PARON

No content yet

Pin

PARON

0

0

Capital Expenditures (CAPEX) in 2026:

Amazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

View OriginalAmazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

When a dump happens in the market, it looks like everyone agrees on a decline... a real farce.

We don't see a single coin hold its ground; everyone collapses at the same moment.

This only happens in the cryptocurrency market.

Truly a strange and bizarre phenomenon.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #

View OriginalWe don't see a single coin hold its ground; everyone collapses at the same moment.

This only happens in the cryptocurrency market.

Truly a strange and bizarre phenomenon.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #

- Reward

- like

- Comment

- Repost

- Share

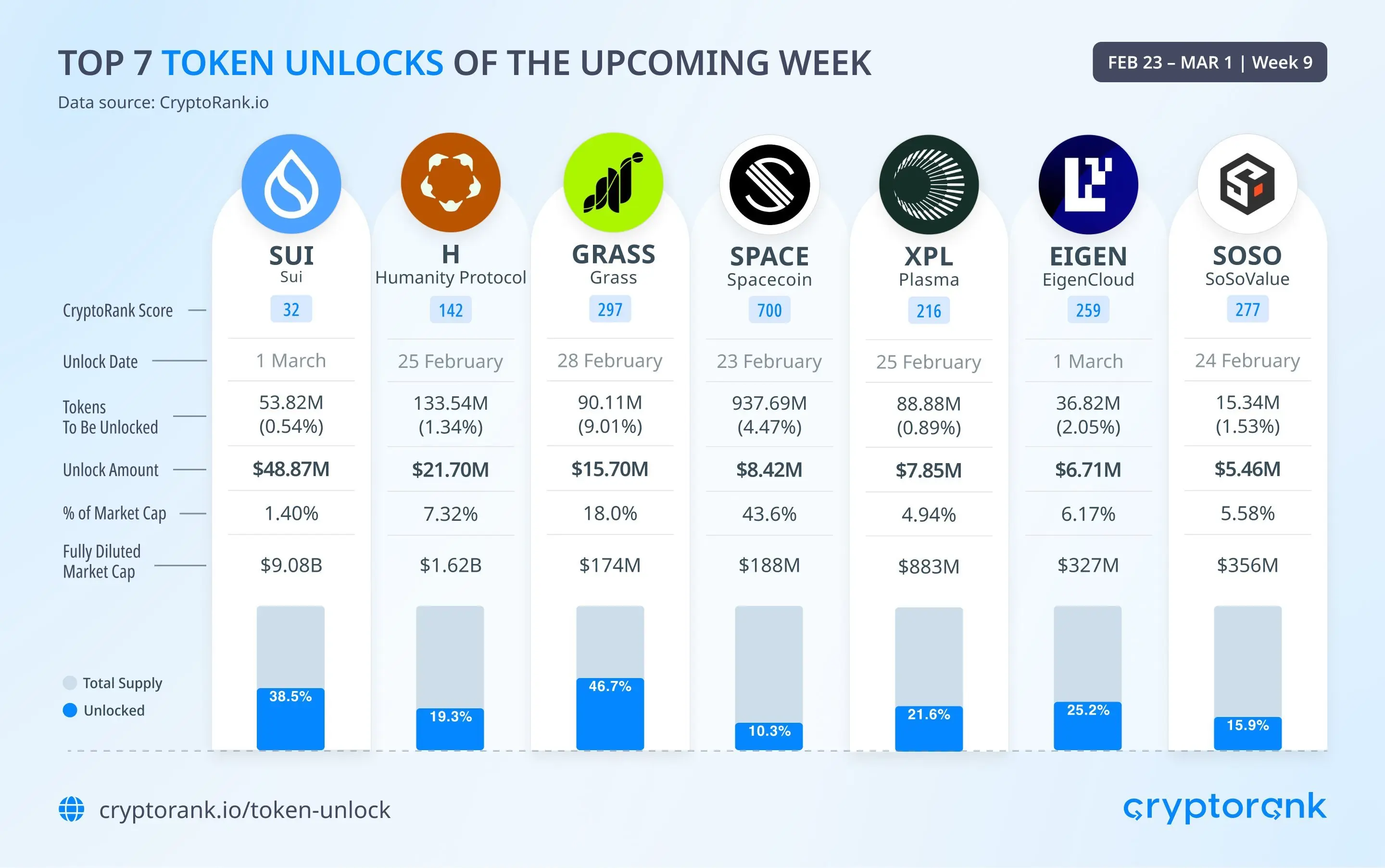

Top 7 Token Releases This Week!

