# BitcoinLiquidity

58.24K

HighAmbition

#BitcoinLiquidity

Understanding Bitcoin Liquidity: A Comprehensive & In-Depth Guide

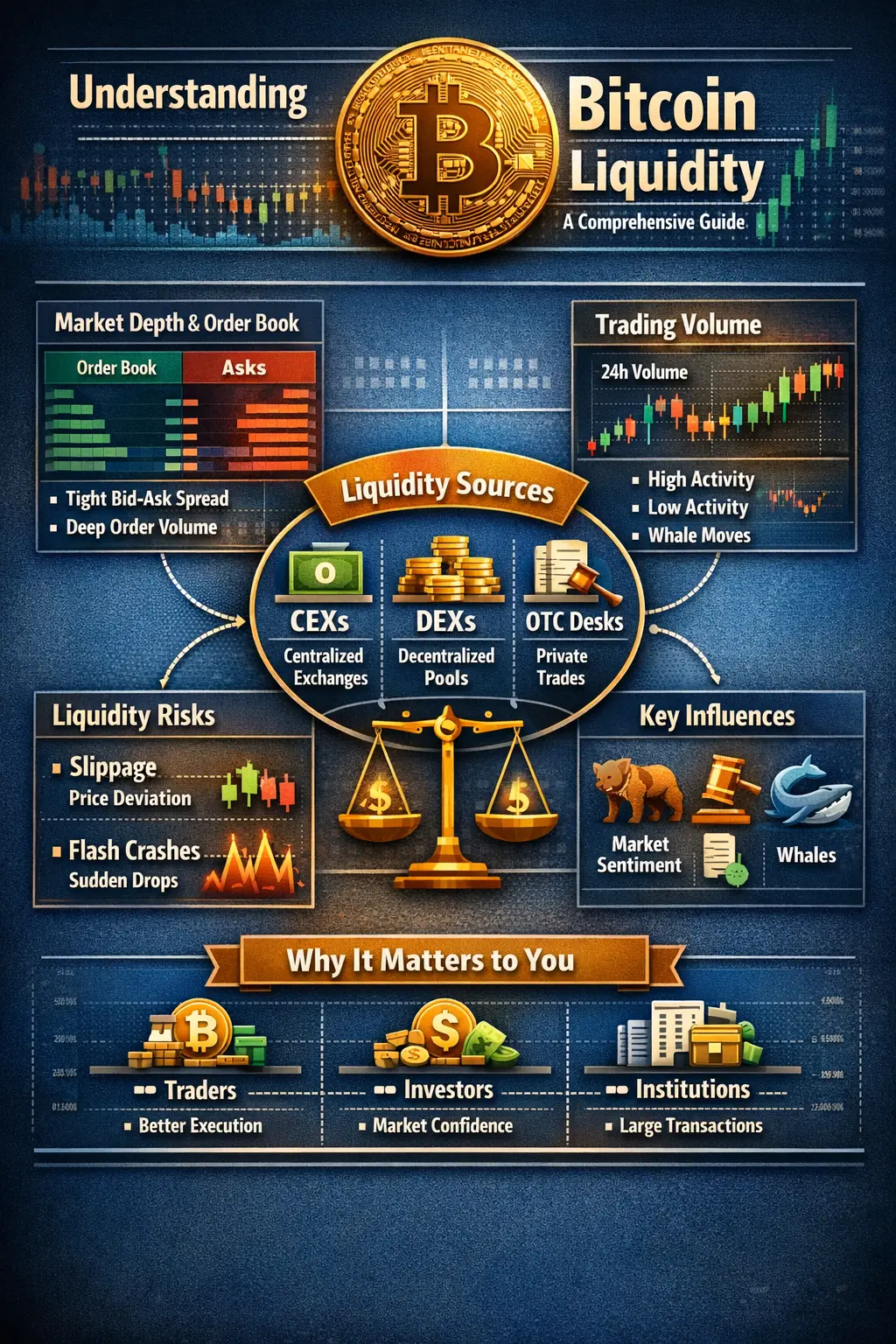

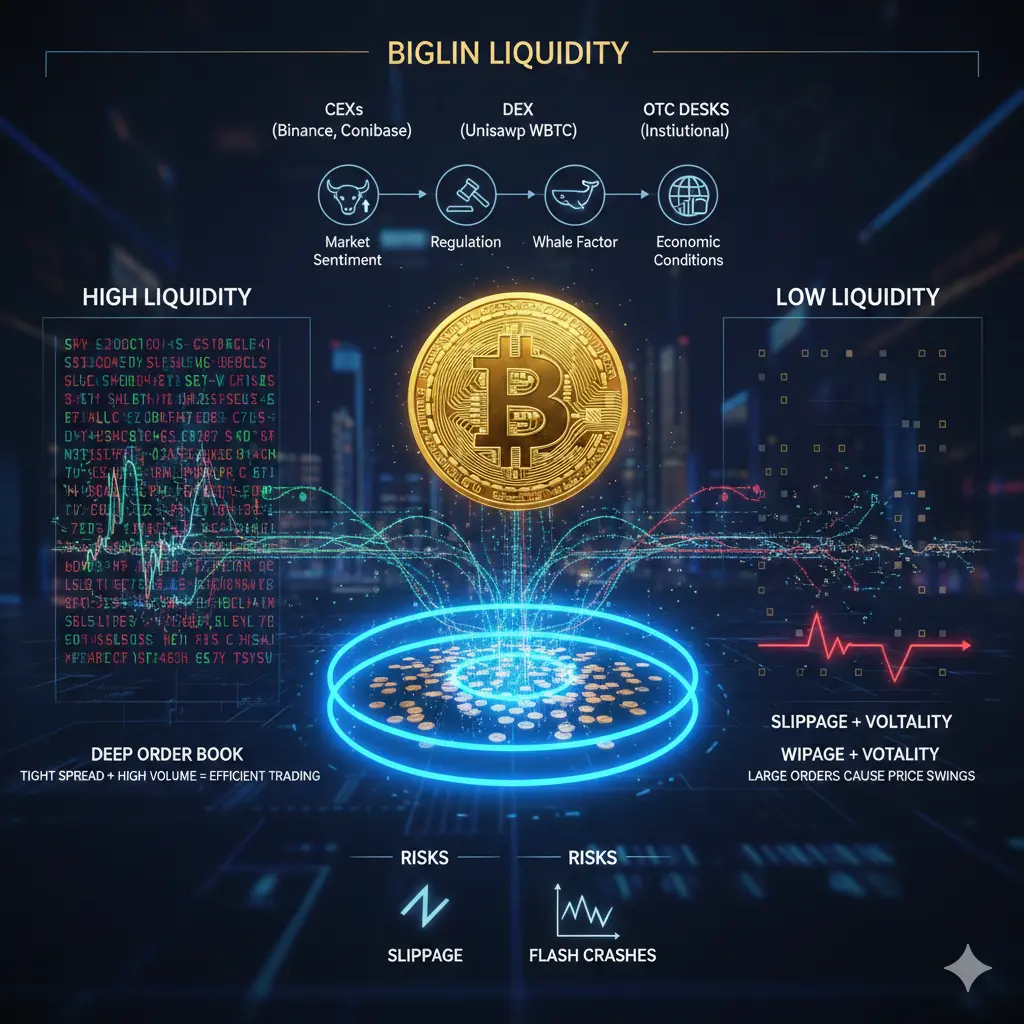

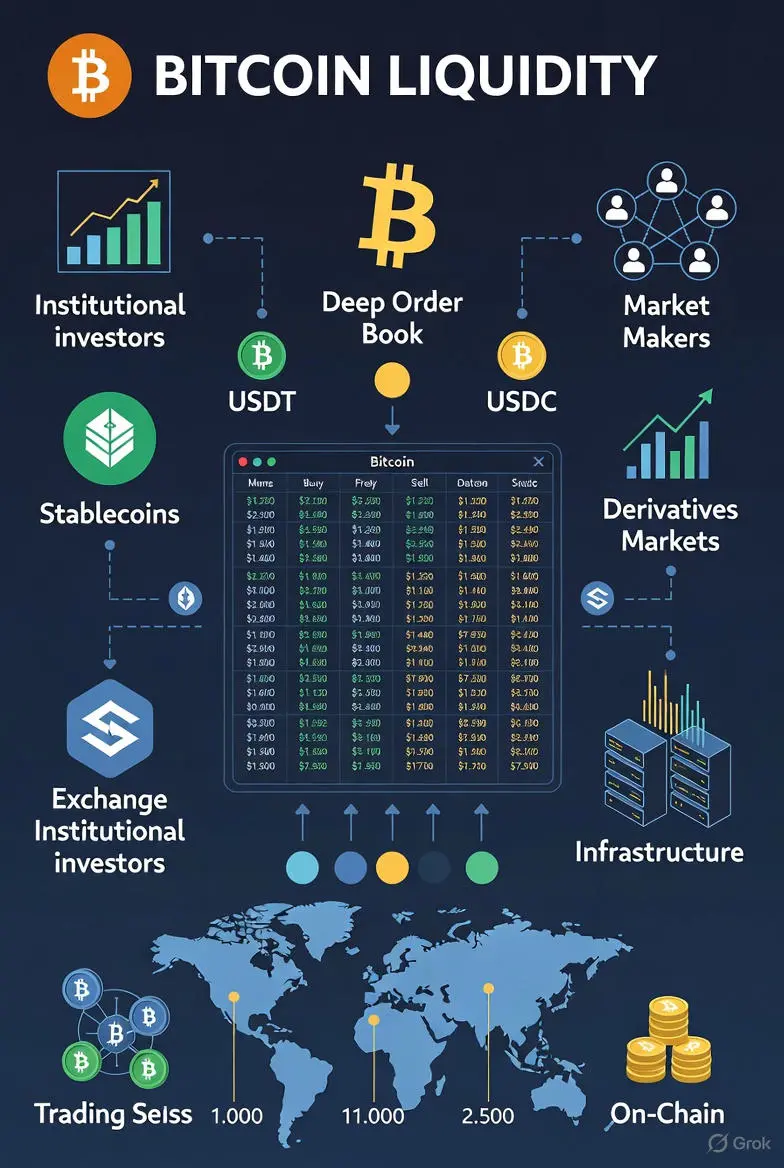

Liquidity is the backbone of every financial market—and in cryptocurrency, it is the invisible force that determines price stability, volatility, and execution quality. For Bitcoin, liquidity represents how efficiently BTC can be exchanged for cash or other assets without causing sharp price distortions. A highly liquid Bitcoin market reflects maturity, confidence, and strong participation from both retail and institutional players.

This guide explores Bitcoin liquidity in depth, breaking down its structure, s

Understanding Bitcoin Liquidity: A Comprehensive & In-Depth Guide

