IntoTheBlock

No content yet

IntoTheBlock

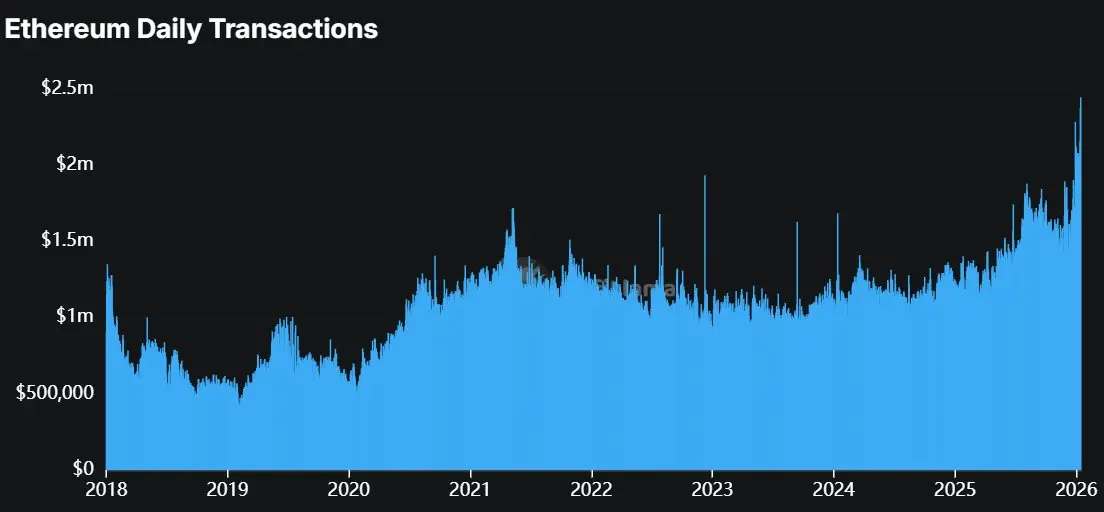

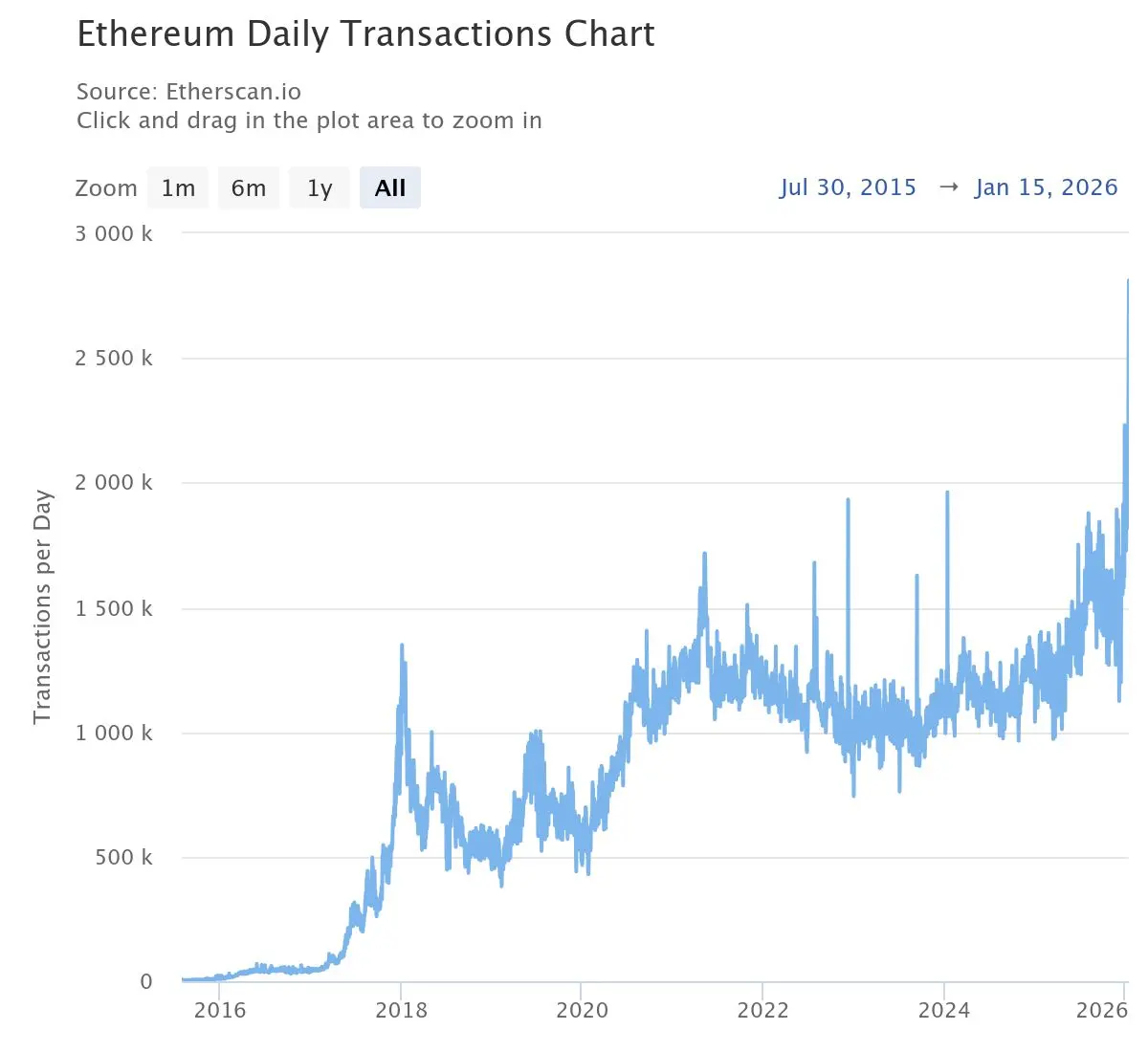

Ethereum daily transactions hit an impressive new high of 2.8 million on Thursday, 64% higher than the daily levels observed during the 2021 bull market

