# PostonSquaretoEarn$50

104.97K

Gate Square Newcomer & returning user perks are live! Post your first or comeback post with #MyFirstPostOnSquare to claim a $50 Position Voucher. Top monthly poster & most interactive user each get an extra $50! Feel free to share now!

Pin

Gate广场_Official

👀 fam, every day watching the market and scrolling through pro opinions, but never speaking up? Your perspective might be more valuable than you think!

New Plaza Members & Return Benefits are officially launched! Whether it's your first time posting or you're returning after a long time, we directly give you rewards! 🎁

A monthly bonus of $20,000 awaits you!

📅 Event Duration: Valid for a long time (settlement at the end of the month)

💎 Participation Method:

Users must be new users making their first post or returning users who haven't posted in a month.

When posting, you must in

View OriginalNew Plaza Members & Return Benefits are officially launched! Whether it's your first time posting or you're returning after a long time, we directly give you rewards! 🎁

A monthly bonus of $20,000 awaits you!

📅 Event Duration: Valid for a long time (settlement at the end of the month)

💎 Participation Method:

Users must be new users making their first post or returning users who haven't posted in a month.

When posting, you must in

- Reward

- 20

- 27

- Repost

- Share

JungleKing888-ConquerTheWild :

:

The post was posted out of sight, it seemed to be blocked, what's going on, do you have any family members who know?View More

#PostonSquaretoEarn$50

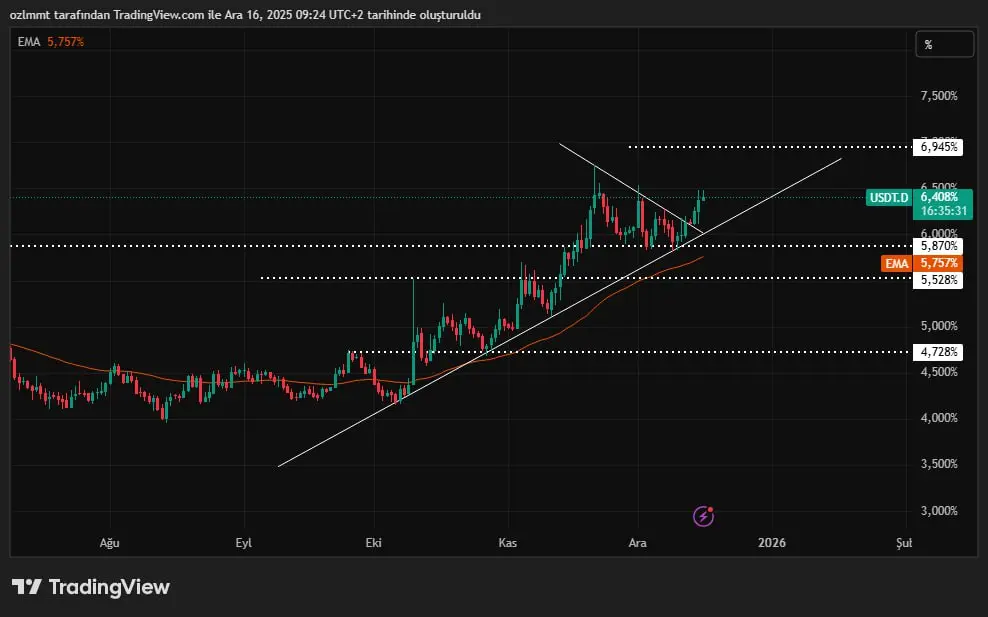

Crypto Market Analysis: An In-Depth Look at BTC, ETH, Dominance, and Total Market Capitalization

Hello Gate Square community! long-time active investor in the crypto markets, and today I wanted to share a market analysis focused on BTC, ETH, OTHERS dominance (altcoin dominance), and TOTAL2 (total altcoin market capitalization). In this analysis, I will thoroughly cover support/resistance levels, chart patterns, and my overall market expectations based on weekly and daily timeframes. All charts are prepared on TradingView, and my commentary reflects real-time market cond

Crypto Market Analysis: An In-Depth Look at BTC, ETH, Dominance, and Total Market Capitalization

Hello Gate Square community! long-time active investor in the crypto markets, and today I wanted to share a market analysis focused on BTC, ETH, OTHERS dominance (altcoin dominance), and TOTAL2 (total altcoin market capitalization). In this analysis, I will thoroughly cover support/resistance levels, chart patterns, and my overall market expectations based on weekly and daily timeframes. All charts are prepared on TradingView, and my commentary reflects real-time market cond

- Reward

- 55

- 44

- Repost

- Share

YildirimBeyy :

:

Christmas to the Moon! 🌕View More

#PostonSquaretoEarn$50 ETH Market Outlook & Complete Support/Resistance Map (USDT)

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

- Reward

- 7

- 2

- Repost

- Share

mark123 :

:

bitcoin is a future asset, it's really good to have it, indeed.View More

#PostonSquaretoEarn$50 ETH Market Outlook & Complete Support/Resistance Map (USDT)

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Watching Closely 🔍#PostonSquaretoEarn$50 ETH Market Outlook & Complete Support/Resistance Map (USDT)

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

- Reward

- like

- Comment

- Repost

- Share

#PostonSquaretoEarn$50 Solana (SOL): A High-Performance Blockchain With Strong Future Potential — Why You Should Watch It

Hello Gate Square community! While the crypto market is experiencing volatility in mid-December 2025, with Bitcoin consolidating around the $87,000–88,000 range, fundamentally strong projects like Solana (SOL) continue to present long-term opportunities. Solana stands out among Layer-1 blockchains due to its high speed, low transaction costs, and rapidly expanding ecosystem. At its current price range (~$128–130), many investors view SOL as being in an accumulation zone, m

