Elainee

No content yet

Elainee

6 Iron Rules for Survival in the Crypto World

1. The essence of the sickle: All projects aim to drain your pockets; don't dream of being the "Chosen One."

2. Trust only the mainstream: Hold steady with BTC/ETH/SOL/BNB! The ecosystem is there, and even if you're trapped at high levels, there's a chance to recover. Don't gamble on the "next ETH."

3. New coins are scams: 99% of new coins are scams packaged by Southeast Asia/Dubai operators. No ecosystem on-chain, all air; they harvest immediately upon launch.

4. Be cautious with contracts: 2x leverage can blow up; high leverage will definitely ge

View Original1. The essence of the sickle: All projects aim to drain your pockets; don't dream of being the "Chosen One."

2. Trust only the mainstream: Hold steady with BTC/ETH/SOL/BNB! The ecosystem is there, and even if you're trapped at high levels, there's a chance to recover. Don't gamble on the "next ETH."

3. New coins are scams: 99% of new coins are scams packaged by Southeast Asia/Dubai operators. No ecosystem on-chain, all air; they harvest immediately upon launch.

4. Be cautious with contracts: 2x leverage can blow up; high leverage will definitely ge

- Reward

- 2

- 3

- Repost

- Share

ChristmasEve :

:

2026 Go Go Go 👊View More

Previously, it was mentioned that $HYPE broke through the long-standing downtrend line.

Then we drew a range, and if a consolidation occurs here, it could be a structure where we might consider entering.

Currently, $HYPE is following our script perfectly:

1. After breaking the trend line, a very perfect small consolidation was formed

2. Then it continued to break upward

As the only token that can still rise against the overall bearish market, it remains worth paying close attention to.

Then we drew a range, and if a consolidation occurs here, it could be a structure where we might consider entering.

Currently, $HYPE is following our script perfectly:

1. After breaking the trend line, a very perfect small consolidation was formed

2. Then it continued to break upward

As the only token that can still rise against the overall bearish market, it remains worth paying close attention to.

HYPE2,46%

- Reward

- 1

- 3

- Repost

- Share

ChristmasEve :

:

2026 Go Go Go 👊View More

We can understand the abstraction of a trading system as:

Expected profit per trade = Win rate × Profit per win – Loss rate × Loss per trade. Simplified, it’s the average amount earned per trade after subtracting the amount lost per trade.

Here, we consider three roles:

1. Retail investor: Win rate 45%, expected profit = 0.45 × 1.5 – 0.55 × 1 = +0.125

2. Ordinary trader: Win rate 50%, expected profit = 0.50 × 1.5 – 0.50 × 1 = +0.25

3. Professional trader: Win rate 55%, expected profit = 0.55 × 1.5 – 0.45 × 1 = +0.375

You can see that, from retail investors to ordinary traders, a 5% increas

View OriginalExpected profit per trade = Win rate × Profit per win – Loss rate × Loss per trade. Simplified, it’s the average amount earned per trade after subtracting the amount lost per trade.

Here, we consider three roles:

1. Retail investor: Win rate 45%, expected profit = 0.45 × 1.5 – 0.55 × 1 = +0.125

2. Ordinary trader: Win rate 50%, expected profit = 0.50 × 1.5 – 0.50 × 1 = +0.25

3. Professional trader: Win rate 55%, expected profit = 0.55 × 1.5 – 0.45 × 1 = +0.375

You can see that, from retail investors to ordinary traders, a 5% increas

- Reward

- 1

- 5

- Repost

- Share

ChristmasEve :

:

2026 Go Go Go 👊View More

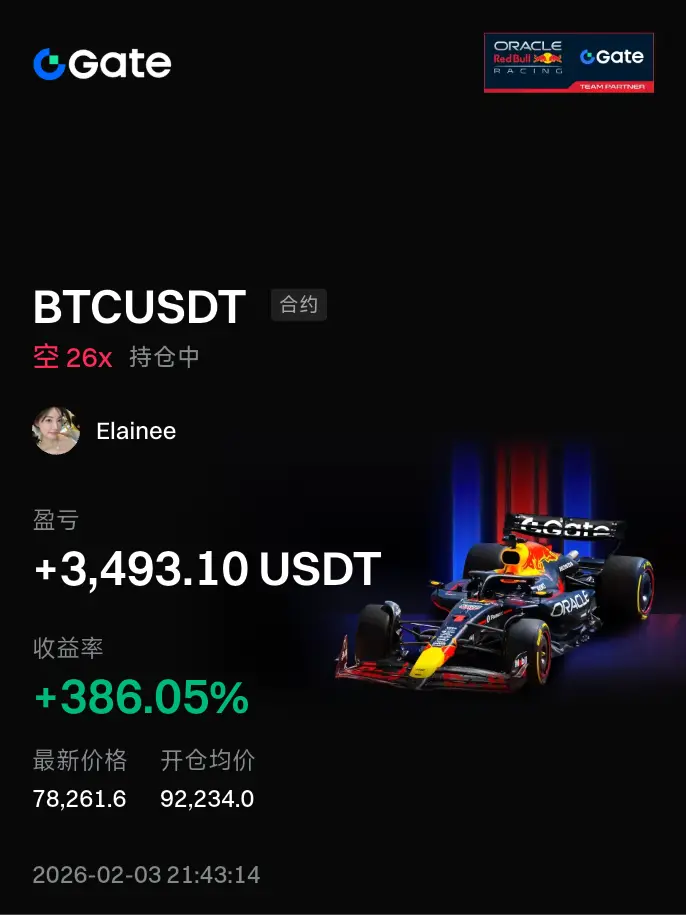

A few days ago, I mentioned if BTC drops back to 80,000 by the end of the month, would you still dare to buy the dip? Now it looks like this dip can only be short-term bullish, no way to hold long-term. If you listen to Aunt Mu's saying that 90,000 is the bottom, then the bulls will die without a burial ground. The Federal Reserve pausing interest rate cuts and regional tensions intensifying, the negative impact will continue.

BTC 80,000 will definitely be broken in the near future, and the support around 80,000 is the monthly EMA30, which is about 78,800. The first break usually rebounds to 8

BTC 80,000 will definitely be broken in the near future, and the support around 80,000 is the monthly EMA30, which is about 78,800. The first break usually rebounds to 8

BTC-2,6%

- Reward

- 1

- 1

- Repost

- Share

币圈里看人生 :

:

111111111111111111111111111111111This round of the market may have temporarily ended. Writing this review might get me called an idiot or lose followers. But I still want to write it because I mainly post on Twitter for my own review and growth; Elon Musk's salary isn't important.

View Original

- Reward

- 3

- 3

- Repost

- Share

SuperShort-TermKing :

:

111View More

A Valid Deep Bitcoin Bear Signal

From the quarterly candlestick chart, Bitcoin exhibits a classic Evening Star pattern, which is also a typical trend reversal signal. The appearance of an Evening Star at the quarterly candlestick level clearly indicates a transition between bull and bear cycles.

From the perspective of price-volume relationship, the volume of the right-side bearish candle is significantly higher than that of the left-side bullish candle, indicating that selling pressure has clearly overwhelmed buying pressure. The volume and price performance further reinforce the credibility

From the quarterly candlestick chart, Bitcoin exhibits a classic Evening Star pattern, which is also a typical trend reversal signal. The appearance of an Evening Star at the quarterly candlestick level clearly indicates a transition between bull and bear cycles.

From the perspective of price-volume relationship, the volume of the right-side bearish candle is significantly higher than that of the left-side bullish candle, indicating that selling pressure has clearly overwhelmed buying pressure. The volume and price performance further reinforce the credibility

BTC-2,6%

- Reward

- 1

- Comment

- Repost

- Share

Recently, do you feel that many crypto friends are now trading gold and silver? They are also sharing on social media, but we've experienced this script before! BTC went crazy, ETH went crazy, and looking back, it's always the same beginning: prices soar to make everyone doubt life, then pull back and you can't find the bottom... ^_^

History doesn't lie:

In 1979, the Hunt brothers drove silver from $6 to $50, and gold surged to $850. What happened next? Silver collapsed, and chaos ensued.

In 2011, silver skyrocketed 150% in 8 months, and gold broke through $1900. Then a news event caused a 30%

View OriginalHistory doesn't lie:

In 1979, the Hunt brothers drove silver from $6 to $50, and gold surged to $850. What happened next? Silver collapsed, and chaos ensued.