ETH-0,83%

- Reward

- 1

- Comment

- Repost

- Share

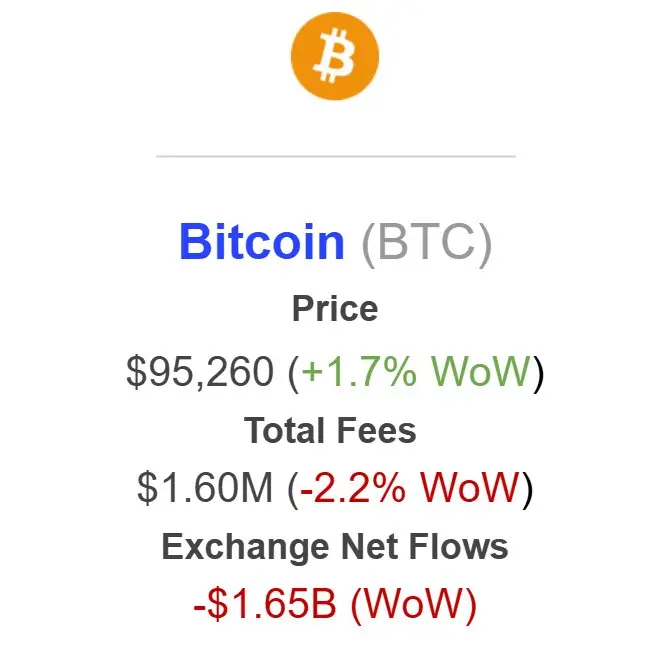

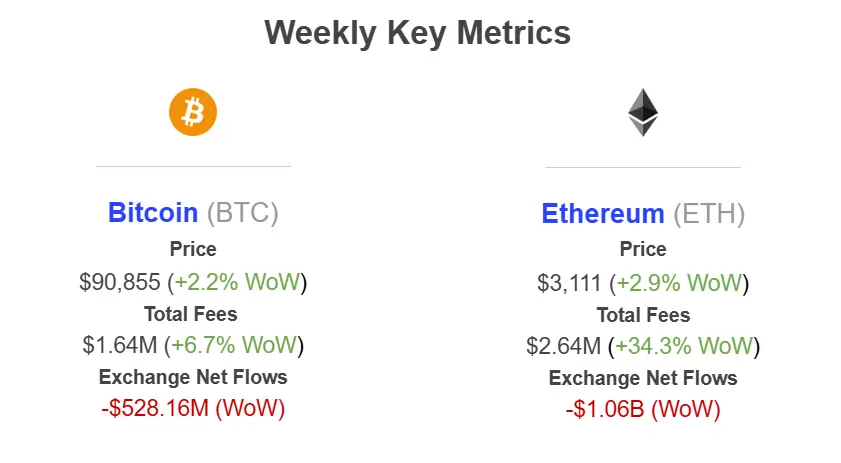

This week saw a massive shift towards BTC accumulation with -$1.65 billion in net outflows from exchanges.

This indicates a strong preference for cold storage holding, effectively creating a supply shock that removes significant liquidity from the sell-side order books.

This indicates a strong preference for cold storage holding, effectively creating a supply shock that removes significant liquidity from the sell-side order books.

BTC-0,36%

- Reward

- like

- Comment

- Repost

- Share

Retail owns stocks, but brokers still monetize the collateral via funding and securities lending.

Tokenized equities change that, making stocks and ETFs usable as DeFi collateral.

Join our live session Feb 4 to learn what this unlocks:

Tokenized equities change that, making stocks and ETFs usable as DeFi collateral.

Join our live session Feb 4 to learn what this unlocks:

DEFI3,25%

- Reward

- like

- Comment

- Repost

- Share

Tokenized equities or equity perps? This piece by @jrdothoughts explains the tradeoffs and why the difference matters.