The following tokens will see the largest releases by value:

• Sui ( $SUI) — $48.87 million

• $H — $21.70 million

• $GRASS — $15.70 million

• $SPACE — $8.42 million

• $XPL — $7.85 million

• EigenLayer ( $EIGEN) — $6.71 million

• $SOSO — $5.46 million

Increased supply may raise volatility levels, especially if it coincides with low liquidity

Risk management becomes essential during weeks of large releases

$XRP $SOL $ETH

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #BuyTheDipOrWaitNow?

View OriginalThe following tokens will see the largest releases by value:

• Sui ( $SUI) — $48.87 million

• $H — $21.70 million

• $GRASS — $15.70 million

• $SPACE — $8.42 million

• $XPL — $7.85 million

• EigenLayer ( $EIGEN) — $6.71 million

• $SOSO — $5.46 million

Increased supply may raise volatility levels, especially if it coincides with low liquidity

Risk management becomes essential during weeks of large releases

$XRP $SOL $ETH

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #BuyTheDipOrWaitNow?

- Reward

- like

- Comment

- Repost

- Share

Strategy company purchases 592 #بيتكوين worth approximately $39.8 million, at an average price of $67,286 per Bitcoin.

It now holds a total of 717,722 Bitcoins purchased for nearly $54.56 billion, with an average price of about $76,020 per Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

It now holds a total of 717,722 Bitcoins purchased for nearly $54.56 billion, with an average price of about $76,020 per Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is number 1 in digital currencies.

But can you mention the reason why?

$BTC

#WhenisBestTimetoEntertheMarket #CLARITYActAdvances

But can you mention the reason why?

$BTC

#WhenisBestTimetoEntertheMarket #CLARITYActAdvances

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Michael Saylor is not buying "the currency"

He is betting on "scarcity."

-

At a time when the market is in panic with Bitcoin dropping today and testing the $64,000 levels,

Strategy (formerly MicroStrategy) announced the purchase of an additional 592 Bitcoins at an average price of $67,286.

This move raised the company's total holdings to a staggering number: 717,722 Bitcoins,

Equivalent to about 3.42% of all Bitcoin that will ever exist.

What’s notable about this purchase is not just the timing,

but the structural stability; the company now owns Bitcoin with an average total c

He is betting on "scarcity."

-

At a time when the market is in panic with Bitcoin dropping today and testing the $64,000 levels,

Strategy (formerly MicroStrategy) announced the purchase of an additional 592 Bitcoins at an average price of $67,286.

This move raised the company's total holdings to a staggering number: 717,722 Bitcoins,

Equivalent to about 3.42% of all Bitcoin that will ever exist.

What’s notable about this purchase is not just the timing,

but the structural stability; the company now owns Bitcoin with an average total c

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin reaching $64K caused liquidations worth $508 million in the last 24 hours

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #GateSpringFestivalHorseRacingEvent

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #GateSpringFestivalHorseRacingEvent

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin's targets that I never liked to share, but since I'll be absent for a while, I will post them; and I pray that they never come true 😔

Bitcoin below 74,000 will break the 60,000 bottom at any moment.

Current bear market targets in order:

49,000

38,000

29,000

24,000

Our only exit is a return to full, comprehensive positivity in the market, a return of momentum, and a change in trend; and unfortunately, as we see, there is no liquidity or momentum other than downward movement!

I pray that God changes the situation for the better, and that these decline numbers never come true—neither som

Bitcoin below 74,000 will break the 60,000 bottom at any moment.