In 2011, silver skyrocketed 150% in 8 months, and gold broke through $1900. Then a news event caused a 30%

- Reward

- 2

- Comment

- Repost

- Share

#金价突破5200美元

【Some Thoughts on Gold Price Breaking Through $5200】

Seeing the price surge to $5200, honestly, it's a bit shocking. This move from the beginning of the month until now has almost no retracement, with an increase of nearly $900, much faster than I expected. Currently, this level really tests the mindset—buying more fears a pullback, taking profits fears missing out.

Here are my key observations:

1. Weekly Chart Structure: The weekly chart is now an almost vertical rise, and such steep slopes are rarely sustainable over the long term. The last similar sharp move appeared after the

View Original【Some Thoughts on Gold Price Breaking Through $5200】

Seeing the price surge to $5200, honestly, it's a bit shocking. This move from the beginning of the month until now has almost no retracement, with an increase of nearly $900, much faster than I expected. Currently, this level really tests the mindset—buying more fears a pullback, taking profits fears missing out.

Here are my key observations:

1. Weekly Chart Structure: The weekly chart is now an almost vertical rise, and such steep slopes are rarely sustainable over the long term. The last similar sharp move appeared after the

- Reward

- 3

- 6

- Repost

- Share

ChristmasEve :

:

2026 Go Go Go 👊View More

I’ve seen too many people die the same way—criticizing contracts as gambling, yet rushing into them faster than anyone else. Where’s the problem?

Most people don’t even understand how leverage works.

You think opening 5x leverage is safe? With a $10,000 capital, full position at 5x, how much can you lose before liquidation?

Many believe they can lose $10,000—wrong.

The actual volatility they can withstand is less than $500.

It’s like you think you’re driving a sedan, but under your feet is a rocket—one wrong turn, and you’re instantly in the sky. It’s not flying; it’s exploding.

So why do some

View OriginalMost people don’t even understand how leverage works.

You think opening 5x leverage is safe? With a $10,000 capital, full position at 5x, how much can you lose before liquidation?

Many believe they can lose $10,000—wrong.

The actual volatility they can withstand is less than $500.

It’s like you think you’re driving a sedan, but under your feet is a rocket—one wrong turn, and you’re instantly in the sky. It’s not flying; it’s exploding.

So why do some

- Reward

- 4

- 6

- Repost

- Share

TheWholeWorldIsFullOfDreams :

:

Hold on tight, we're about to take off 🛫View More

The survival rules for the crypto world in 2026:

Ultra-short-term swing trading: Focus mainly on BTC/ETH 4H-1H levels, combined with highly volatile altcoins, strict stop-loss, profit-loss ratio >1:2, using tools and discipline to outperform the market.

RWA structural opportunities: Do not chase concepts; only choose real asset tracks with cash flow, backing, and low valuation—such as tokenized government bonds from M country, supply chain finance, and on-chain carbon credits.

Avoid becoming a bagholder: Spend a lot of time tracking smart money movements daily. Enter small positions when new n

View OriginalUltra-short-term swing trading: Focus mainly on BTC/ETH 4H-1H levels, combined with highly volatile altcoins, strict stop-loss, profit-loss ratio >1:2, using tools and discipline to outperform the market.

RWA structural opportunities: Do not chase concepts; only choose real asset tracks with cash flow, backing, and low valuation—such as tokenized government bonds from M country, supply chain finance, and on-chain carbon credits.

Avoid becoming a bagholder: Spend a lot of time tracking smart money movements daily. Enter small positions when new n

- Reward

- 4

- 9

- Repost

- Share

HeavenSlayerSupporter :

:

Stay tuned to 🔍View More

Where will Bitcoin rebound after TACO?

The S&P continued to rebound yesterday, fully filling the gap caused by this "TACO" trade. The probability of continuing to rise and reaching new highs remains relatively high.

Bitcoin's performance has been relatively weaker, mostly fluctuating below 90,000, without breaking through the previous day's rebound high.

However, there's no need to be overly pessimistic. The S&P experienced a three-wave upward structure between 2025.12.17 and 2026.1.13, and during the S&P Wave A, Bitcoin didn't rebound much, but during the subsequent Wave C, it experienced two

The S&P continued to rebound yesterday, fully filling the gap caused by this "TACO" trade. The probability of continuing to rise and reaching new highs remains relatively high.