Quick read worth your time 👇

Quick read worth your time 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

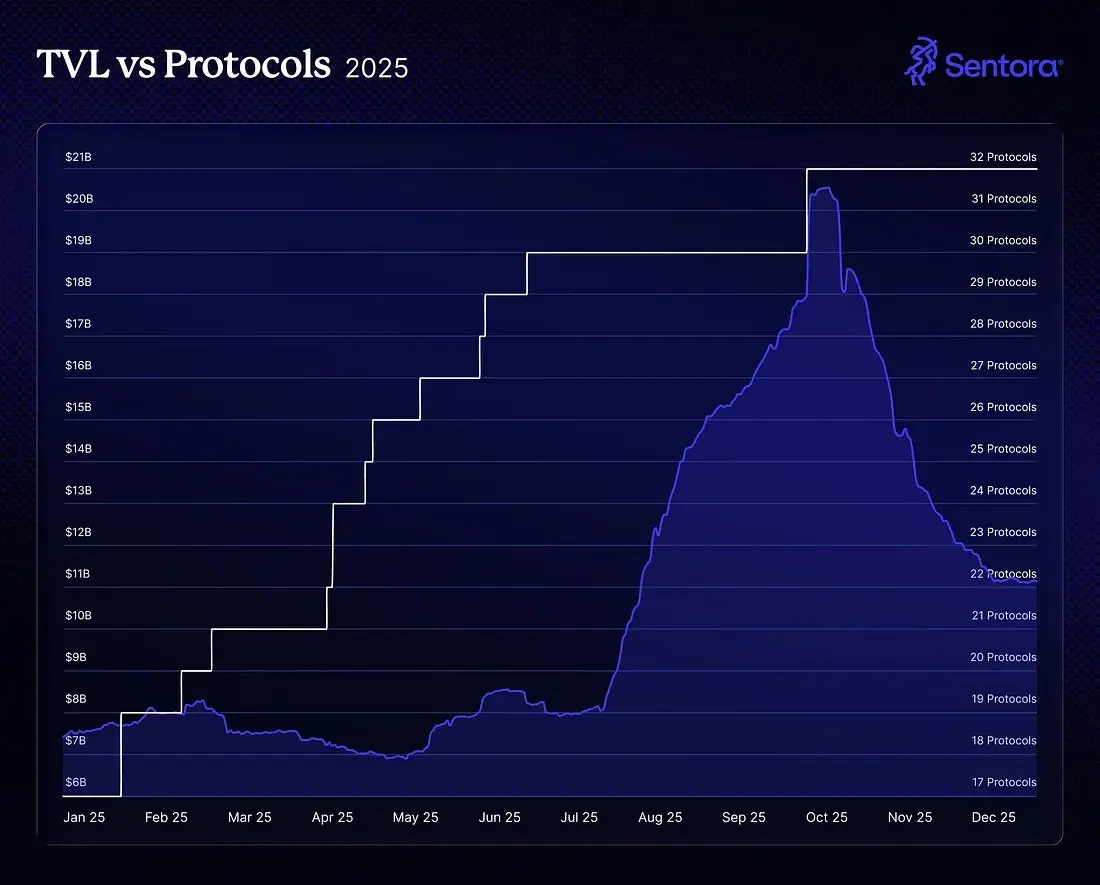

Basis trade protocols were one of DeFi’s biggest growth stories last year.

Ethena led the surge and the number of similar protocols roughly doubled. Since the peak, TVL is down ~50% and has been mostly flat since December.

Do you expect a comeback, and what would be the catalyst?

Ethena led the surge and the number of similar protocols roughly doubled. Since the peak, TVL is down ~50% and has been mostly flat since December.

Do you expect a comeback, and what would be the catalyst?

ENA-1,47%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

DeFi is not a set of silos.

It is an interconnected value stack. If the rails, liquidity, risk and security, or governance layers weaken, everything above them becomes fragile. Our DeFi Value Pyramid model maps this system.

Download the full PDF here:

It is an interconnected value stack. If the rails, liquidity, risk and security, or governance layers weaken, everything above them becomes fragile. Our DeFi Value Pyramid model maps this system.

Download the full PDF here:

