Daneliya

No content yet

Daneliya

$Move is slowly turning the wheel.

After dipping toward 3.6c, candles started printing higher lows and pushing back up.

Not a moon shot like others, but that steady climb often tells a stronger story.

If trend stays clean, it might surprise people who weren’t paying attention.

After dipping toward 3.6c, candles started printing higher lows and pushing back up.

Not a moon shot like others, but that steady climb often tells a stronger story.

If trend stays clean, it might surprise people who weren’t paying attention.

MOVE-10,83%

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for sharing- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

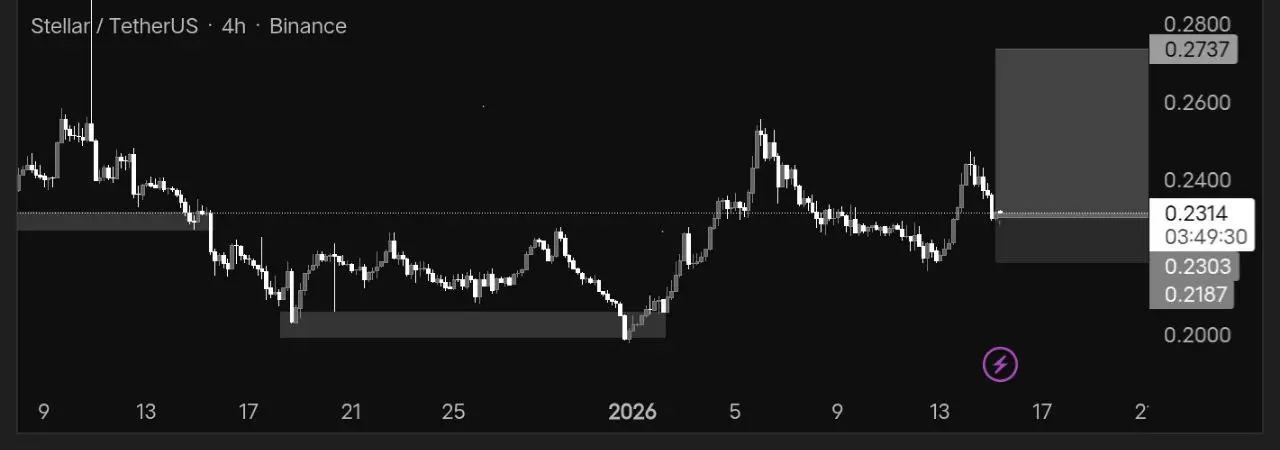

$XLM recently bounced strongly from a long-term demand area, signaling that buyers are still active at lower prices. Since that bounce, price has moved into a consolidation phase, which often reflects balance rather than weakness.

Instead of sharp selling, the market appears to be digesting the previous move. This kind of behavior is typically seen when participants are reassessing value after expansion. If XLM can stabilize here and reclaim nearby resistance as support, it would suggest that the consolidation is a continuation pattern rather than a topping structure. That scenario could ope

Instead of sharp selling, the market appears to be digesting the previous move. This kind of behavior is typically seen when participants are reassessing value after expansion. If XLM can stabilize here and reclaim nearby resistance as support, it would suggest that the consolidation is a continuation pattern rather than a topping structure. That scenario could ope

XLM-6,19%

- Reward

- 1

- Comment

- Repost

- Share

$DOGE has been quietly building a solid base after a strong move from its demand zone. After testing key support, price paused and started consolidating, which is exactly what healthy bullish action looks like. This is a critical phase: the market is deciding whether buyers remain in control or if sellers regain momentum.

The encouraging part is how $DOGE held above prior lows without aggressive selling. This suggests buyers are accumulating and ready for another run toward recent highs. The consolidation is acting as a springboard the longer it holds above demand, the stronger the potential

The encouraging part is how $DOGE held above prior lows without aggressive selling. This suggests buyers are accumulating and ready for another run toward recent highs. The consolidation is acting as a springboard the longer it holds above demand, the stronger the potential

DOGE-9,97%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊$SOL5S just posted a clean trend shift.

A strong bounce from the recent low followed by a steady climb into fresh highs shows buyers stepping back into control.

Each leg up is supported by higher lows, which signals confidence and momentum building underneath the chart rather than just a one-off spike.

As long as SOL5S protects its support levels and keeps rejecting dips, this trend has room to keep stretching upward.

A strong bounce from the recent low followed by a steady climb into fresh highs shows buyers stepping back into control.

Each leg up is supported by higher lows, which signals confidence and momentum building underneath the chart rather than just a one-off spike.

As long as SOL5S protects its support levels and keeps rejecting dips, this trend has room to keep stretching upward.

SOL5S30,15%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

$LINK5S has quietly turned into a clean trend continuation play.

After basing out at the bottom, the move upward has been steady, controlled, and backed by strong candles that keep breaking through previous resistance zones.

The lack of deep retracements shows firm demand each pause turns into a new push higher.

