# CryptoMarketWatch

224.88K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

YingYue

Crypto Daily Report #加密市场观察 03.04 (: Lightning Network Integration Accelerates, Geopolitical Conflicts Trigger BTC Safe-Haven Fluctuations, Futures Demand Cools but Spot Resilience Remains

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

- Reward

- 3

- 2

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

Crypto Daily Report #加密市场观察 03.04 (: Lightning Network Integration Accelerates, Geopolitical Conflicts Trigger BTC Safe-Haven Fluctuations, Futures Demand Cools but Spot Resilience Remains

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

- Reward

- 5

- 6

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Crypto Daily Report #加密市场观察 03.04 (: Lightning Network Integration Accelerates, Geopolitical Conflicts Trigger BTC Safe-Haven Fluctuations, Futures Demand Cools but Spot Resilience Remains

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

- Reward

- 4

- 2

- Repost

- Share

xxx40xxx :

:

LFG 🔥View More

Crypto Daily Report #加密市场观察 03.04 (: Lightning Network Integration Accelerates, Geopolitical Conflicts Trigger BTC Safe-Haven Fluctuations, Futures Demand Cools but Spot Resilience Remains

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

- Reward

- 2

- Comment

- Repost

- Share

Crypto Daily Report #加密市场观察 03.04 (: Lightning Network Integration Accelerates, Geopolitical Conflicts Trigger BTC Safe-Haven Fluctuations, Futures Demand Cools but Spot Resilience Remains

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

1. Cake Wallet App Upgrade (Integrating Bitcoin Lightning Network and Supporting Self-Custody)

1 Cake Wallet announces integration of Bitcoin Lightning Network, supporting self-custody without third-party escrow or channel management, enabling easy use through Breez SDK and Spark technology.