Bitcoin's performance has been relatively weaker, mostly fluctuating below 90,000, without breaking through the previous day's rebound high.

However, there's no need to be overly pessimistic. The S&P experienced a three-wave upward structure between 2025.12.17 and 2026.1.13, and during the S&P Wave A, Bitcoin didn't rebound much, but during the subsequent Wave C, it experienced two

BTC-2,6%

- Reward

- 3

- 8

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

Can Bitcoin still outperform the US stock market in the future?

Comparing the peak values of each bull market for BTC/SPX (the ratio of Bitcoin to the S&P 500 index), it's easy to see that the growth rate of BTC/SPX has been clearly slowing down. The gap between the peaks of consecutive bull markets is shrinking rapidly:

The second bull market peak increased by 3350% compared to the first;

The third bull market peak increased by 971% compared to the second;

The fourth bull market peak increased by 112% compared to the third;

This bull market peak only increased by 25% compared to the fourth.

T

Comparing the peak values of each bull market for BTC/SPX (the ratio of Bitcoin to the S&P 500 index), it's easy to see that the growth rate of BTC/SPX has been clearly slowing down. The gap between the peaks of consecutive bull markets is shrinking rapidly:

The second bull market peak increased by 3350% compared to the first;

The third bull market peak increased by 971% compared to the second;

The fourth bull market peak increased by 112% compared to the third;

This bull market peak only increased by 25% compared to the fourth.

T

BTC-2,6%

- Reward

- 3

- 11

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

Investment is not a sprint, nor is it a marathon; it's rock climbing.

The key is not to see who climbs faster, but to make sure each step is solid, to firmly plant your footing, and to avoid falling to your death.

If you're not preparing for retirement, this climb will never end, and you could fall back to the bottom at any moment due to a major mistake.

That's also why I once said that being scammed and going bankrupt should be dealt with early.

Just starting to learn rock climbing, falling more times from lower positions is not a bad thing.

View OriginalThe key is not to see who climbs faster, but to make sure each step is solid, to firmly plant your footing, and to avoid falling to your death.

If you're not preparing for retirement, this climb will never end, and you could fall back to the bottom at any moment due to a major mistake.

That's also why I once said that being scammed and going bankrupt should be dealt with early.

Just starting to learn rock climbing, falling more times from lower positions is not a bad thing.

- Reward

- 2

- 8

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#2026币圈Flag

Playing with small funds in the first level—let’s take $10,000 as an example. Don’t think about turning it around right away. The vast majority of people make a fatal mistake right from the start: they treat $10,000 as a one-time opportunity, rather than 20–50 chances.

What is the true win rate in the primary market?

Projects that can actually reach 5–10M or more: 5%–10%. They can give you 2–3 times returns, 15%–20%. The rest either stagnate and die slowly or go straight to Rug Pull. This means you’re not choosing which one will definitely rise; you’re betting on a probability dis

View OriginalPlaying with small funds in the first level—let’s take $10,000 as an example. Don’t think about turning it around right away. The vast majority of people make a fatal mistake right from the start: they treat $10,000 as a one-time opportunity, rather than 20–50 chances.

What is the true win rate in the primary market?

Projects that can actually reach 5–10M or more: 5%–10%. They can give you 2–3 times returns, 15%–20%. The rest either stagnate and die slowly or go straight to Rug Pull. This means you’re not choosing which one will definitely rise; you’re betting on a probability dis

- Reward

- 6

- 8

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

Have you ever thought about a question? The cycle has never been exactly four years, but around four years, and this "around" can vary by half a year before or after. Three and a half years is also acceptable.

I used to think that the cycle had changed or no longer existed, but that was very naive. The cycle will always be there. Even if it changes, it won't undergo a huge shift in a short period; it will only change gradually, just like Earth's rotation and revolution—changes that humans cannot perceive.

Last year, I firmly believed that 120,000+ was the top. Judging this doesn't require

I used to think that the cycle had changed or no longer existed, but that was very naive. The cycle will always be there. Even if it changes, it won't undergo a huge shift in a short period; it will only change gradually, just like Earth's rotation and revolution—changes that humans cannot perceive.