Momentum is clearly on the long side for now, and as long as dips stay supported, LINK5S can keep stepping higher from here.

After basing out at the bottom, the move upward has been steady, controlled, and backed by strong candles that keep breaking through previous resistance zones.

The lack of deep retracements shows firm demand each pause turns into a new push higher.

Momentum is clearly on the long side for now, and as long as dips stay supported, LINK5S can keep stepping higher from here.

LINK5S29,74%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊$ASTER3S showing a sharp impulse move after sweeping liquidity near the lows.

Strong bullish candle suggests aggressive dip absorption and short covering.

As long as price holds above the recent base, momentum favors continuation.

Immediate focus is reclaiming prior supply near the recent rejection zone.

Failure to hold could lead to consolidation, but structure has flipped short-term bullish

Strong bullish candle suggests aggressive dip absorption and short covering.

As long as price holds above the recent base, momentum favors continuation.

Immediate focus is reclaiming prior supply near the recent rejection zone.

Failure to hold could lead to consolidation, but structure has flipped short-term bullish

ASTER3S21,09%

- Reward

- like

- Comment

- Repost

- Share

$BANK grinding higher with consistent higher lows and steady buying pressure.

Price pushed through local resistance, signaling strength rather than a dead-cat bounce.

As long as pullbacks remain shallow, trend continuation remains likely.

Acceptance above the breakout zone opens room for expansion, while loss of it turns this into a range again.

Price pushed through local resistance, signaling strength rather than a dead-cat bounce.

As long as pullbacks remain shallow, trend continuation remains likely.

Acceptance above the breakout zone opens room for expansion, while loss of it turns this into a range again.

BANK-11,11%

- Reward

- 1

- Comment

- Repost

- Share

$PEOPLE3S showing a clean rebound after a deep retrace.

Liquidity sweep at the lows followed by a strong recovery candle hints at a short-term trend shift.

If price sustains above the recovery level, upside continuation is favored.

Rejection here would imply this move was relief-driven, but structure currently leans bullish.

Liquidity sweep at the lows followed by a strong recovery candle hints at a short-term trend shift.

If price sustains above the recovery level, upside continuation is favored.

Rejection here would imply this move was relief-driven, but structure currently leans bullish.

PEOPLE3S37,96%

- Reward

- like

- Comment

- Repost

- Share

$BONK has made a powerful impulsive move, breaking out aggressively from its base.

The recent pullback appears to be profit-taking after a sharp rally, not a breakdown. Momentum is still strong, but volatility is high, so sharp candles are expected.

If price holds above the breakout zone, continuation remains likely. This is strength, but risk management matters with moves this fast.

The recent pullback appears to be profit-taking after a sharp rally, not a breakdown. Momentum is still strong, but volatility is high, so sharp candles are expected.

If price holds above the breakout zone, continuation remains likely. This is strength, but risk management matters with moves this fast.

BONK-11,08%

- Reward

- like

- Comment

- Repost

- Share

$BNB is showing a strong bullish structure with clear higher highs and higher lows. Buyers are firmly in control, pushing price toward the 894 zone without any signs of exhaustion.

The breakout above the recent range looks clean, not forced. As long as price holds above the previous support area around 885–880, the trend remains intact.

Pullbacks look healthy and controlled, suggesting continuation rather than reversal.

The breakout above the recent range looks clean, not forced. As long as price holds above the previous support area around 885–880, the trend remains intact.

Pullbacks look healthy and controlled, suggesting continuation rather than reversal.

BNB-9,64%

- Reward

- like

- Comment

- Repost

- Share

$HYPER is moving with steady and disciplined price action. Higher lows and strong closes show consistent buying pressure without panic selling.

The breakout above the range confirms accumulation turning into expansion. As long as price stays above the breakout area, upside continuation remains favored. This type of calm strength often leads to sustained moves rather than quick spikes.

#Bitcoin2026PriceOutlook

The breakout above the range confirms accumulation turning into expansion. As long as price stays above the breakout area, upside continuation remains favored. This type of calm strength often leads to sustained moves rather than quick spikes.

#Bitcoin2026PriceOutlook

HYPER-10,59%

- Reward

- like

- Comment

- Repost

- Share

$BTC BTC is trading around $89,960, and price action continues to show controlled bullish expansion.

This move is not emotional it’s structured.

• Higher highs remain intact

• Pullbacks are shallow and quickly absorbed

• Sellers fail to gain follow-through

The move below $88.8K acted as a liquidity sweep, followed by an immediate reclaim. That behavior typically signals strong underlying demand, not weakness.

As long as BTC holds above $89K, the path of least resistance remains higher.

Acceptance above $90.2K could open continuation toward $91K+.

Only a loss of $88.6K would force a reassessme

This move is not emotional it’s structured.

• Higher highs remain intact

• Pullbacks are shallow and quickly absorbed

• Sellers fail to gain follow-through

The move below $88.8K acted as a liquidity sweep, followed by an immediate reclaim. That behavior typically signals strong underlying demand, not weakness.

