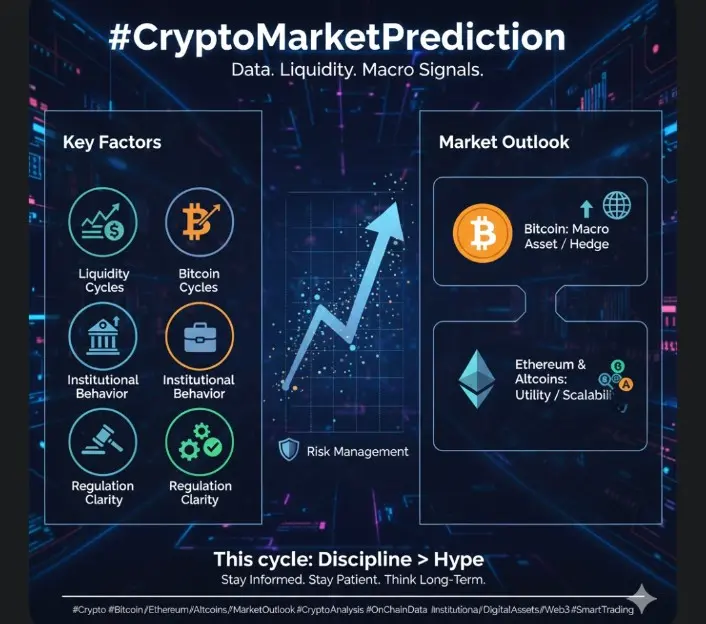

#加密行情预测 Liquidity is coming! The Federal Reserve once again employs the "money printing" tactic. Can the crypto market absorb this wave of capital outflow?

In the early morning, the Federal Reserve injected $16 billion into the banking system through overnight repurchase operations, marking the second-largest single operation since YQ. This move indicates that the financial market will see a short-term increase in funds and has garnered widespread attention from the cryptocurrency community.

What impact does increased liquidity have on the crypto market?

Historically, when traditional markets

In the early morning, the Federal Reserve injected $16 billion into the banking system through overnight repurchase operations, marking the second-largest single operation since YQ. This move indicates that the financial market will see a short-term increase in funds and has garnered widespread attention from the cryptocurrency community.

What impact does increased liquidity have on the crypto market?

Historically, when traditional markets

BTC1,29%