MAB350

No content yet

MAB350

Walrus Protocol does something quieter, more profound. It doesn\'t build a bridge. It becomes the sea.

- Reward

- like

- Comment

- Repost

- Share

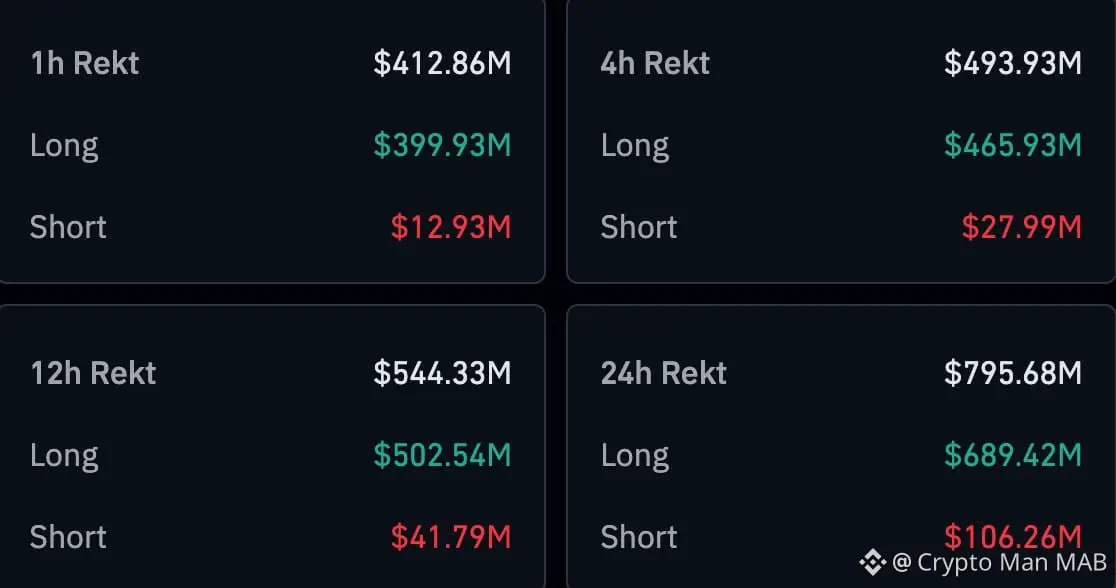

🔽 $800M of liquidations in 24 hours

- Reward

- like

- Comment

- Repost

- Share

🚨🚨 GOLD ERASES $1.79TRILLION IN MARKET CAP IN LESS THAN AN HOUR

- Reward

- like

- Comment

- Repost

- Share

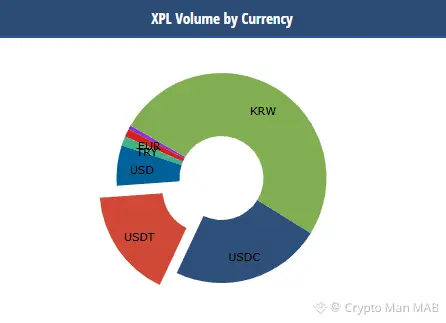

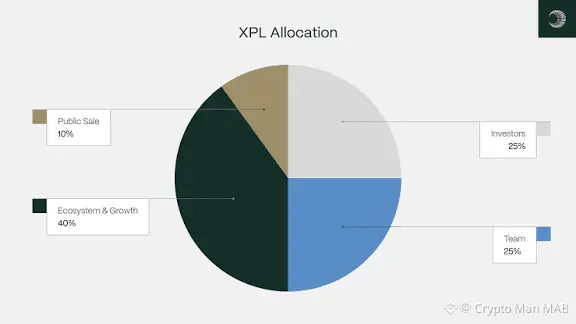

In balancing security and performance, Plasma adopts a hybrid consensus mechanism. It utilizes sub-second PlasmaBFT consensus to achieve instant payment confirmation while anchoring its final state on the Bitcoin network, inheriting Bitcoin\'s immutable security features. As a strategic extension of the Tether ecosystem, Plasma provides a fully controllable, compliant, and high-performance settlement channel. With massive liquidity of stablecoins migrating here in the future, XPL will become a key infrastructure for global digital financial settlements.

- Reward

- 2

- Comment

- Repost

- Share

In the fast-paced world of cryptocurrency, where projects often chase dramatic "leap-forward" updates massive overhauls that promise overnight transformations and generate explosive hype Dusk Network stands apart. Rather than risking system-wide disruptions through sweeping major version upgrades that could upend existing operations, Dusk adopts a deliberate, incremental approach grounded in modular architecture. This design breaks the protocol into independent components, enabling targeted upgr

DUSK-11,62%

- Reward

- like

- Comment

- Repost

- Share

Morgan Stanley adds a new role to push into crypto, appointing Amy Oldenburg as Head of Digital-Asset Strategy.

