XRP News Today

Latest crypto news and price forecasts for XRP: Gate News brings together the latest updates, market analysis, and in-depth insights.

Gate Daily (December 16): JPMorgan's tokenized fund launches on Ethereum; digital asset ETP sees three consecutive weeks of inflows

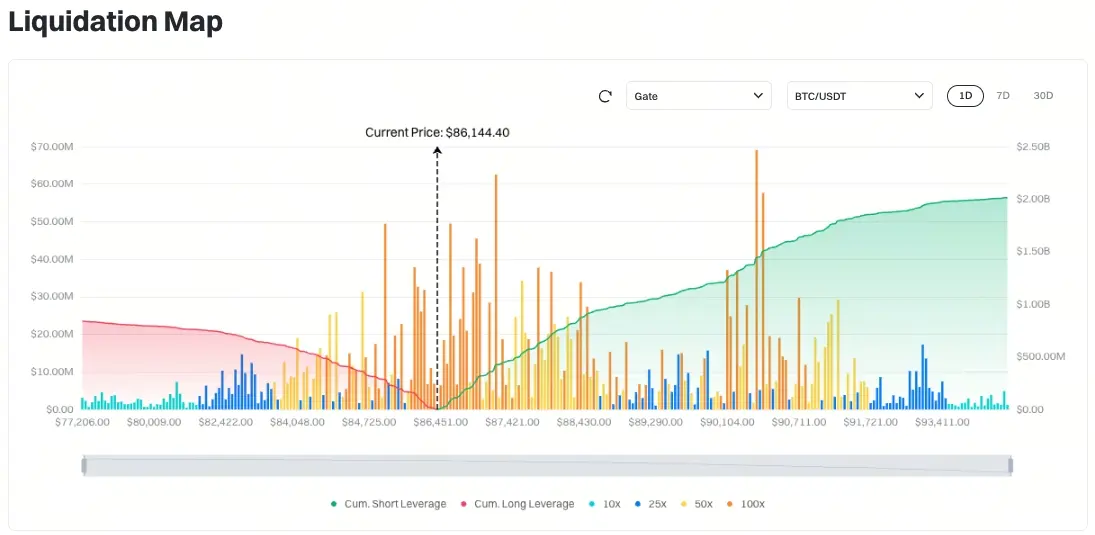

Bitcoin (BTC) crashes and plummets, temporarily reporting around $85,994 on December 16. JPMorgan launches its first tokenized money market fund on Ethereum, offering qualified investors the opportunity to earn USD returns through its institutional trading platform Morgan Money. Digital asset ETP experiences net inflows for the third consecutive week, mainly driven by demand in the United States.

MarketWhisper·4m ago

XRP copying the 2017 script? Traders: After breaking through, replay the 1440% surge myth

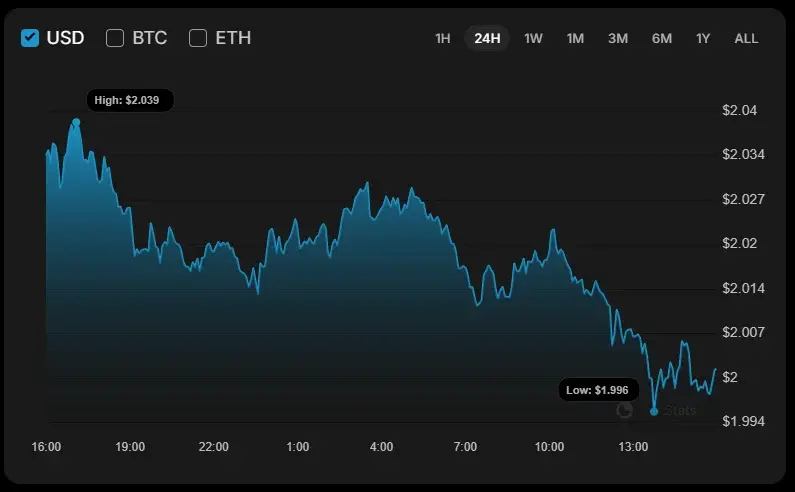

XRP price has been hovering around $2 for several days, forming a critical technical stalemate. From the daily chart, the sharp decline over the past few months has created a descending wedge pattern, with the price narrowing around $2. Well-known trader Steph is Crypto pointed out that the current trend is remarkably similar to the accumulation phase in 2017, when XRP surged from $0.25 to $3.84, a gain of 1440%.

