Mayooo

No content yet

Mayooo

Pumps are a good opportunity to open new shorts.

- Reward

- like

- Comment

- Repost

- Share

Whenever there’s extreme fear, you should buy more crypto, not sell.

Do the opposite of what everyone else is doing, and you win.

It’s as simple as that.

Do the opposite of what everyone else is doing, and you win.

It’s as simple as that.

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 President Trump delivers his State of the Union tonight at 9 PM ET.

The address comes amid new tariffs and rising tensions in the Middle East, a pivotal moment for U.S. policy.

The address comes amid new tariffs and rising tensions in the Middle East, a pivotal moment for U.S. policy.

- Reward

- like

- Comment

- Repost

- Share

Mr. President, I’m getting tired of all this winning.

- Reward

- like

- Comment

- Repost

- Share

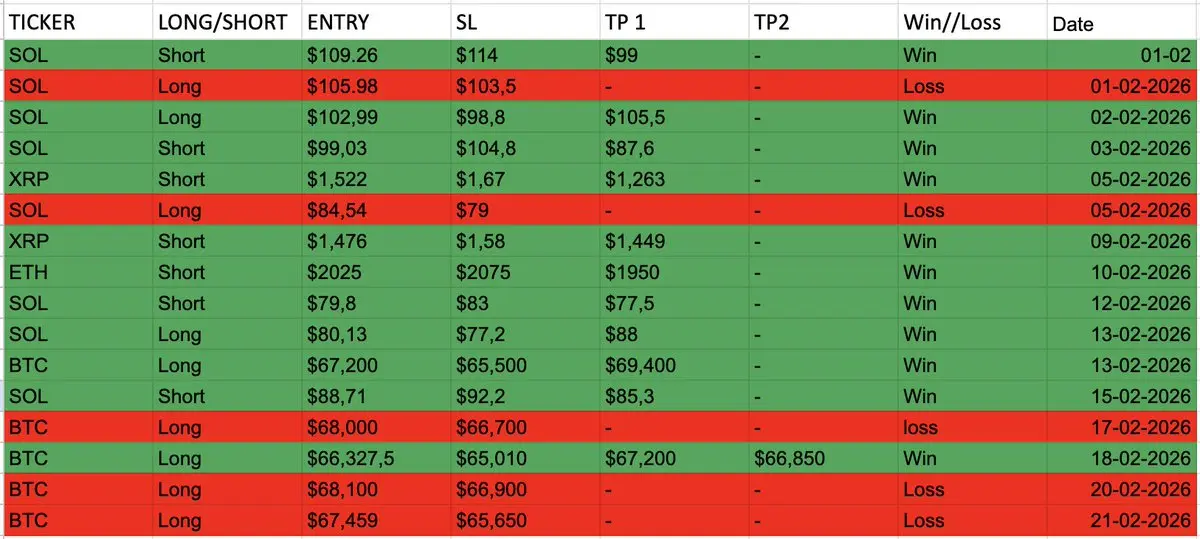

So far in February, 11 out of 16 trades have been successful, a 68.75% win rate.

The last few trades have been disappointing, but overall February is still solidly profitable. A series of losing trades is simply part of trading. If you can’t handle those losses, it usually means your risk management needs improvement before continuing.

Notably, all five losing trades were longs, which is a clear pattern I’m paying attention to. For now, I will primarily focus on shorts, as this aligns better with current bearish market conditions.

The last few trades have been disappointing, but overall February is still solidly profitable. A series of losing trades is simply part of trading. If you can’t handle those losses, it usually means your risk management needs improvement before continuing.

Notably, all five losing trades were longs, which is a clear pattern I’m paying attention to. For now, I will primarily focus on shorts, as this aligns better with current bearish market conditions.

- Reward

- 1

- Comment

- Repost

- Share

This Wednesday, $NVDA reports earnings.

It’s the key event of the week.

A weak report could break the tech rally and drag crypto down with it.

It’s the key event of the week.

A weak report could break the tech rally and drag crypto down with it.

- Reward

- 2

- Comment

- Repost

- Share

Small, low-volume sunday drop for $BTC.

We're currently trading $500 below the CME close.

You don’t want to short below the CME close on a Sunday.

I’m still in my long. Nothing has changed in my thesis.

I still expect the move up before we move lower.

We're currently trading $500 below the CME close.

You don’t want to short below the CME close on a Sunday.

I’m still in my long. Nothing has changed in my thesis.

I still expect the move up before we move lower.

BTC2,98%

- Reward

- 2

- 2

- Repost

- Share

WhaleProtocolOfficial :

:

Go full throttle 🚀View More

On February 24, 2022, almost exactly 4 years ago, the war between Russia and Ukraine began.

In the month that followed, Bitcoin pumped 30%.

War is tragic and destructive, but it hasn’t necessarily been bearish for Bitcoin.

Selling your crypto purely because of Middle East tensions?

Not a good idea, in my opinion.

In the month that followed, Bitcoin pumped 30%.

War is tragic and destructive, but it hasn’t necessarily been bearish for Bitcoin.

Selling your crypto purely because of Middle East tensions?

Not a good idea, in my opinion.

BTC2,98%

- Reward

- 2

- Comment

- Repost

- Share

Boring sideways price action for $BTC.

Typical weekend movement, we’re trading very close to Friday’s CME close.

Ideally, we continue ranging until CME opens, then push toward $70,000.

I still expect the move up, even though everyone is bearish due to Middle East tensions.

First move up to $70,000–$72,000.

Then a retrace.

Typical weekend movement, we’re trading very close to Friday’s CME close.

Ideally, we continue ranging until CME opens, then push toward $70,000.

I still expect the move up, even though everyone is bearish due to Middle East tensions.

First move up to $70,000–$72,000.

Then a retrace.

BTC2,98%

- Reward

- 2

- Comment

- Repost

- Share

I see people getting scared to long the crypto market right now because they expect an escalation in the Middle East.

You shouldn’t trade based on the news, most of the time, it doesn’t play out the way you expect.

These things rarely happen when everyone is expecting them. Just take the trade and place a SL and TP as you normally would.

With the right risk management and a stop loss in place, there’s nothing to worry about.

The market is already approaching $69,000.

I see us reaching $70,000+ within the next 48 hours.

You shouldn’t trade based on the news, most of the time, it doesn’t play out the way you expect.

These things rarely happen when everyone is expecting them. Just take the trade and place a SL and TP as you normally would.

With the right risk management and a stop loss in place, there’s nothing to worry about.

The market is already approaching $69,000.

I see us reaching $70,000+ within the next 48 hours.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More71.07K Popularity

164.59K Popularity

41.73K Popularity

7.71K Popularity

418.37K Popularity

Pin