Liquidity is the backbone of every financial market—and in cryptocurrency, it is the invisible force that determines price stability, volatility, and execution quality. For Bitcoin, liquidity represents how efficiently BTC can be exchanged for cash or other assets without causing sharp price distortions. A highly liquid Bitcoin market reflects maturity, confidence, and strong participation from both retail and institutional players.

This guide explores Bitcoin liquidity in depth, breaking down its structure, s

- Reward

- 23

- 13

- Repost

- Share

BabaJi :

:

Merry Christmas ⛄View More

Bitcoin Liquidity A Deep Dive into Market Depth, Capital Movement, and Its Role in Bitcoin’s Long-Term Market Strength

Bitcoin liquidity is one of the most important yet often misunderstood components of the digital asset market. As Bitcoin continues to grow beyond its early experimental phase and move further into mainstream financial discussions, liquidity has become a key measure of its maturity, efficiency, and overall market health. Strong liquidity allows Bitcoin to function not only as a speculative asset, but also as a reliable medium for trading, investment, and long-term value stor

Bitcoin liquidity is one of the most important yet often misunderstood components of the digital asset market. As Bitcoin continues to grow beyond its early experimental phase and move further into mainstream financial discussions, liquidity has become a key measure of its maturity, efficiency, and overall market health. Strong liquidity allows Bitcoin to function not only as a speculative asset, but also as a reliable medium for trading, investment, and long-term value stor

BTC-2,3%

- Reward

- 14

- 12

- Repost

- Share

Ryakpanda :

:

Hurry up and enter a position! 🚗View More

#BitcoinLiquidity

#BitcoinLiquidity

. Bitcoin liquidity refers to how easily BTC can be bought or sold in the market without causing a significant change in price. High liquidity means large orders can be executed smoothly, while low liquidity can lead to sharp price swings.

