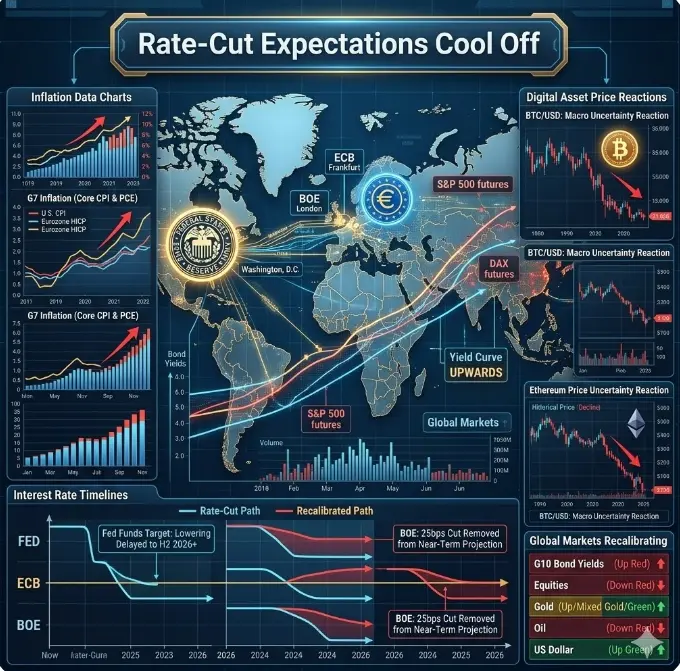

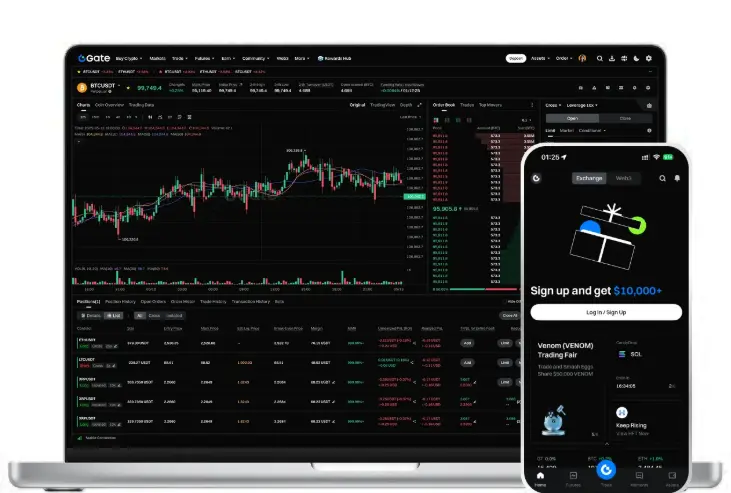

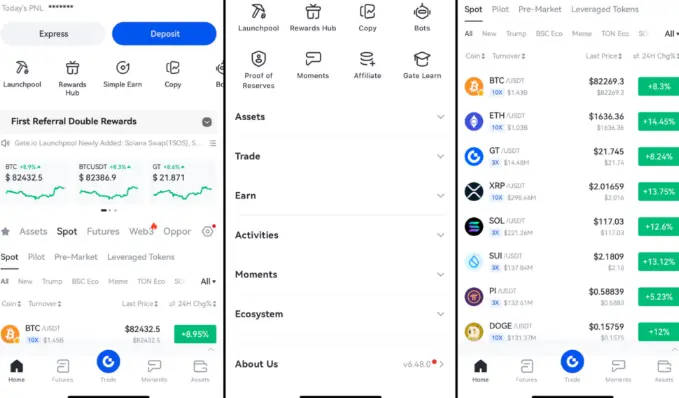

Use Gate for AI MCP to let your AI Agent read information, analyze the market, and execute trades.

🦞 Red → Blue

🏆 Share a 3,000 GT prize pool

Link: https://www.gate.com/announcements/article/50096

#GateBlueLobsters

Use Gate for AI MCP to let your AI Agent read information, analyze the market, and execute trades.

🦞 Red → Blue

🏆 Share a 3,000 GT prize pool

Link: https://www.gate.com/announcements/article/50096

#GateBlueLobsters