DEFI3,25%

- Reward

- like

- Comment

- Repost

- Share

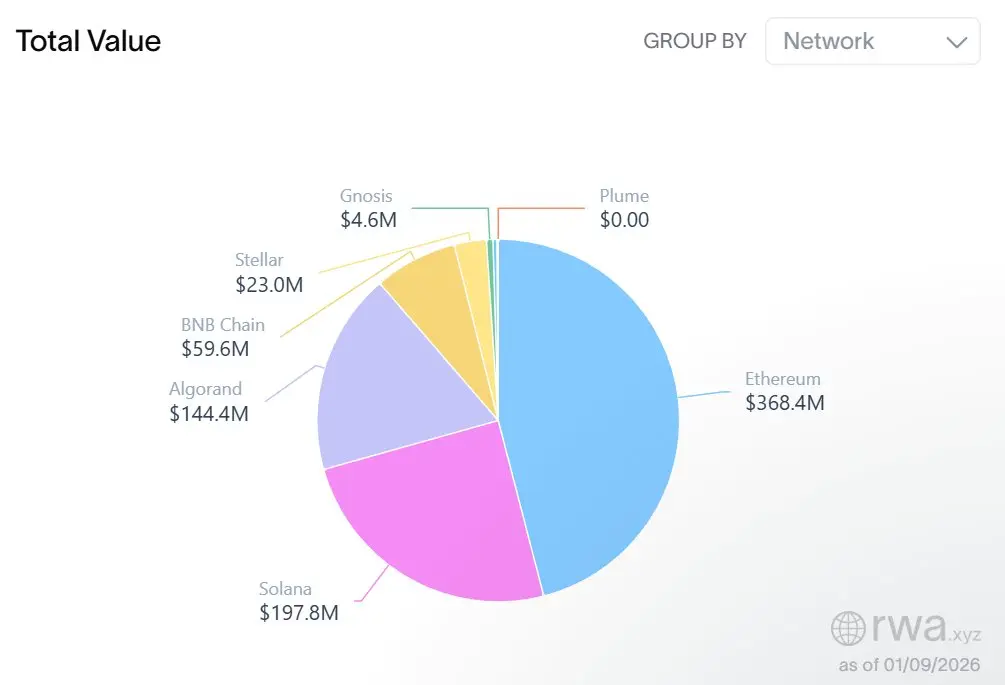

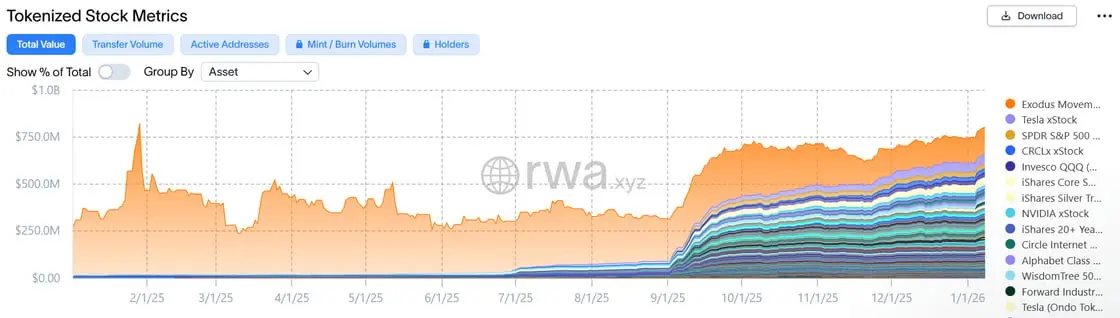

The tokenized equities sectors exhibits high concentration, with the top three providers, Ondo, Backed Finance, and Securitize, controlling over 90% of the total on-chain equity value.

ONDO1,04%

- Reward

- like

- Comment

- Repost

- Share

In this week's newsletter we take a closer look at tokenized equities and why they might be a key trend to watch this year👇

- Reward

- like

- Comment

- Repost

- Share

Tokenized equities recorded surpassed $800M in market cap, a 2,500% increase from the $16 million recorded at the start of last year.

- Reward

- like

- Comment

- Repost

- Share

Ethereum saw a staggering -$1.06 billion in net outflows this week.

This is one of the strongest accumulation signals in recent months. Combined with the 120% spike in the validator entry queue and record address growth, this data suggests that the "post-holiday" period is being used by major players to lock up ETH for staking and long-term positioning

This is one of the strongest accumulation signals in recent months. Combined with the 120% spike in the validator entry queue and record address growth, this data suggests that the "post-holiday" period is being used by major players to lock up ETH for staking and long-term positioning