. In crypto markets, liquidity is a key indicator of market health. When liquidity is strong, traders experience tighter spreads, faster order execution, and more reliable price discovery.

Bitcoin is generally the most liquid cryptocurrency in the world. Its long history, global adoption, and presence on nearly every maj

#BitcoinLiquidity

. Bitcoin liquidity refers to how easily BTC can be bought or sold in the market without causing a significant change in price. High liquidity means large orders can be executed smoothly, while low liquidity can lead to sharp price swings.

. In crypto markets, liquidity is a key indicator of market health. When liquidity is strong, traders experience tighter spreads, faster order execution, and more reliable price discovery.

Bitcoin is generally the most liquid cryptocurrency in the world. Its long history, global adoption, and presence on nearly every maj

BTC-2,3%

- Reward

- 17

- 10

- Repost

- Share

GateUser-97821dcb :

:

thank you for this very important information.View More

🚨The largest Bitcoin options expiry of 2025 hits next week.

Around $23.7B in $BTC options expire on December 26.

#BitcoinLiquidity #CryptoMarketWatch #BTCMarketAnalysis $BTC

Around $23.7B in $BTC options expire on December 26.

#BitcoinLiquidity #CryptoMarketWatch #BTCMarketAnalysis $BTC

BTC-2,3%

- Reward

- 7

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

⚡ “Energy here is contagious, loving the crypto charisma!”View More

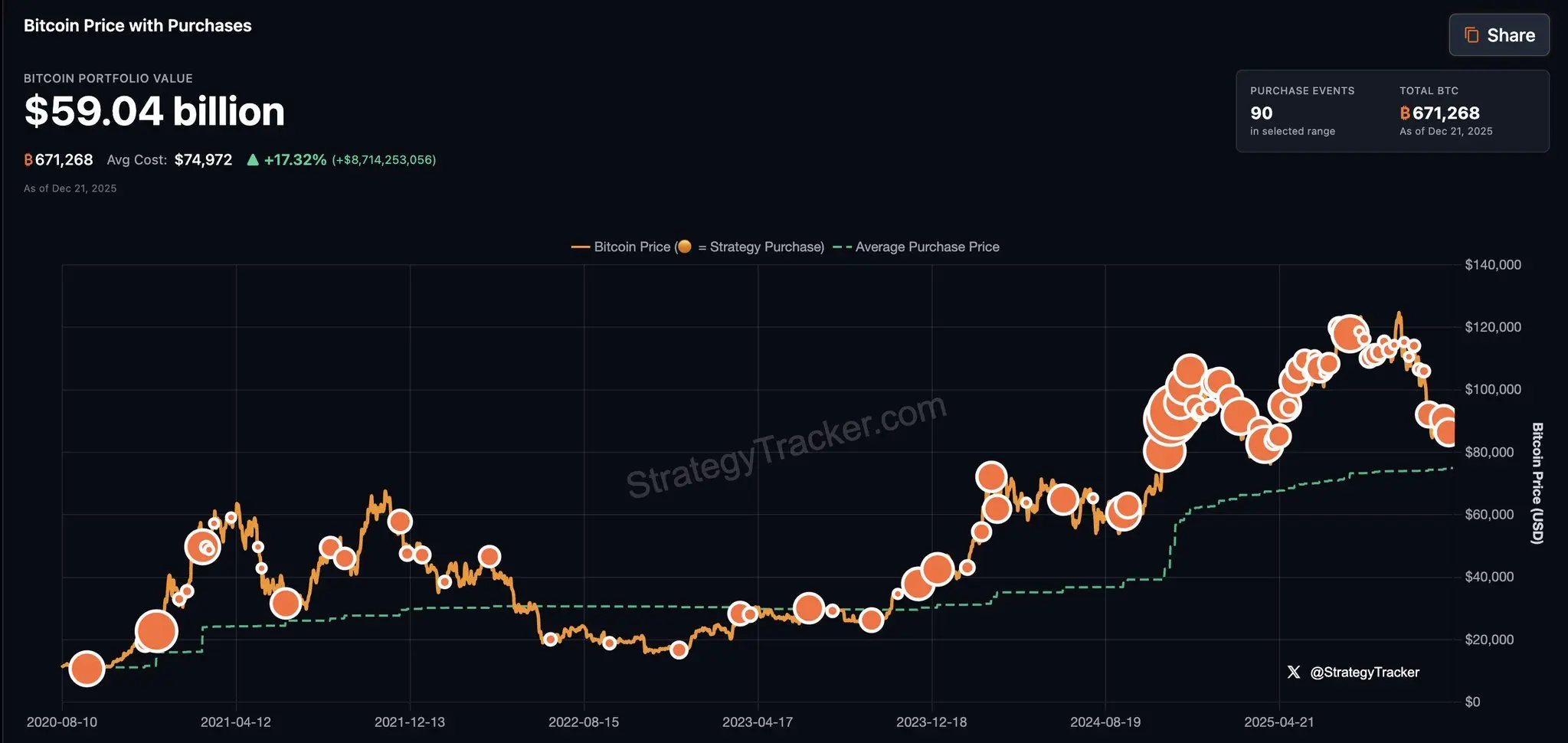

JUST IN: Michael Saylor hints at buying more Bitcoin.

“Green dots ₿eget orange dots.”

⚠️ Warning:

Every time he buys, the market usually does the opposite. His buys have often lined up with local tops, followed by sharp selloffs. Treat the news as liquidity bait, not a green light. Chasing after these announcements is how people get trapped. Trend and liquidity matter more than headlines.

#FedRateCutPrediction #CryptoMarketWatch #BitcoinLiquidity #BTCMarketAnalysis #BigWhaleMovement

“Green dots ₿eget orange dots.”

⚠️ Warning:

Every time he buys, the market usually does the opposite. His buys have often lined up with local tops, followed by sharp selloffs. Treat the news as liquidity bait, not a green light. Chasing after these announcements is how people get trapped. Trend and liquidity matter more than headlines.

#FedRateCutPrediction #CryptoMarketWatch #BitcoinLiquidity #BTCMarketAnalysis #BigWhaleMovement

BTC-2,3%

- Reward

- 11

- 7