Current bear market targets in order:

49,000

38,000

29,000

24,000

Our only exit is a return to full, comprehensive positivity in the market, a return of momentum, and a change in trend; and unfortunately, as we see, there is no liquidity or momentum other than downward movement!

I pray that God changes the situation for the better, and that these decline numbers never come true—neither som

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

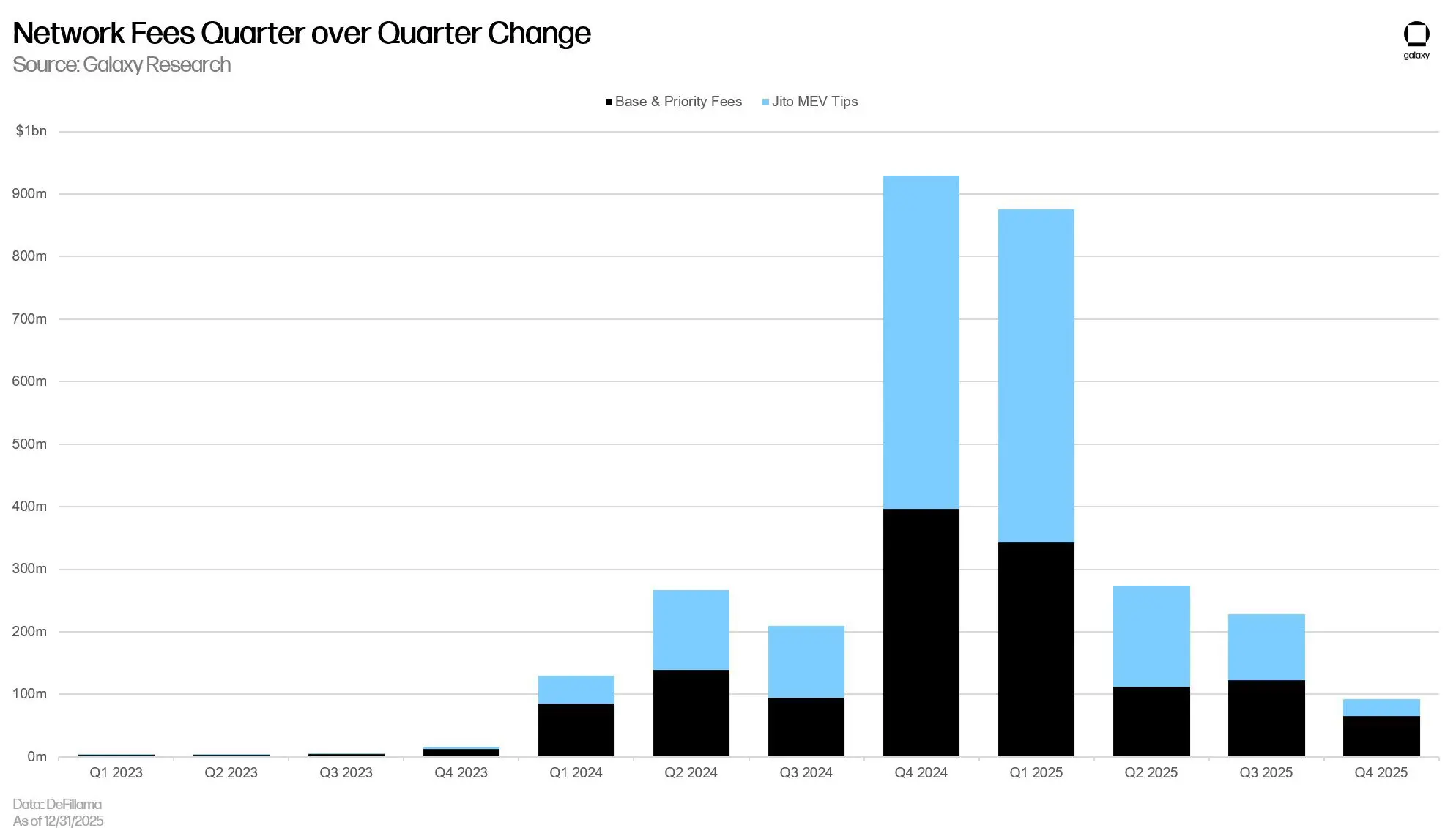

Solana network fees decreased by approximately 60% in Q4 as speculative activity on the network declined.

