# ETHEREUM

604.97K

DragonFlyOfficial

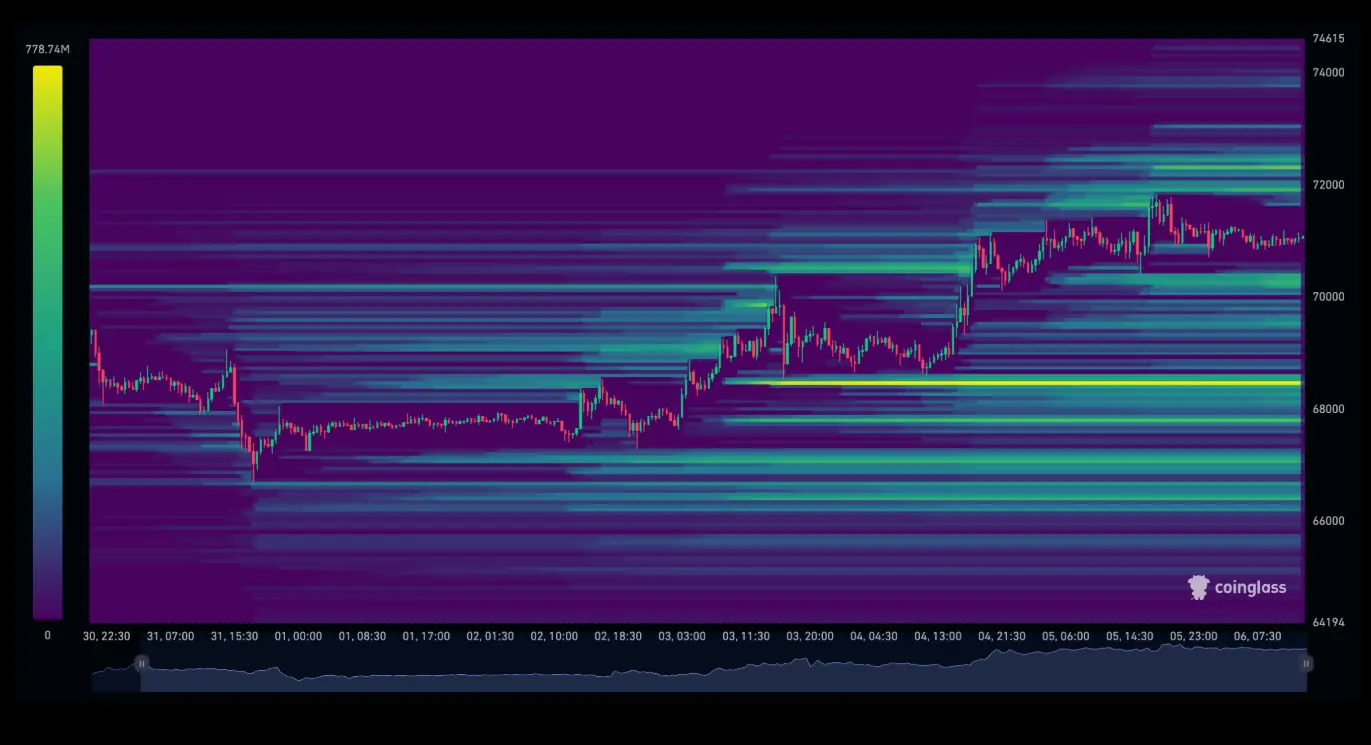

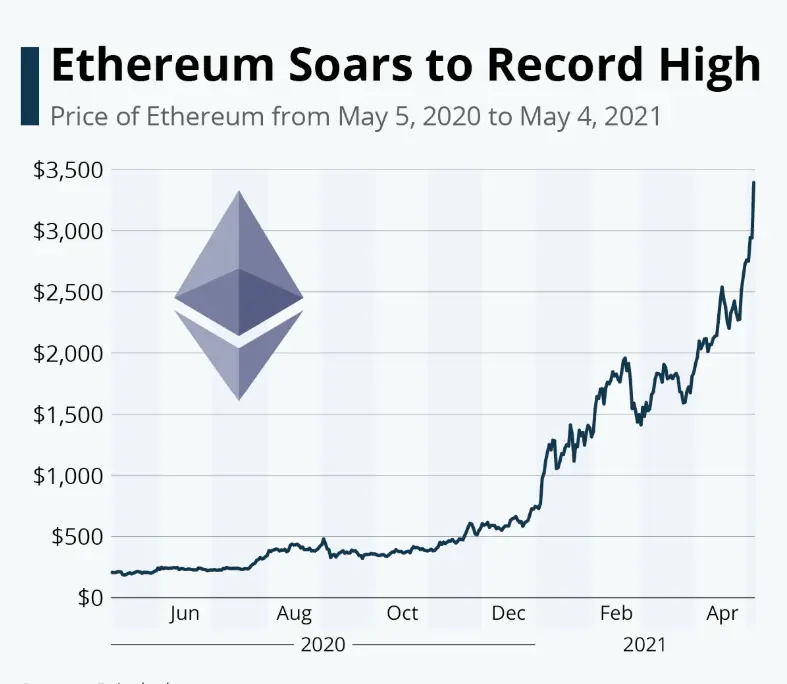

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 16

- 14

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

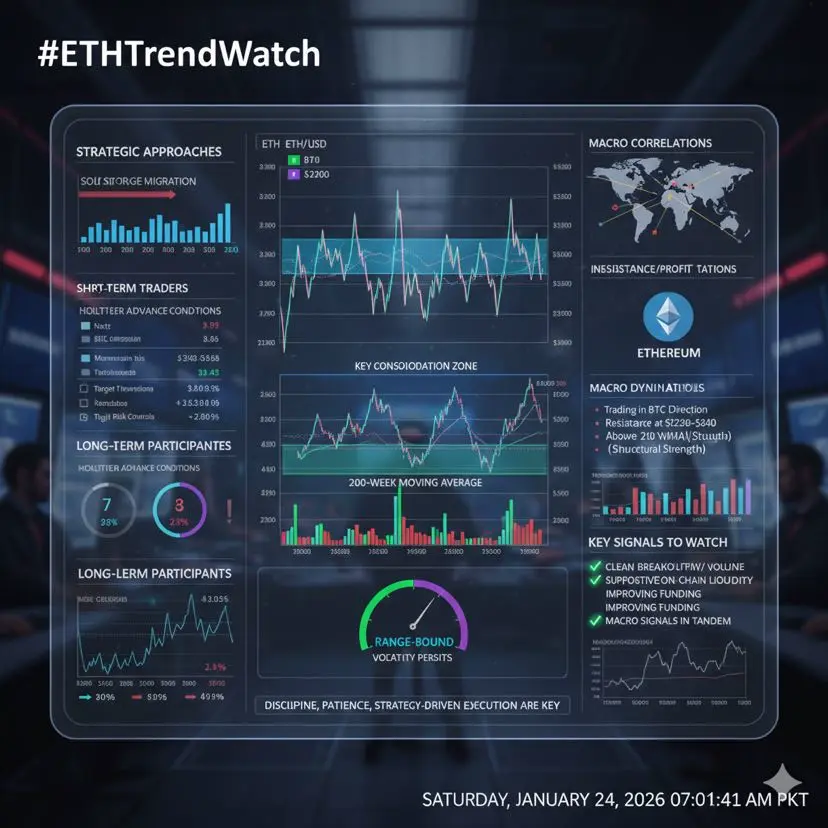

🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

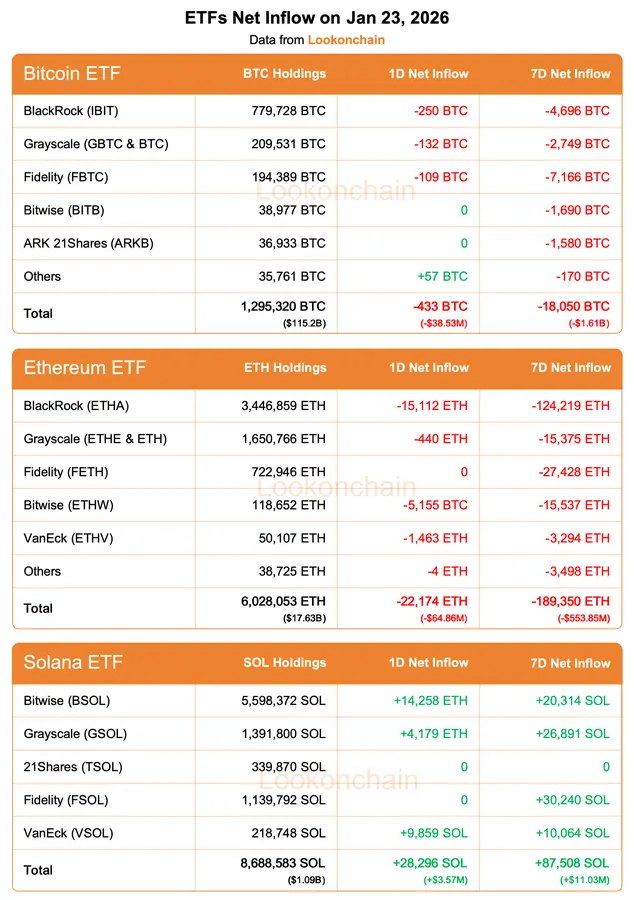

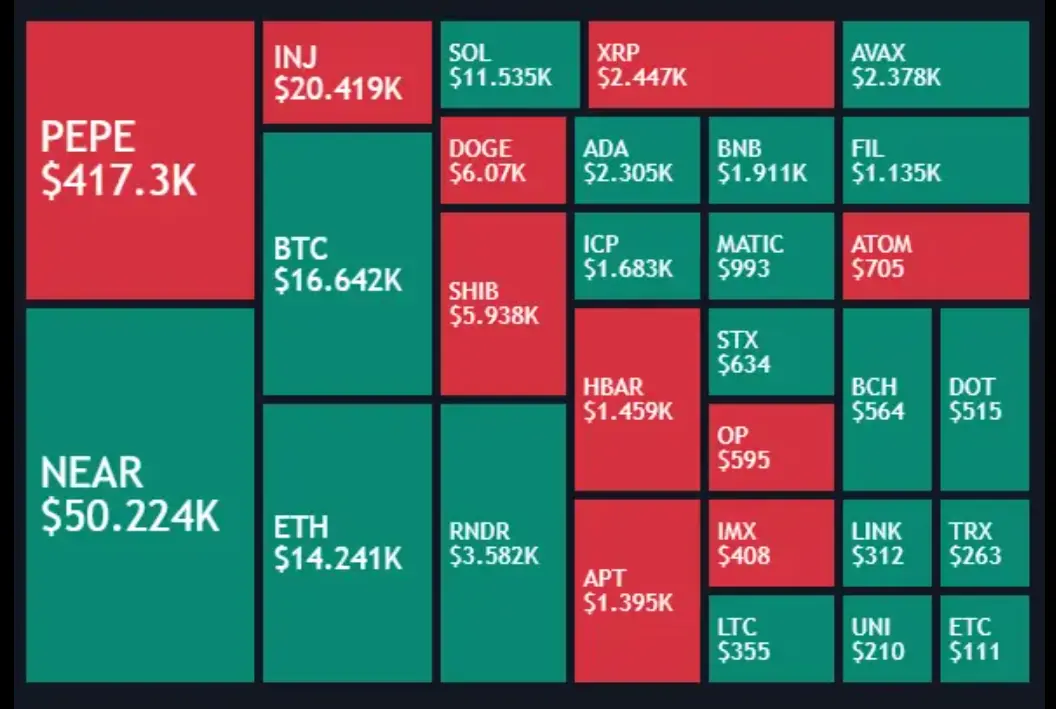

#CryptoMarketWatch 📊 | Market Snapshot

The crypto market shows mixed signals as volatility stays high.

🔹 Bitcoin (BTC): Trading near key support — holding steady amid cautious sentiment.

🔹 Ethereum (ETH): Under pressure but defending short-term support zones.

📌 Market Highlights:

Institutional interest in crypto continues to grow, signaling long-term confidence.

Traders are watching macro signals and upcoming policy moves.

Short-term consolidation could lead to heightened volatility.

⚠️ Sentiment: Neutral → cautious. Focus on risk management and monitor key levels for potential breakouts.

The crypto market shows mixed signals as volatility stays high.

🔹 Bitcoin (BTC): Trading near key support — holding steady amid cautious sentiment.

🔹 Ethereum (ETH): Under pressure but defending short-term support zones.

📌 Market Highlights:

Institutional interest in crypto continues to grow, signaling long-term confidence.

Traders are watching macro signals and upcoming policy moves.

Short-term consolidation could lead to heightened volatility.

⚠️ Sentiment: Neutral → cautious. Focus on risk management and monitor key levels for potential breakouts.