XRP-4.83%

MarketWhisper·29m ago

Analyst Says Here’s Why You’re Underpricing XRP

An analyst suggests the XRP market hasn't fully considered Ripple’s recent regulatory advancements, particularly its OCC approval for a trust bank charter. While Ripple strengthens ties with U.S. finance, XRP's current price remains undervalued, indicating potential for future recovery as these developments unfold.

XRP-4.83%

TheCryptoBasic·11h ago

Price prediction for the top 3 cryptocurrencies: BTC, ETH, and XRP enter a sensitive phase at key technical levels

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are hovering around key technical levels in Monday's trading session, after a slight correction last week. The three largest market cap cryptocurrencies are facing the risk of deeper downward pressure, as signals indicate market movement.

TapChiBitcoin·15h ago

XRP Flashes Buy Signal with 50% Volume Surge, but Analyst Gives "Reality Check" - Coinspeaker

XRP's trading volume surged 50% recently as a buy signal emerged, yet the price stays under $2. Analysts caution about unrealistic year-end price targets while emphasizing the importance of maintaining the $1.90 support level.

Coinspeaker·16h ago

CNBC Trader Ran Neuner Rules out XRP as Wall Street Demand Rises.

Neuner maintains his stance on XRP despite new product launches, citing ongoing control and pricing issues. Meanwhile, interest in XRP and the Solana ecosystem has grown, with positive product flows and increased institutional activity indicating rising market demand.

CryptoBreaking·16h ago

Why XRP Price Isn’t Moving Despite Japan’s Ripple Boost

XRP is trading around the $2.00 level and, for now, it is barely moving. This comes at a time when headlines around Ripple’s activity in Japan should, in theory, be supportive for price. Instead, the market looks stuck, with buyers and sellers canceling each other out.

That disconnect is exactly wh

CaptainAltcoin·17h ago

Expert Warns XRP Holders that Institutional Change Is Imminent

Digital Asset Solutions' research, supported by influencer Amonyx, indicates that many XRP holders may be unprepared for its potential rapid institutional adoption. Ripple aims to integrate XRP into global finance, emphasizing utility and scalability amidst competition and volatility challenges. The report outlines catalysts for growth, such as technological upgrades and regulatory clarity, which could enhance XRP's market position.

XRP-4.83%

Cryptoknowmics·18h ago

XRP Today's News: Bank of Japan's rate hike panic strikes, ETF frantically absorbs 970 million to stabilize the market

XRP breaks below the $2 psychological level. Bank of Japan Governor Ueda Fumio hinted last week that an interest rate hike to 0.75% is imminent. Economists expect a 25 basis point increase on Friday, December 19, which could narrow the interest rate spread and trigger yen arbitrage unwinding. However, the US XRP spot ETF market has shown remarkable resilience, with a total net inflow of $974.5 million over 19 consecutive trading days as of December 12.

MarketWhisper·21h ago

XRP Today News: Breaks below $2! Bank of Japan stirs the market, ETF funds become a key buffer

XRP briefly fell below $1.98 on December 14, hitting the lowest point since November 23 and failing to hold the $2 psychological level. This correction was mainly driven by market concerns over the upcoming interest rate decision by the Bank of Japan and the potential for a "neutral interest rate," which triggered panic selling in yen arbitrage trades. However, the strong performance of the US XRP spot ETF with 19 consecutive days of net capital inflows provided a solid buffer for the price, highlighting the resilience of institutional demand. In the medium to long term, Ripple receiving approval for a US banking license and the progressing crypto-friendly legislation together form a bullish fundamental support for XRP.

XRP-4.83%

MarketWhisper·22h ago

Will XRP continue to decline further despite the influx of capital into ETFs?

The price of XRP is currently at a critical crossroads, as technical warning signals directly oppose the strong surge of institutional capital inflows.