ETH-0,83%

- Reward

- like

- Comment

- Repost

- Share

Tokenized equities or equity perps? This piece by @jrdothoughts explains the tradeoffs and why the difference matters.

Quick read worth your time 👇

Quick read worth your time 👇

- Reward

- like

- Comment

- Repost

- Share

Bringing stocks into DeFi could unlock a kind of access and utility retail investors simply haven’t had before.

In this article, we take a closer look at what that means, along with the other key trends shaping the year ahead.

In this article, we take a closer look at what that means, along with the other key trends shaping the year ahead.

- Reward

- like

- Comment

- Repost

- Share

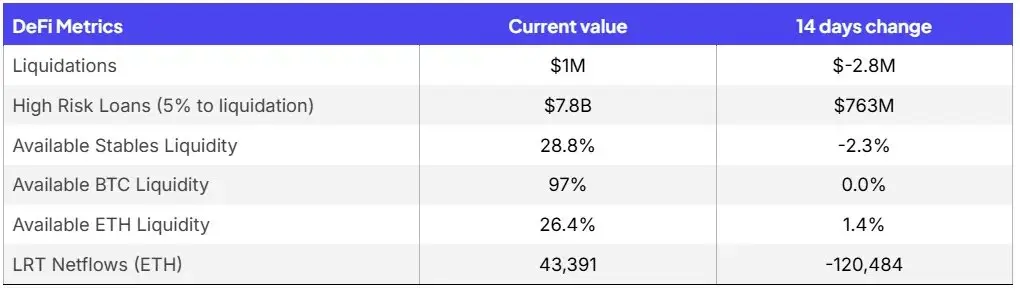

Here are some key risk metrics to consider

✔️ Liquidations fell further over the holiday period

✔️ Available liquidity remains high, with DeFi leverage still relatively muted

Read more here:

✔️ Liquidations fell further over the holiday period

✔️ Available liquidity remains high, with DeFi leverage still relatively muted

Read more here:

- Reward

- like

- Comment

- Repost

- Share