- Reward

- 2

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-4,14%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

🚨 Kevin O’Leary Streamlines Crypto Portfolio

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

Shark Tank’s Kevin O’Leary is selling 27 crypto positions, narrowing his bets exclusively to Bitcoin and Ethereum.

💡 What this signals: Even high-profile investors are focusing on blue-chip cryptos, prioritizing liquidity, market dominance, and long-term viability over speculative altcoins.

👀 Takeaway: In a volatile market, quality > quantity. O’Leary’s move highlights a growing trend: institutions and seasoned investors are doubling down on BTC & ETH as the pillars of the crypto ecosystem.

💬 Your thoughts — is this a smart consolidation or play

- Reward

- 1

- Comment

- Repost

- Share

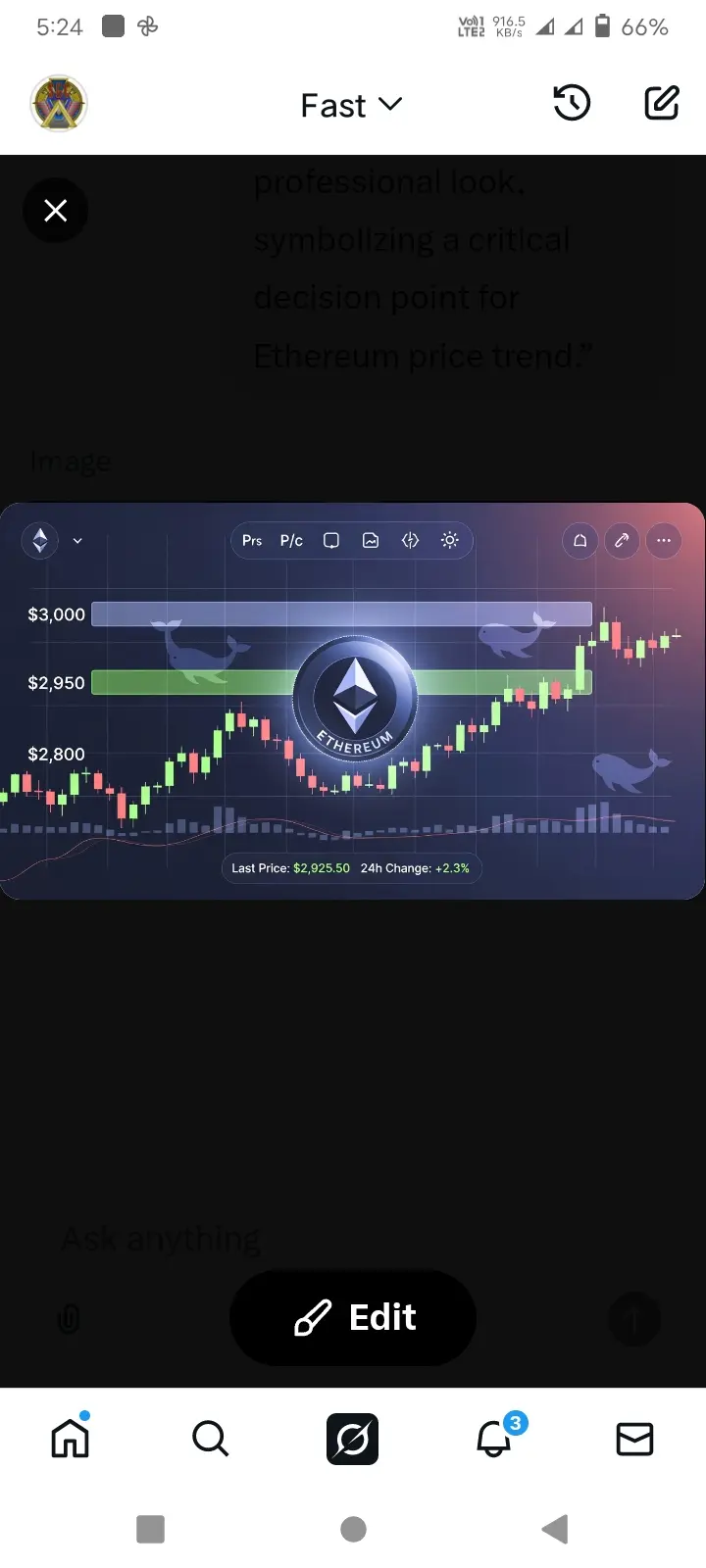

#ETHTrendWatch

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

ETH-4,14%

- Reward

- 7

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

🚨 #ETHTrendWatch – Ethereum Market Structure Update 🚨

Ethereum is currently in a compression phase — volatility exists, but directional conviction is limited. Price is rotating within a defined range, showing positioning, not momentum.