Despite the continuous influx of new funds into XRP spot ETFs, the price structure shows increasing downward pressure. Therefore, the forecast for XRP price is

XRP-4.83%

TapChiBitcoin·23h ago

XRP Technical Breakout Signal! 6-Month Target $5.85, Bullish Expansion Initiated

XRP recently dropped to the $2 level, but analyst Egrag Crypto believes this is a consolidation rather than a trend reversal. Technical charts show that XRP has broken out of the bottom accumulation zone around $0.50 that has persisted for years, with the long-term EMA indicator remaining above the 21-week EMA, showing no death cross signals. The Fibonacci target price forecast for the first zone is $3.40, with subsequent zones extending to $5.85.

XRP-4.83%

MarketWhisper·23h ago

Vivopower Positions for XRP-Linked Upside With $300M Ripple Equity Structure

Vivopower struck a joint venture to gain indirect exposure to Ripple and XRP by sourcing up to $300 million in Ripple Labs shares, tapping strong South Korean investor demand while avoiding balance-sheet risk.

Vivopower Targets Ripple Labs Equity to Capture XRP-Linked Upside

A joint venture

XRP-4.83%

Coinpedia·23h ago

Gate Daily (December 15): SEC releases crypto custody guidelines; UK plans to implement crypto regulation rules by 2027

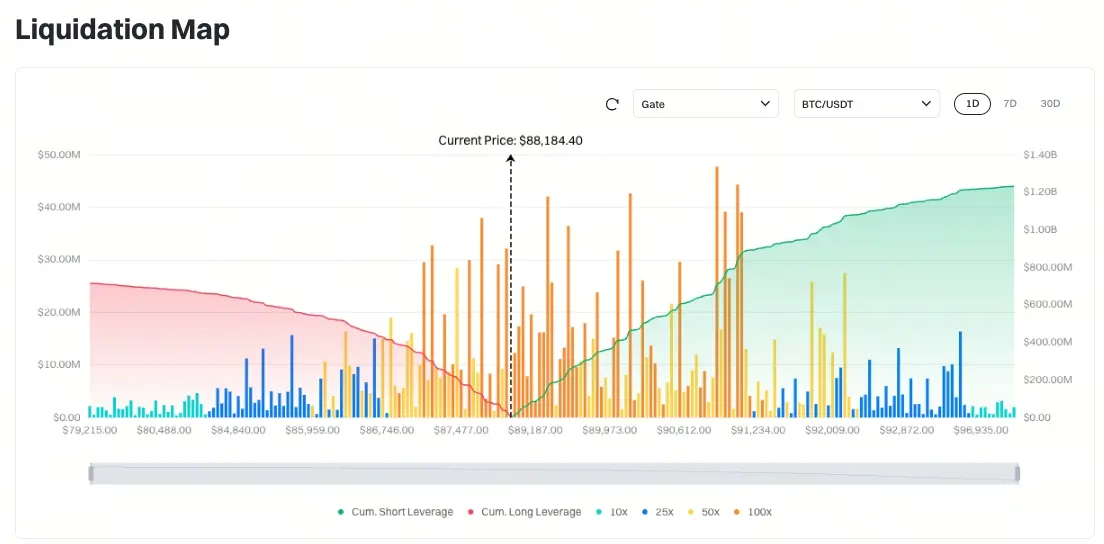

Bitcoin (BTC) opened this week with a sharp decline, currently around $88,460 as of December 15. The UK Treasury plans to establish crypto regulatory rules, to be implemented starting in 2027. The U.S. Securities and Exchange Commission (SEC) released crypto custody guidelines aimed at educating investors. Hong Kong Legislative Council member Wu Jiezhuang was successfully re-elected, promising to continue promoting Web3 development.

MarketWhisper·12-15 01:21

The smartest brain on Earth bets on XRP! The 2026 target price of $15 hits a new all-time high

The world record holder for IQ, YoungHoon Kim (IQ 276), predicts that XRP will hit a new all-time high in 2026 and reveals that he will actively start buying XRP from now on. This prediction shocks the cryptocurrency community, as renowned commentator Gordon points out that when the smartest people on Earth begin accumulating XRP, it means that XRP's current price of $2 is beginning to approach a new all-time high.