Last year, I firmly believed that 120,000+ was the top. Judging this doesn't require

BTC-2,6%

- Reward

- 4

- 6

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#我的2026第一条帖

A summary of some personal short-term and Yue trading experience details:

1. The total daily position should not exceed 25%.

2. Conduct a position review once before going to bed each day. During the review, perform a comprehensive assessment of orders and existing positions.

3. Stick to staying as far away from liquidation as possible. Only when the position is safe can you steadily build up and achieve consistent growth.

4. Strictly adhere to trading discipline. Take profits near resistance points in advance, rather than deliberately chasing the highest point for profit-taking.

View OriginalA summary of some personal short-term and Yue trading experience details:

1. The total daily position should not exceed 25%.

2. Conduct a position review once before going to bed each day. During the review, perform a comprehensive assessment of orders and existing positions.

3. Stick to staying as far away from liquidation as possible. Only when the position is safe can you steadily build up and achieve consistent growth.

4. Strictly adhere to trading discipline. Take profits near resistance points in advance, rather than deliberately chasing the highest point for profit-taking.

- Reward

- 2

- 1

- Repost

- Share

#周末行情分析

Structural Opportunities in Volatility: My Watch-and-Test Strategy

This weekend's market sentiment is indeed very delicate. The consensus is that selling pressure has weakened, but in the absence of clear catalysts, the possibility of a "volatility correction" seems greater than a "strong rebound." Large funds are still waiting for more explicit signals, whether macro-level interest rate clues or Bitcoin ETF fund flow data. Therefore, I lean towards believing that this weekend will be a period of reduced volume consolidation and gradual bottoming, building momentum for the next direct

View OriginalStructural Opportunities in Volatility: My Watch-and-Test Strategy

This weekend's market sentiment is indeed very delicate. The consensus is that selling pressure has weakened, but in the absence of clear catalysts, the possibility of a "volatility correction" seems greater than a "strong rebound." Large funds are still waiting for more explicit signals, whether macro-level interest rate clues or Bitcoin ETF fund flow data. Therefore, I lean towards believing that this weekend will be a period of reduced volume consolidation and gradual bottoming, building momentum for the next direct

- Reward

- 3

- 9

- Repost

- Share

晚风Y :

:

Hold on tight, we're about to take off 🛫View More

#GateFun代币推荐

My Choices and Outlook: The Art of Balancing Potential and Consensus

The recent popularity of the Gate Fun sector truly demonstrates the explosive community-driven momentum, from GM, Ma Coin to Confucius Coin, and Star Fire—each project carrying distinct community culture and narrative tension. If I had to pick the most attention-grabbing projects recently, “Rainbow Horse” and “Sesame Community” perhaps represent two different dimensions of potential.

Rainbow Horse, as an upcoming project, features visual symbols and a lighthearted, fun setting that easily create memorable impres

View OriginalMy Choices and Outlook: The Art of Balancing Potential and Consensus

The recent popularity of the Gate Fun sector truly demonstrates the explosive community-driven momentum, from GM, Ma Coin to Confucius Coin, and Star Fire—each project carrying distinct community culture and narrative tension. If I had to pick the most attention-grabbing projects recently, “Rainbow Horse” and “Sesame Community” perhaps represent two different dimensions of potential.

Rainbow Horse, as an upcoming project, features visual symbols and a lighthearted, fun setting that easily create memorable impres

- Reward

- 4

- 7

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#我的2026第一条帖 should be the information that BNB Chain posted yesterday about the upcoming meme season.

Today, BSC collectively rebounded again.

Damn, I got up too.

I also got up.

The grassroots culture had a 130,000 buy order last night, and it suddenly ran away.

Still not clear what exactly happened.

The USD1 liquidity pool is currently almost inactive.

There are two high-market-cap tokens: one is increasing volume, and the other is not.

One of the older coins, EGL1, rose for a while, then suddenly dumped last night.

Last night, I tried a meme coin, but I found I sold too early; the chart was

View OriginalToday, BSC collectively rebounded again.

Damn, I got up too.

I also got up.

The grassroots culture had a 130,000 buy order last night, and it suddenly ran away.

Still not clear what exactly happened.

The USD1 liquidity pool is currently almost inactive.

There are two high-market-cap tokens: one is increasing volume, and the other is not.

One of the older coins, EGL1, rose for a while, then suddenly dumped last night.

Last night, I tried a meme coin, but I found I sold too early; the chart was

- Reward

- 5

- 8

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More