As long as BTC holds above $89K, the path of least resistance remains higher.

Acceptance above $90.2K could open continuation toward $91K+.

Only a loss of $88.6K would force a reassessme

BTC-7,7%

- Reward

- 2

- 1

- Repost

- Share

Noaa_Grace :

:

Agree. Market feels calm and calculated, not euphoric. Trend still deserves respect.$ETH is trading near $3,099, and reclaiming $3,000 has clearly shifted market bias.

Price is holding above former resistance, with buyers stepping in aggressively on every pullback. This behavior suggests acceptance above $3K, not a temporary spike.

Key zones to watch: • Resistance: $3,115–$3,130

• Support: $3,050 → $3,000

As long as ETH holds above $3,050, bullish continuation remains favored.

Sustained strength above $3,120 puts $3,200 into focus.

Above $3K, patience pays.

Price is holding above former resistance, with buyers stepping in aggressively on every pullback. This behavior suggests acceptance above $3K, not a temporary spike.

Key zones to watch: • Resistance: $3,115–$3,130

• Support: $3,050 → $3,000

As long as ETH holds above $3,050, bullish continuation remains favored.

Sustained strength above $3,120 puts $3,200 into focus.

Above $3K, patience pays.

ETH-8,76%

- Reward

- 2

- 1

- Repost

- Share

MakeAProfitOf100Million! :

:

2026 Go Go Go 👊$XRP is trading around $1.94 after breaking out of consolidation with strong momentum.

Market structure remains clean: • Higher lows respected

• Breakout from $1.88 held

• No meaningful rejection yet

As long as price remains above $1.90, the bullish structure stays valid.

A firm break above $1.95 brings the $2.00 psychological level into play.

Weakness only appears below $1.88.

Until then, momentum favors continuation.

#BitcoinGoldBattle

Market structure remains clean: • Higher lows respected

• Breakout from $1.88 held

• No meaningful rejection yet

As long as price remains above $1.90, the bullish structure stays valid.

A firm break above $1.95 brings the $2.00 psychological level into play.

Weakness only appears below $1.88.

Until then, momentum favors continuation.

#BitcoinGoldBattle

XRP-8,75%

- Reward

- 3

- Comment

- Repost

- Share

$PEPE is doing exactly what strong charts do before expansion.

Price has been spending time building a base at a key demand area, and every dip into this zone keeps getting absorbed. That’s not weakness that’s quiet accumulation.

What stands out is how sellers keep trying to push price lower, but momentum fades quickly each time. This tells me supply is drying up. When that happens on memecoins, moves tend to be sharp, not slow.

PEPE doesn’t need hype to move. It needs structure. And right now, structure is stabilizing after a corrective phase. The longer price holds this base, the more energ

Price has been spending time building a base at a key demand area, and every dip into this zone keeps getting absorbed. That’s not weakness that’s quiet accumulation.

What stands out is how sellers keep trying to push price lower, but momentum fades quickly each time. This tells me supply is drying up. When that happens on memecoins, moves tend to be sharp, not slow.

PEPE doesn’t need hype to move. It needs structure. And right now, structure is stabilizing after a corrective phase. The longer price holds this base, the more energ

PEPE-9,19%

- Reward

- 5

- Comment

- Repost

- Share

$2Z shows a textbook reversal structure after a prolonged downtrend. Price formed a base around 0.111, followed by a sharp V-shaped recovery driven by strong bullish candles and expanding volume.

This move reclaimed multiple intraday levels in a short period, signaling aggressive demand stepping in. The recent push toward 0.13 confirms momentum expansion and a shift in market control.

As long as price holds above the 0.12 region, dips are likely to be bought, and continuation toward higher resistance zones remains the dominant scenario.

#2025GateYearEndSummary

This move reclaimed multiple intraday levels in a short period, signaling aggressive demand stepping in. The recent push toward 0.13 confirms momentum expansion and a shift in market control.

As long as price holds above the 0.12 region, dips are likely to be bought, and continuation toward higher resistance zones remains the dominant scenario.

#2025GateYearEndSummary

2Z-10,87%

- Reward

- like

- Comment

- Repost

- Share

$ASTER3S experienced a strong expansion move from the 0.52 lows, followed by a controlled consolidation just below local highs. Price is respecting the previous breakout zone and holding structure, which suggests strength rather than exhaustion.

The current range looks like absorption, with sellers failing to push price back into prior demand.

This type of sideways action after an impulse often precedes continuation. A decisive break above the 0.63–0.64 resistance area could trigger the next leg higher, while pullbacks into the range remain constructive as long as support holds.

The current range looks like absorption, with sellers failing to push price back into prior demand.

This type of sideways action after an impulse often precedes continuation. A decisive break above the 0.63–0.64 resistance area could trigger the next leg higher, while pullbacks into the range remain constructive as long as support holds.

ASTER3S21,09%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More98.15K Popularity

14.8K Popularity

386.44K Popularity

2.98K Popularity

1.2K Popularity

Pin