XRP-4.83%

MarketWhisper·12-15 00:54

XRP Maintains 1.90 Support As Buyers Gradually Regain Control

XRP has maintained stability within a demand zone of 1.90 to 2.00, experiencing extended consolidation and reduced volatility. A recent base formation indicates weakening selling momentum, suggesting potential upward movement into 2026 if buyer support continues.

XRP-4.83%

CryptoNewsLand·12-14 21:54

XRP Bulls Under Pressure, but One Price Level Now Matters Most

The XRP price might be at a critical moment on the weekly chart, and if you are a holder, you might feel the pressure. A chart shared by ChartNerd shows a familiar setup: XRP remains inside a bullish Gaussian Channel, but price has slipped below an important mid-range level that now needs to be

XRP-4.83%

CaptainAltcoin·12-14 17:24

ETF’s Update: Bitcoin, Ethereum, XRP Prices React to Latest Institutional Activity

Bitcoin, Ethereum, and XRP spot ETFs revealed contrasting trends, with Bitcoin and Ethereum facing significant outflows, while XRP experienced sustained inflows. Market sentiment fluctuates ahead of the Federal Reserve's policy decision, impacting investor behaviors.

CryptoNewsLand·12-14 16:36

XRP Set for Upswing As Investor Confidence Grows and ETFs Accumulate

XRP shows potential for a rebound as bullish patterns emerge, alongside strong ETF inflows indicating renewed investor confidence. Despite previous struggles, the Ripple ecosystem's growth may bolster long-term demand.

CryptoNewsLand·12-14 15:45

XRP Bulls Gain Confidence as Social Sentiment Turns Positive

Ripple Demonstrates Growing Market Momentum and Bullish Sentiment

Ripple (XRP) is experiencing a notable resurgence in market interest, fueled by rising social media optimism and continued inflows into XRP-focused exchange-traded funds (ETFs). As the digital asset hovers around the $2 mark,

XRP-4.83%

CryptoBreaking·12-14 06:39

Here’s Where XRP Price Could Be Headed This Week

Ripple’s XRP has been stuck in a tight range over the past few days, even as several bullish headlines hit the market. Wrapped XRP just went live on Solana, giving the token access to one of the deepest DeFi ecosystems in crypto

At the same time, U.S. spot XRP ETFs have quietly pulled in close to

XRP-4.83%

CaptainAltcoin·12-14 06:14

XRP Consolidates Near $2 as Analysts Watch Key Support Amid Weak Liquidity Below

XRP consolidates near $2 as declining volume signals indecision after months of volatility.

$2 remains critical support, with limited liquidity below increasing downside risk toward $1.20.

ETF launch and steady inflows boost adoption, but price stays compressed amid weak momentum.

XRP continues t

XRP-4.83%

CryptoFrontNews·12-14 05:02

Chainlink Consolidation Mirrors XRP Setup From $0.30 to $0.50

Chainlink holds a long-term trendline while price builds a wide base below resistance

Repeated reactions suggest accumulation rather than distribution across cycles

Analysts compare this structure to XRP before its $0.30 to $0.50 breakout

Chainlink continues to trade along a long-standing trendli

CryptoNewsLand·12-14 01:44

XRP Sentiment Surges Amid Ethereum Caution

XRP shows strong trader optimism for a potential rally, targeting $2.10, while Ethereum sentiment is cautious, ranking only 23rd most bullish amid a 35% price drop. This reflects differing market psyches as XRP consolidates and Ethereum pulls back.

CryptoFrontNews·12-13 17:16

Hex Trust to Launch Wrapped XRP, Extending XRP’s Reach Across Multi-Chain DeFi

Key Takeaways:

Hex Trust will issue and safeguard Wrapped XRP (wXRP) for use on multiple blockchains.

The initiative expands XRP’s access to DeFi ecosystems beyond the XRP Ledger.

Institutions gain a regulated path to deploy XRP liquidity across cross-chain markets.