2 New features include privacy protection technologies like Silent Payments and PayJoin, customizable Lightning add

- Reward

- 1

- Comment

- Repost

- Share

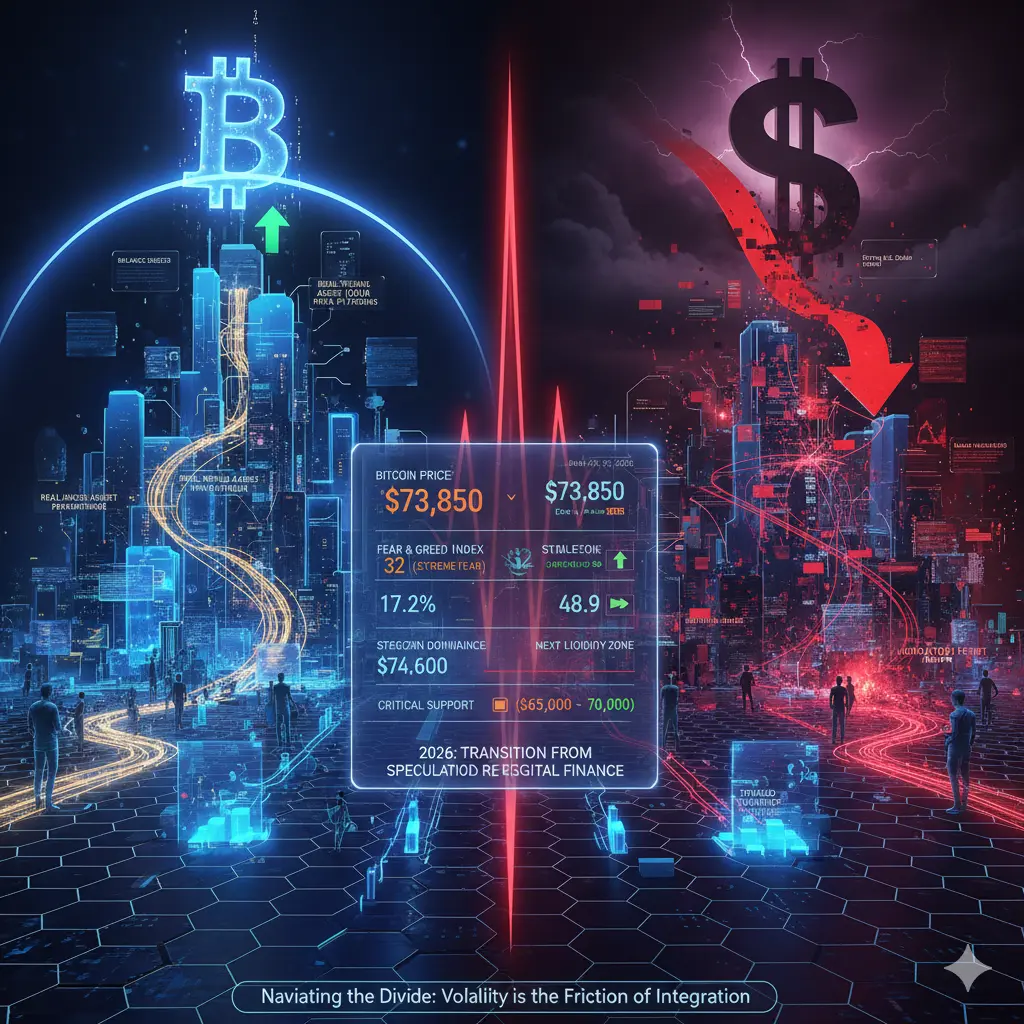

#CryptoMarketWatch Market Update & Structural Insights

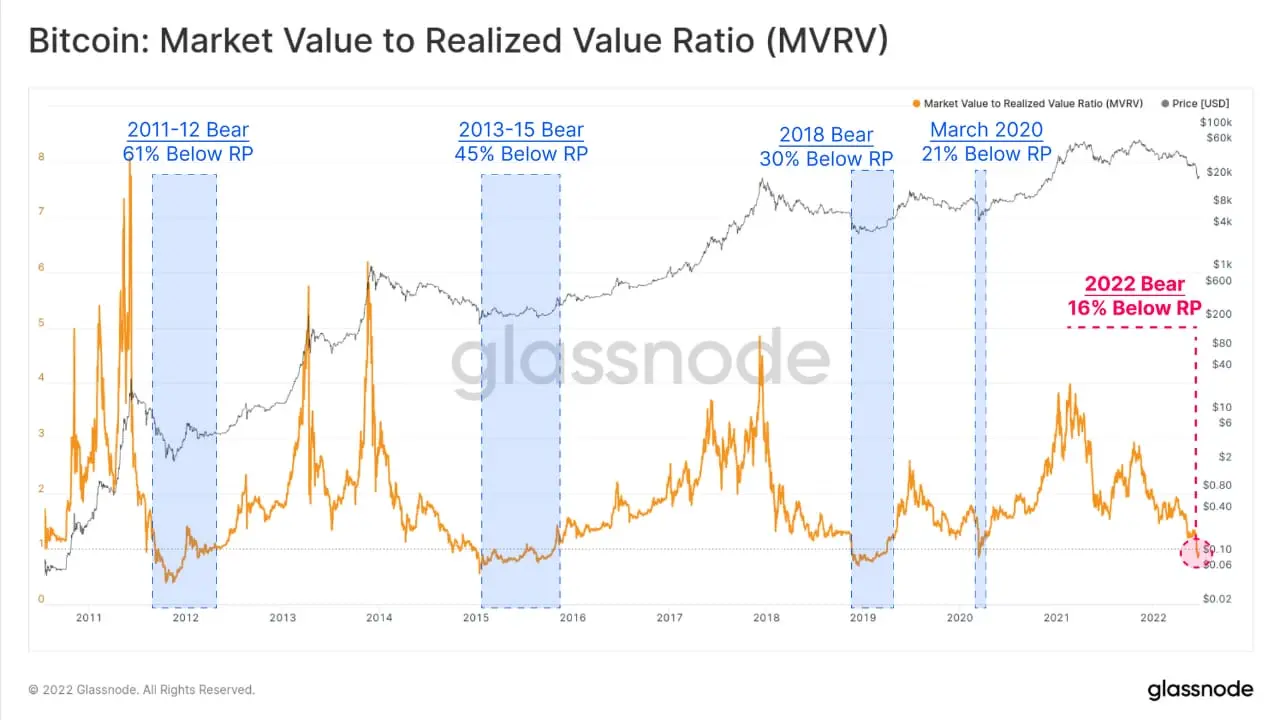

The crypto market is navigating one of its most critical transition phases. Volatility is high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments are quietly unfolding. This is more than a correction; it’s a period where positioning, patience, and perspective matter more than speed.