Hello Gate Square community! While the crypto market is experiencing volatility in mid-December 2025, with Bitcoin consolidating around the $87,000–88,000 range, fundamentally strong projects like Solana (SOL) continue to present long-term opportunities. Solana stands out among Layer-1 blockchains due to its high speed, low transaction costs, and rapidly expanding ecosystem. At its current price range (~$128–130), many investors view SOL as being in an accumulation zone, m

- Reward

- 5

- Comment

- Repost

- Share

#PostonSquaretoEarn$50 ETH Market Outlook & Complete Support/Resistance Map (USDT)

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

Ethereum (ETH) is currently testing key structural zones in the 3,000–3,200 USDT range, making this a critical period for both traders and long-term holders. Here’s a detailed breakdown of supports, resistances, and strategic trading plans.

Support Zones (USDT)

Zone

Importance

Confirmation

3,000–3,050

Psychological threshold; algorithmic buys & spot demand converge

Quick dip below 2,980 followed by hourly close above 3,050

3,080–3,120

First line of defense during pullbacks

Volume surge and reclaim of 3,100

3,15

- Reward

- like

- Comment

- Repost

- Share

#PostonSquaretoEarn$50

ETH Market Outlook and Complete Support/Resistance Map (USDT)

- Monthly structure: The backbone of the long-term bullish narrative is built around the psychological–structural threshold of 3,000 USDT. Monthly closes above this level indicate a healthy trend; closes below open the door to deeper corrections.

- Weekly structure: Weekly control points are 3,150–3.200, 3,400, 3,600, and 4,000 USDT. Supports are layered and clear; rallies usually progress step by step: “impulse from support, profit-taking at intermediate resistance.”

- Trend confirmation: For an upt

ETH Market Outlook and Complete Support/Resistance Map (USDT)

- Monthly structure: The backbone of the long-term bullish narrative is built around the psychological–structural threshold of 3,000 USDT. Monthly closes above this level indicate a healthy trend; closes below open the door to deeper corrections.

- Weekly structure: Weekly control points are 3,150–3.200, 3,400, 3,600, and 4,000 USDT. Supports are layered and clear; rallies usually progress step by step: “impulse from support, profit-taking at intermediate resistance.”

- Trend confirmation: For an upt

- Reward

- 81

- 51

- Repost

- Share

MrSTAR :

:

Merry Christmas ⛄View More

#PostonSquaretoEarn$50

ETH Market Outlook and Complete Support/Resistance Map (USDT)

- Monthly structure: The backbone of the long-term bullish narrative is built around the psychological–structural threshold of 3,000 USDT. Monthly closes above this level indicate a healthy trend; closes below open the door to deeper corrections.

- Weekly structure: Weekly control points are 3,150–3.200, 3,400, 3,600, and 4,000 USDT. Supports are layered and clear; rallies usually progress step by step: “impulse from support, profit-taking at intermediate resistance.”

- Trend confirmation: For an upt

ETH Market Outlook and Complete Support/Resistance Map (USDT)

- Monthly structure: The backbone of the long-term bullish narrative is built around the psychological–structural threshold of 3,000 USDT. Monthly closes above this level indicate a healthy trend; closes below open the door to deeper corrections.

- Weekly structure: Weekly control points are 3,150–3.200, 3,400, 3,600, and 4,000 USDT. Supports are layered and clear; rallies usually progress step by step: “impulse from support, profit-taking at intermediate resistance.”

- Trend confirmation: For an upt

- Reward

- like

- Comment

- Repost

- Share

#PostonSquaretoEarn$50

Bitcoin Swing Trading Strategy: Capturing Profit Opportunities While Minimizing Risk

Hello Gate Square community! In the volatile nature of the crypto market, acting with the right strategies can both increase profit potential and limit losses. Today, I’d like to share a swing trading strategy specifically for Bitcoin (BTC). Swing trading aims to capture short- to mid-term price fluctuations by opening positions that usually last from a few days to weeks. I will explain this strategy step by step, supported by technical analysis tools. My goal is to provide an applicabl

Bitcoin Swing Trading Strategy: Capturing Profit Opportunities While Minimizing Risk

Hello Gate Square community! In the volatile nature of the crypto market, acting with the right strategies can both increase profit potential and limit losses. Today, I’d like to share a swing trading strategy specifically for Bitcoin (BTC). Swing trading aims to capture short- to mid-term price fluctuations by opening positions that usually last from a few days to weeks. I will explain this strategy step by step, supported by technical analysis tools. My goal is to provide an applicabl

BTC1,58%

- Reward

- 18

- 14

- Repost

- Share

Bab谋_Ali :

:

HODL Tight 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

381.15K Popularity

10.25K Popularity

9.99K Popularity

5.66K Popularity

4.02K Popularity

6.41K Popularity

3.83K Popularity

4.43K Popularity

2.23K Popularity

43 Popularity

55.09K Popularity

69.55K Popularity

20.7K Popularity

27.02K Popularity

201.91K Popularity

News

View MoreU.S. stock indices extend gains, with the Dow Jones rising by 1%

5 m

Circle has increased the issuance of 750 million USDC on the Solana network.

41 m

Circle Transfers 750 Million USDC

45 m

Argentine cryptocurrency scam suspect arrested in Venezuela after allegedly fleeing with $56 million worth of Bitcoin

54 m

Data: The only group currently continuing to buy is the mega whales holding over 1,000 BTC. Retail investors holding less than 10 BTC have been continuously selling for a month.

1 h

Pin