Table of Contents

A

CryptoNinjas·12-13 14:47

Peter Brandt Says XRP Holders Are the Most Uneducated Perma Bulls

Veteran trader Peter Brandt criticized XRP holders as ignorant perma bulls, prompting varied responses from the XRP community. Some countered with sentiments favoring long-term gains, while others emphasized broader systemic developments over traditional chart analysis.

TheCryptoBasic·12-13 14:30

Here is XRP Bull Case Projection If Saylor’s 2045 Bitcoin Prediction Materializes

XRP could potentially reach $1,101 by 2045 if it parallels Bitcoin's growth trajectory, influenced by Michael Saylor's bullish Bitcoin forecast. Despite recent declines, market optimism remains high for long-term crypto recovery.

TheCryptoBasic·12-13 14:30

XRP Defends $2 As Bulls Hold the Line, but Ethereum’s 35% Slide Changes the Mood

XRP price has reached one of those moments where the chart starts doing the talking. After months of sharp swings and fading excitement across crypto, Ripple is now sitting at a level that feels important. Price is no longer racing higher, yet it is not collapsing either. XRP has been hovering

CaptainAltcoin·12-13 14:03

Sistine Research Predicts 2 Digit XRP Price Which Looks More Likely

Sistine Research indicates that XRP may soon reach a double-digit price, supported by rising dominance despite past underperformance. With a current market cap of $122 billion, projected growth to $600 billion-$900 billion is anticipated with a potential breakout.

TheCryptoBasic·12-13 13:15

ETF Bitcoin attracts $49.16 million, Ethereum experiences capital withdrawal, XRP records an inflow of $20.17 million

On December 12, Bitcoin spot ETFs saw a net inflow of $49.16 million, indicating strong institutional demand, mainly driven by BlackRock's IBIT. In contrast, Ethereum ETFs faced a net outflow of $19.41 million, while XRP ETFs noted a positive inflow of $20.17 million, reflecting selective investor preferences for liquidity and reputable brands.

TapChiBitcoin·12-13 13:06

XRP Holds $2 as Market Pressure Builds Around a Critical Support Zone

XRP consolidates near $2 after months of weakening structure and repeated upper resistance failures

Selling pressure increased after rejected rallies above $3 earlier in 2025

Short-term stability masks elevated downside risk if $2 support breaks

XRP centers on a critical support test as the

XRP-4.83%

CryptoFrontNews·12-13 13:02

XRP Bulls Maintain $2 Value While Ethereum Faces 35% Drop in 12 Weeks

XRP holds steady at $2 amid bullish sentiment, while Ethereum faces a 35% drop in 12 weeks, signaling shifting market dynamics.

XRP has held its ground at the $2 mark despite market fluctuations, while Ethereum has seen a 35% drop over the last 12 weeks.

Despite the strong performance of XRP,

LiveBTCNews·12-13 12:35

XRP Price Prediction Holds Above $2, Investors Push DeepSnitchAI to $1 Million With New Year Offe...

Ripple has launched the “XRP Ledger v3.0.0” upgrade, which promises to bring more stability to the blockchain. The XRP price prediction is promising, with charts showing a possible breakout of the resistance at $2.23. Ethereum is waiting for a massive falling wedge breakout to be confirmed, which

CaptainAltcoin·12-13 12:34

Must-Read for Investors: Bitcoin Weakens, XRP Strengthens – Why XRPStaking is Becoming a New Choice for Global Users

Against a backdrop of persistent global market volatility, geopolitical uncertainty, and tightening traditional yield channels, investors are increasingly focused not only on identifying opportunities, but also on understanding risk-adjusted and sustainable return models. As equities, bonds, and rea

Coinfomania·12-13 11:36

Here Is XRP Price Prediction for 2026 if Bitcoin Hits $200K

As 2025 winds down, market watchers are now focusing on what the new year could bring for leading crypto assets like XRP and Bitcoin.

This year, several crypto assets set new peaks following Bitcoin’s lead, including XRP and Ethereum. While most assets have lost much of their gains in the final

TheCryptoBasic·12-13 09:47

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28