📊 Key Levels:

Support: ~$3,000 ✅ Buyers active on pullbacks

Resistance: Mid-$3,000s ✅ Sellers defending higher levels

💡 Technical Takeaways:

Price remains above the 200-week MA, preserving the broader bullish framework

Volume spikes near support → accumulation

Volume thins near resistance → profit-taking, capped rallies

Range-bound market suggests energy is

Ethereum is currently in a compression phase — volatility exists, but directional conviction is limited. Price is rotating within a defined range, showing positioning, not momentum.

📊 Key Levels:

Support: ~$3,000 ✅ Buyers active on pullbacks

Resistance: Mid-$3,000s ✅ Sellers defending higher levels

💡 Technical Takeaways:

Price remains above the 200-week MA, preserving the broader bullish framework

Volume spikes near support → accumulation

Volume thins near resistance → profit-taking, capped rallies

Range-bound market suggests energy is

ETH-4,14%

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

Happy New Year! 🤑#CryptoMarketWatch 📊 | Market Snapshot

The crypto market is sending mixed signals as volatility stays elevated.

🔹 Bitcoin (BTC) is hovering near key support levels, holding firm amid cautious market sentiment.

🔹 Ethereum (ETH) remains under pressure but continues to defend its short-term support zone.

📌 Market Highlights ▪️ Institutional interest in crypto keeps growing — a strong signal for long-term confidence

▪️ Traders are closely monitoring macroeconomic data and upcoming policy decisions

▪️ Short-term consolidation could set the stage for heightened volatility

⚠️ Market Sentiment Neu

The crypto market is sending mixed signals as volatility stays elevated.

🔹 Bitcoin (BTC) is hovering near key support levels, holding firm amid cautious market sentiment.

🔹 Ethereum (ETH) remains under pressure but continues to defend its short-term support zone.

📌 Market Highlights ▪️ Institutional interest in crypto keeps growing — a strong signal for long-term confidence

▪️ Traders are closely monitoring macroeconomic data and upcoming policy decisions

▪️ Short-term consolidation could set the stage for heightened volatility

⚠️ Market Sentiment Neu

- Reward

- 1

- Comment

- Repost

- Share

💎💎💎💎💎

Ethereum Is Thinking Long-Term — Very Long-Term

The #Ethereum Foundation has officially launched a “Post-Quantum” team, led by Thomas Coratger, to proactively address cryptographic risks posed by quantum computing.

This move highlights Ethereum’s commitment to:

🔐 Future-proof security

🧠 Long-term protocol resilience

🌐 Staying ahead of next-generation threats

Quantum computing isn’t a short-term issue — but preparing early is what serious infrastructure does.

🔍 Why This Matters

Cryptography is the backbone of blockchain security

Quantum breakthroughs could challenge today’s encry

Ethereum Is Thinking Long-Term — Very Long-Term

The #Ethereum Foundation has officially launched a “Post-Quantum” team, led by Thomas Coratger, to proactively address cryptographic risks posed by quantum computing.

This move highlights Ethereum’s commitment to:

🔐 Future-proof security

🧠 Long-term protocol resilience

🌐 Staying ahead of next-generation threats

Quantum computing isn’t a short-term issue — but preparing early is what serious infrastructure does.

🔍 Why This Matters

Cryptography is the backbone of blockchain security

Quantum breakthroughs could challenge today’s encry

ETH-4,14%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

72.87K Popularity

46.33K Popularity

38.28K Popularity

14.38K Popularity

29.67K Popularity

21.68K Popularity

17.48K Popularity

88.46K Popularity

57.8K Popularity

27.53K Popularity

17.2K Popularity

6.01K Popularity

263.16K Popularity

27.02K Popularity

167.13K Popularity

News

View MoreBTC fell below 87,000 USDT

11 m

Data: 8,148,800 WLD transferred out from BitGo, worth approximately $3.66 million

15 m

Data: If BTC breaks through $91,854, the total liquidation strength of short positions on mainstream CEXs will reach $1.323 billion.

24 m

Data: If ETH breaks through $2,996, the total liquidation strength of short positions on mainstream CEXs will reach $921 million.

25 m

ETH 跌破 2850 USDT

42 m

Pin