#sol

$SOL $SOL

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

#sol

$SOL $SOL

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

SOL-0,24%

- Reward

- like

- Comment

- Repost

- Share

The #البيتكوين Australian Investment Fund managed by Monochrome Asset Management increases its holdings to 1,248 Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

BTC-0,96%

- Reward

- 1

- Comment

- Repost

- Share

Ethereum in brief

Perch flag with deviation

Break and retest, then break the order block, and today a retest was made

A sequence of negativity on the chart with no positivity unless it moves back above the order block

Otherwise, its target, as I previously explained, is 1400, which is the next step, but I don't say it's the bottom; I see the bottom when we reach that price action level

Pulling liquidity from last year's bottom will give a good retrace

But if a break occurs and trading stays below, the target will be $880, which is the 2022 bottom

Price action is the king of understanding movem

View OriginalPerch flag with deviation

Break and retest, then break the order block, and today a retest was made

A sequence of negativity on the chart with no positivity unless it moves back above the order block

Otherwise, its target, as I previously explained, is 1400, which is the next step, but I don't say it's the bottom; I see the bottom when we reach that price action level

Pulling liquidity from last year's bottom will give a good retrace

But if a break occurs and trading stays below, the target will be $880, which is the 2022 bottom

Price action is the king of understanding movem

- Reward

- like

- Comment

- Repost

- Share

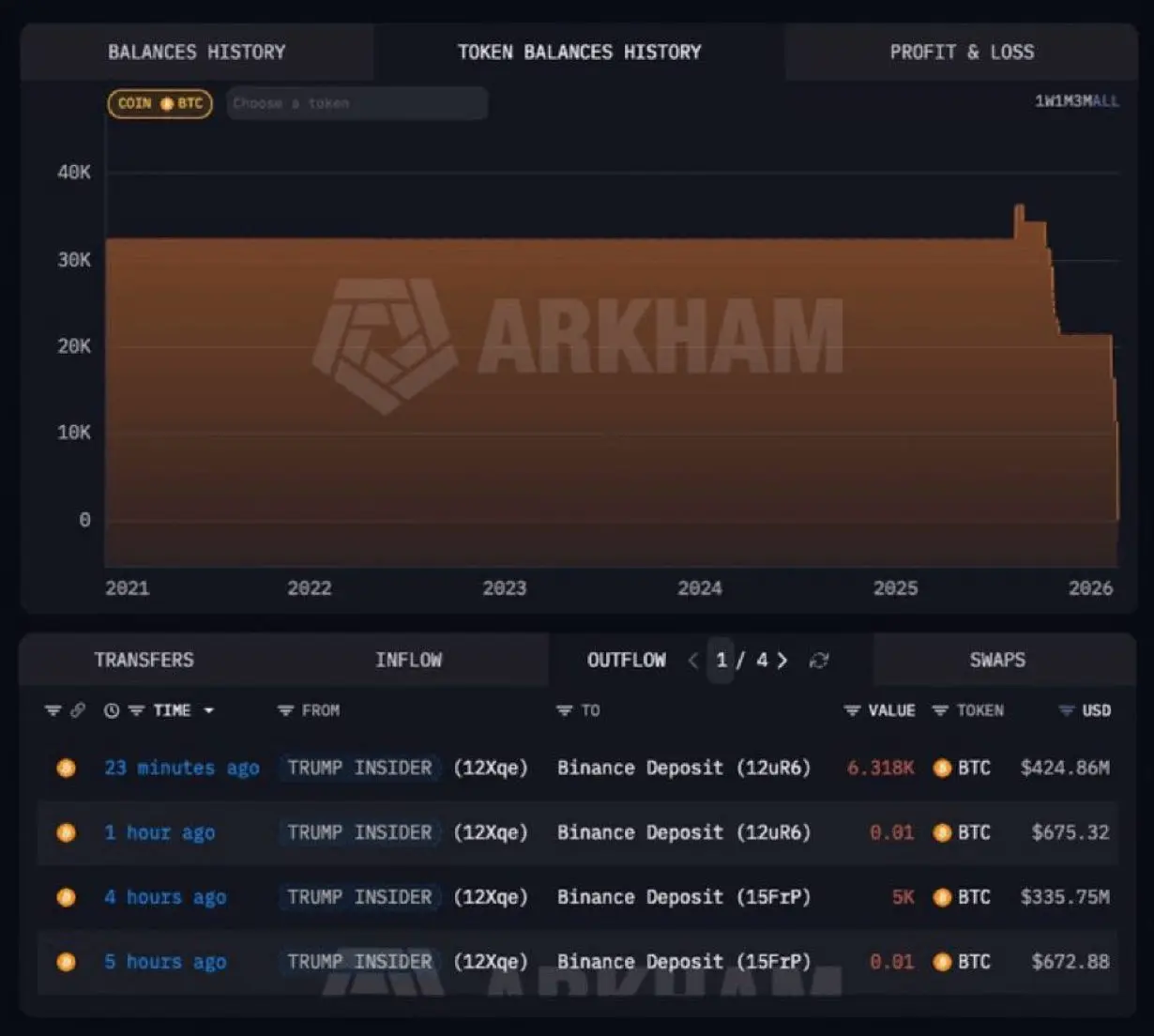

An investor from Satoshi's era (2010–2011) sold approximately 11,300 Bitcoin after holding for about 15 years, worth nearly $750 million.

This transaction is considered significant psychologically and in the media, but from a market perspective, it does not represent a substantial percentage of the total daily Bitcoin liquidity, which is measured in billions of dollars.

$BTC

#TrumpAnnouncesNewTariffs #CLARITYActAdvances