- Reward

- like

- Comment

- Repost

- Share

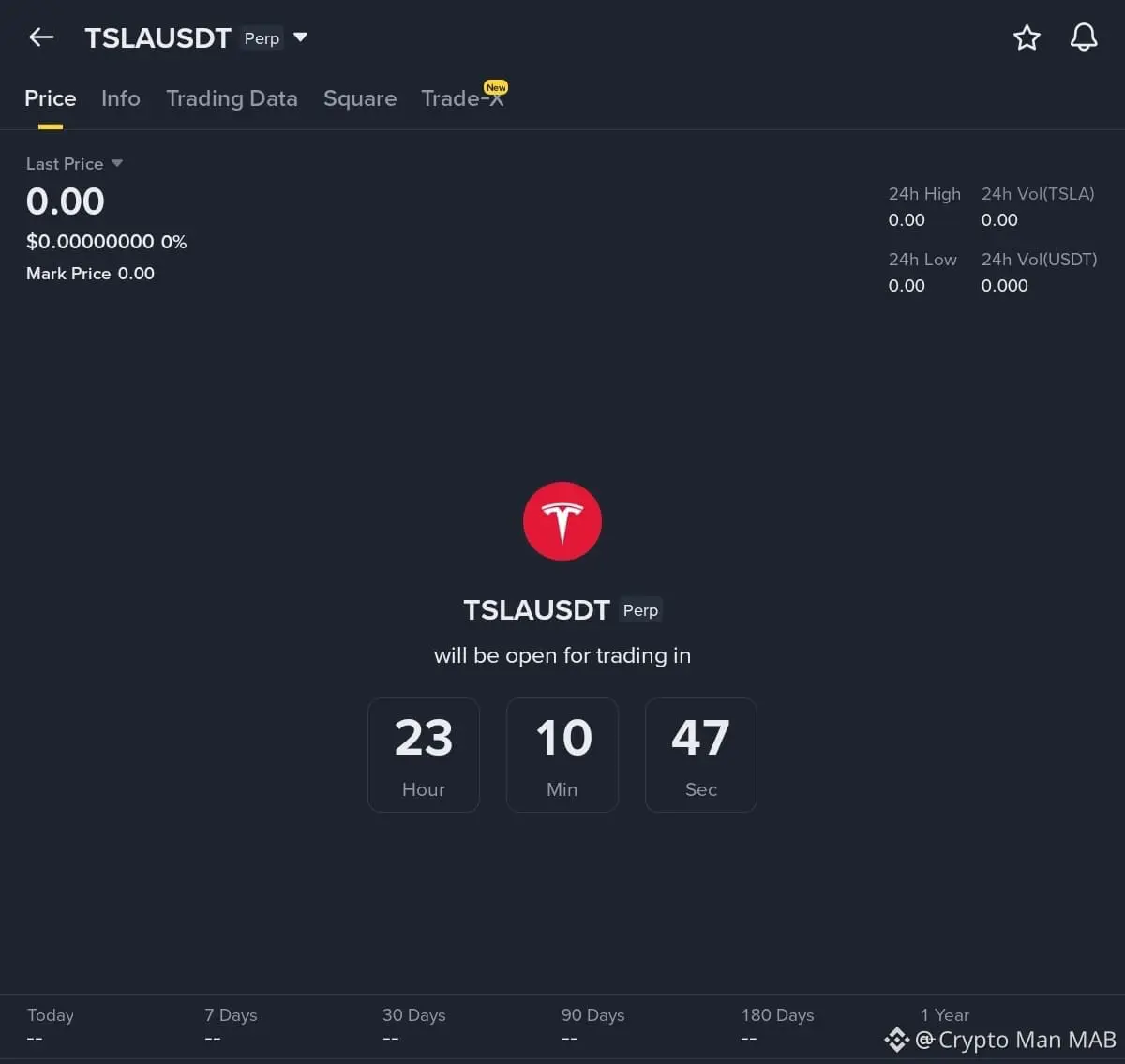

Perpetual drops Jan 28, 2026 at 14:30 UTC on Futures! Trade Elon’s empire 24/7, USDT-margined, up to 5x leverage no more Nasdaq closing bell drama Wall Street volatility meets crypto speed. Liquidity’s about to explode

- Reward

- like

- Comment

- Repost

- Share

🚨💥This ancient holder bought in back when ETH was ~$90 turned a ~$12M bag into a near-400M payday. First move since 2017. is this profit-taking, portfolio shuffle, or something bigger?ETH already dipping below $3k amid the pressure—watch for selling waves if they offload. Classic whale wake-up call shaking the market!

ETH-5,66%

- Reward

- like

- Comment

- Repost

- Share

In the wild world of blockchain, where hype often outpaces reality, Dusk Network is quietly turning heads with hard data. Their testnet has just shattered the 9 million transaction mark, begging the question: Has Dusk\'s "compliance machine" finally revved up for prime time? Forget the Twitter echo chamber-let\'s dive into the on-chain metrics that matter.

DUSK-11,62%

- Reward

- 1

- Comment

- Repost

- Share

3 Features I Absolutely LOVE in 2026

- Reward

- like

- Comment

- Repost

- Share

In an era where data is the new oil, especially with the explosive growth of AI and Web3 applications, secure and efficient storage solutions are more critical than ever. Enter Walrus – a groundbreaking decentralized storage protocol built on the Sui blockchain that\'s set to transform how we handle large-scale data. Imagine storing videos, images, datasets, and more without relying on centralized servers that could fail or censor content. Walrus makes this a reality, empowering developers, AI ag

- Reward

- like

- Comment

- Repost

- Share

Introduction to Liquidity FragmentationIn the world of finance, liquidity refers to how easily assets can be bought or sold without significantly affecting their price. However, one persistent challenge in traditional financial markets is liquidity fragmentation. This occurs when trading activity is spread across multiple exchanges, platforms, or venues, leading to dispersed liquidity pools. As a result, investors often face higher transaction costs, wider bid-ask spreads, slower execution tim

- Reward

- like

- Comment

- Repost

- Share

Why choose centralized cloud when you can go fully on-chain? delivers verifiable, persistent blob storage that\'s chain-agnostic but powered by Sui\'s speed. Store AI models, videos, or big data without worrying about availability. $WAL makes it affordable and rewarding. Bullish on this one!

- Reward

- like

- Comment

- Repost

- Share

Hello Crypto FAM! Hope you guys enjoying SUNDAY

- Reward

- like

- Comment

- Repost

- Share