🔹 Bitcoin: Conviction Amid Pullbacks

Even during retracements, long-term holders remain resilient. Large wallets move cautiously, retail participation is hesitant, and this divergence often si

The crypto market is navigating one of its most critical transition phases. Volatility is high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments are quietly unfolding. This is more than a correction; it’s a period where positioning, patience, and perspective matter more than speed.

🔹 Bitcoin: Conviction Amid Pullbacks

Even during retracements, long-term holders remain resilient. Large wallets move cautiously, retail participation is hesitant, and this divergence often si

- Reward

- 8

- 5

- Repost

- Share

Yunna :

:

HOLD HOLDView More

#CryptoMarketWatch #CryptoMarketWatch

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

The crypto market is moving through one of its most important transition phases. Volatility remains high, sentiment shifts daily, and price action feels uncertain — yet beneath the surface, long-term structural developments continue to unfold. This is not just another correction or consolidation. It’s a period where positioning, patience, and perspective matter more than speed.

Bitcoin continues to lead the narrative. Even during pullbacks, long-term holders show resilience, suggesting that conviction in the broader digital asset story remains intact. Larg

- Reward

- 9

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Watching Closely 🔍️Happy New Year! DYOR 🤓View More

#CryptoMarketWatch $DOGE – BULLISH STRUCTURE HOLDS, MEMECOIN MOON MAP STILL IN PLAY 🚀🐶

$BONK is maintaining a bullish market structure after defending key demand near the lower range. Price is consolidating above support while momentum indicators hint at continuation rather than exhaustion. With meme sentiment staying hot and DOGE holding higher lows, the next move favors an upside push toward the upper resistance zones—provided volume expansion confirms the breakout. The “1000x” talk is hype, but technically, DOGE still has room to trend higher this cycle.$SHIB

Trade Setup:

Position: Long

$BONK is maintaining a bullish market structure after defending key demand near the lower range. Price is consolidating above support while momentum indicators hint at continuation rather than exhaustion. With meme sentiment staying hot and DOGE holding higher lows, the next move favors an upside push toward the upper resistance zones—provided volume expansion confirms the breakout. The “1000x” talk is hype, but technically, DOGE still has room to trend higher this cycle.$SHIB

Trade Setup:

Position: Long

- Reward

- 7

- 8

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

The crypto market in 2026 is witnessing one of the sharpest divergences seen in years. The divide between bulls and bears now extends beyond price expectations into fundamentally different interpretations of what the market itself represents. On one side are those who argue that crypto has finally moved beyond experimentation and is becoming a productive component of the global financial system. On the other, the short-term landscape—marked by aggressive liquidations, fragile liquidity, and increasingly complex correlations with traditional assets—demands caution. The marke

The crypto market in 2026 is witnessing one of the sharpest divergences seen in years. The divide between bulls and bears now extends beyond price expectations into fundamentally different interpretations of what the market itself represents. On one side are those who argue that crypto has finally moved beyond experimentation and is becoming a productive component of the global financial system. On the other, the short-term landscape—marked by aggressive liquidations, fragile liquidity, and increasingly complex correlations with traditional assets—demands caution. The marke

- Reward

- 65

- 51

- Repost

- Share

Crypto_Buzz_with_Alex :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

101.17K Popularity

42.65M Popularity

414.52K Popularity

954.07K Popularity

1.11M Popularity

4.77K Popularity

240.42K Popularity

272.21K Popularity

5.11K Popularity

154.16K Popularity

3.45M Popularity

161.12K Popularity

6.08M Popularity

61.85K Popularity

399.92K Popularity

News

View MoreEthereum Price News: ETH Exchange Reserves Drop to Historic Lows, Vitalik Buterin Proposes "Shelter Technology" Concept

1 m

Hedging demand cools down, and the dollar retreats from three-month highs

1 m

POWER token plummets 90% in 24 hours, unlocking pressure and trading halts trigger panic selling

3 m

Ju.com Mainstream Coins 20% Off for New Listings "Ten Consecutive Launches" Successfully Concluded

5 m

Predict.fun announces a strategic acquisition of the on-chain prediction platform Probable

6 m

Pin