This transaction is considered significant psychologically and in the media, but from a market perspective, it does not represent a substantial percentage of the total daily Bitcoin liquidity, which is measured in billions of dollars.

$BTC

#TrumpAnnouncesNewTariffs #CLARITYActAdvances

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin price dropped below $64,000, recording a 5% decline over the past 24 hours.

The currency traded around $63,971, amid a wave of declines that affected other cryptocurrencies, with Ethereum falling more than 4% to reach $1,864, while XRP declined over 2% to $1.35.

The biggest loss among major coins was in Solana, which decreased nearly 6% to $78.45 over the past 24 hours.

The decline in cryptocurrencies was driven by accelerated leveraged liquidations and increased selling pressures, which directly impacted investor sentiment, leading to a wave of rapid market volatility.

In less than fi

The currency traded around $63,971, amid a wave of declines that affected other cryptocurrencies, with Ethereum falling more than 4% to reach $1,864, while XRP declined over 2% to $1.35.

The biggest loss among major coins was in Solana, which decreased nearly 6% to $78.45 over the past 24 hours.

The decline in cryptocurrencies was driven by accelerated leveraged liquidations and increased selling pressures, which directly impacted investor sentiment, leading to a wave of rapid market volatility.

In less than fi

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

• The biggest dilemma or problem traders face in markets in general and in the Bitcoin ( market #BTC ) and all digital currencies is the inability to make the right decision or at least:

Close to the correct!

Whether to enter or exit!

Those who bought #BITCOIN at a price of $90,000, what prevents them from buying now!

( I mean the believers in it, not the speculators )

Coins we used to buy 100,000 units of at a price of $70,000

And today we can buy ( a million units ) at a price of $40,000 or $60,000!

Knowing that some or most of them are classified as reliable coins!

#Making_Decision is abou

Close to the correct!

Whether to enter or exit!

Those who bought #BITCOIN at a price of $90,000, what prevents them from buying now!

