StacyMuur

No content yet

StacyMuur

Just opened Kaito – first time since the InfoFi ban

(tracking some acc growth data with them)

This is what CT mindshare looks like atm

So many people disappeared after InfoFi became irrelevant

(tracking some acc growth data with them)

This is what CT mindshare looks like atm

So many people disappeared after InfoFi became irrelevant

- Reward

- like

- Comment

- Repost

- Share

Genuine question for everyone on CT

How do you explain what you do for a living to your friends & family?

How do you explain what you do for a living to your friends & family?

- Reward

- like

- Comment

- Repost

- Share

We all hate these phrases, eh?

- Reward

- like

- Comment

- Repost

- Share

February is an insane month for AI ↓

• Kling 3.0 (live)

• Claude Opus 4.6 (live)

• DeepSeek V4

• Siri powered by Gemini

• Codex 5.3

• GLM-5

• Grok 4.2 (maybe)

• Meta Avocado + OpenClaw competitor (maybe)

Did I miss anything?

• Kling 3.0 (live)

• Claude Opus 4.6 (live)

• DeepSeek V4

• Siri powered by Gemini

• Codex 5.3

• GLM-5

• Grok 4.2 (maybe)

• Meta Avocado + OpenClaw competitor (maybe)

Did I miss anything?

- Reward

- like

- Comment

- Repost

- Share

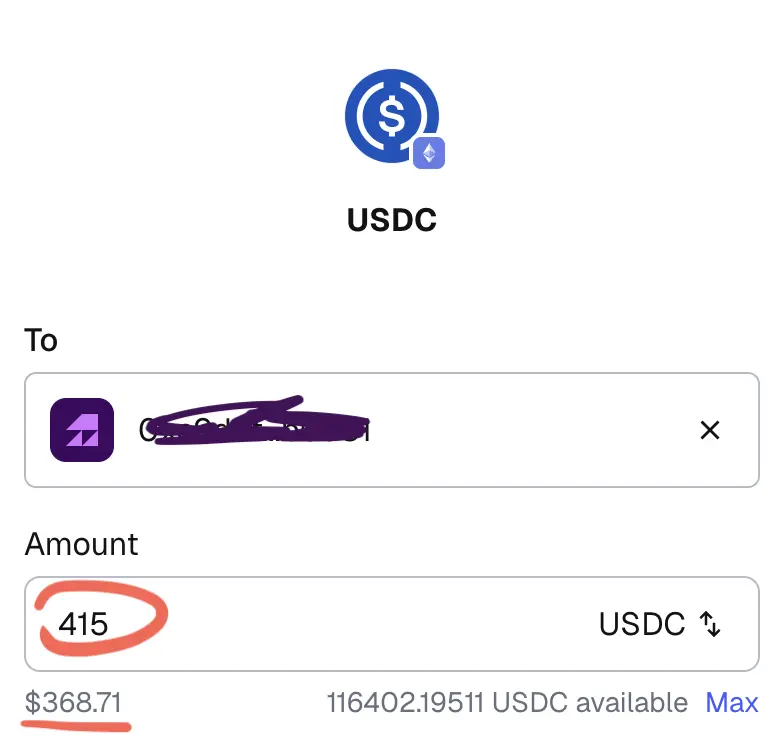

Dear @MetaMask

Stop being the reason for my heart attacks ><

Stop being the reason for my heart attacks ><

- Reward

- like

- Comment

- Repost

- Share

Meanwhile, "get job" requests on Google hit an all-time-high

- Reward

- like

- Comment

- Repost

- Share

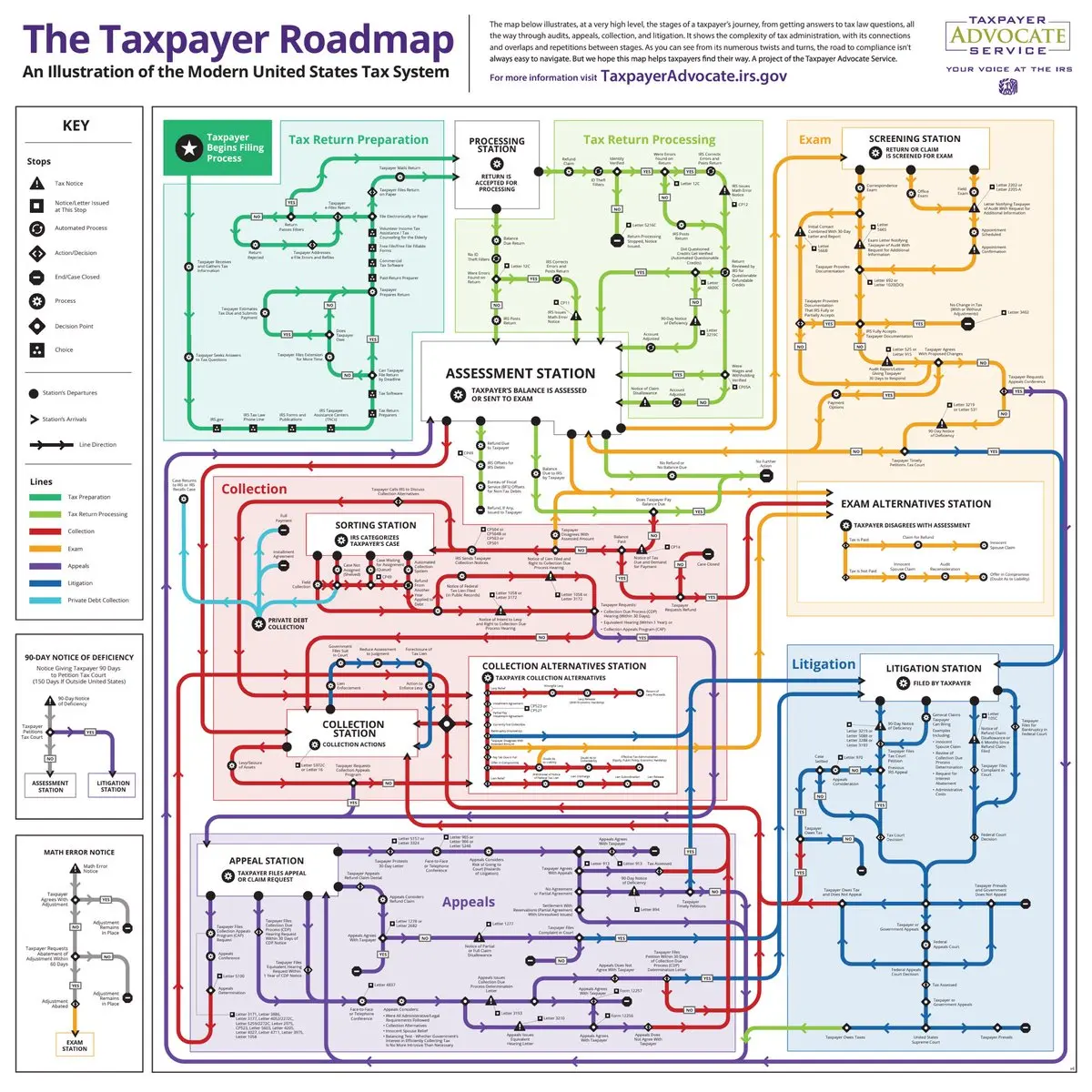

Choose your complexity king fighter:Understanding crypto vs. understanding US taxes.

- Reward

- 1

- Comment

- Repost

- Share