( I mean the believers in it, not the speculators )

Coins we used to buy 100,000 units of at a price of $70,000

And today we can buy ( a million units ) at a price of $40,000 or $60,000!

Knowing that some or most of them are classified as reliable coins!

#Making_Decision is abou

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Violent liquidation in the market within one hour!

Buy orders totaling approximately $200 million were liquidated in the crypto market during the last 60 minutes alone.

()$BTC

$ETH $XRP

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs

View OriginalBuy orders totaling approximately $200 million were liquidated in the crypto market during the last 60 minutes alone.

()$BTC

$ETH $XRP

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs

- Reward

- like

- Comment

- Repost

- Share

Strategi has acquired 592 Bitcoin worth approximately $39.8 million at a price of about $67,286 per Bitcoin. As of February 22, 2026, it holds 717,722 Bitcoin acquired at a total value of approximately $54.56 billion, with an average of about $76,020 per Bitcoin.

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances #GateSpringFestivalHorseRacingEvent

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Mexico is the world's leading "Silver Producer" (producing about 25% of the global output), yet mining there is fraught with danger.

What is the problem simply?

"Cartel" gangs(large organized gangs that control a specific area and exert influence through force) are no longer just smuggling illegal goods; they are systematically extorting mining companies, including paying monthly "protection" fees, and imposing charges on production, equipment, and transportation.

February 2026 Incident:

Vizsla Silver faced a real disaster; instead of the usual extortion, 10 of its workers were kidnapped and a

View OriginalWhat is the problem simply?

"Cartel" gangs(large organized gangs that control a specific area and exert influence through force) are no longer just smuggling illegal goods; they are systematically extorting mining companies, including paying monthly "protection" fees, and imposing charges on production, equipment, and transportation.

February 2026 Incident:

Vizsla Silver faced a real disaster; instead of the usual extortion, 10 of its workers were kidnapped and a

- Reward

- like

- Comment

- Repost

- Share

#البيتكوين Still appears to be highly focused on the UTXO cut level. Approximately 97.7% of the supply is in outputs with a size equal to or greater than 0.1 Bitcoin or 10 million Satoshis.

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

$BTC

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket #CLARITYActAdvances

BTC-0,96%

- Reward

- like

- Comment

- Repost

- Share

Gold surpasses the dollar to become the largest global reserve asset.. So, what happened?

Gold has strengthened its position to become the largest global reserve asset, overtaking the dollar for the first time in decades, following a decline in the role of the US dollar in global reserves, with its share dropping below 50%. This notable shift reflects a profound change in central banks' approaches worldwide, according to data from Bloomberg and the International Monetary Fund.

In recent years, central banks' gold purchases have reached record levels, while the dollar's share has decreased in f

Gold has strengthened its position to become the largest global reserve asset, overtaking the dollar for the first time in decades, following a decline in the role of the US dollar in global reserves, with its share dropping below 50%. This notable shift reflects a profound change in central banks' approaches worldwide, according to data from Bloomberg and the International Monetary Fund.

In recent years, central banks' gold purchases have reached record levels, while the dollar's share has decreased in f

USDG-0,04%

- Reward

- like

- Comment

- Repost

- Share

#الذهب used to be like a prisoner longing for release. Now... he is living days of freedom outside the prison.

All the people said about ( that it was expensive, not the time to buy... it would drop, but it kept rising more and more.

This talk has repeated since the days of $1600 per ounce ). Don't buy... it will crash! (. And it has been rising nonstop since then.

)$BTC

$USDG

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket

View OriginalAll the people said about ( that it was expensive, not the time to buy... it would drop, but it kept rising more and more.

This talk has repeated since the days of $1600 per ounce ). Don't buy... it will crash! (. And it has been rising nonstop since then.

)$BTC

$USDG

#GateSquare$50KRedPacketGiveaway #TrumpAnnouncesNewTariffs #WhenisBestTimetoEntertheMarket

- Reward

- like

- Comment

- Repost

- Share