- Repost

- Share

MoonGirl :

:

Ape In 🚀View More

#BitcoinLiquidity Understanding BTC Market Depth and Stability (Updated December 2025)$BTC $GT $ETH

Bitcoin liquidity refers to how easily BTC can be bought or sold in the market without causing a major price change. High liquidity allows large orders to be executed smoothly, while low liquidity can result in sharp price swings and increased volatility.

In crypto markets, liquidity is a key indicator of market health. Strong liquidity ensures tighter spreads, faster order execution, and more reliable price discovery. Bitcoin, due to its long history, global adoption, and presence on almost ev

Bitcoin liquidity refers to how easily BTC can be bought or sold in the market without causing a major price change. High liquidity allows large orders to be executed smoothly, while low liquidity can result in sharp price swings and increased volatility.

In crypto markets, liquidity is a key indicator of market health. Strong liquidity ensures tighter spreads, faster order execution, and more reliable price discovery. Bitcoin, due to its long history, global adoption, and presence on almost ev

BTC-2,3%

- Reward

- 5

- 2

- Repost

- Share

GateUser-952881a6 :

:

The only way I could do that was if you wanted me too I could come and pick it out and then I can go pick up it from your place or you could just pick me out of there or you could pick me out from the store or you can just come pick me out or you could go to my houseView More

#BitcoinLiquidity Understanding BTC Market Depth and Stability (Updated December 2025)

$BTC $GT

Bitcoin liquidity refers to how easily BTC can be bought or sold without causing significant price changes. High liquidity allows large orders to execute smoothly, while low liquidity can trigger sharp price swings and heightened volatility. In crypto markets, liquidity is a key indicator of market health. Bitcoin, due to its long history, global adoption, and presence on nearly every major exchange, consistently remains the most liquid cryptocurrency, giving it a significant edge over altcoins in

$BTC $GT

Bitcoin liquidity refers to how easily BTC can be bought or sold without causing significant price changes. High liquidity allows large orders to execute smoothly, while low liquidity can trigger sharp price swings and heightened volatility. In crypto markets, liquidity is a key indicator of market health. Bitcoin, due to its long history, global adoption, and presence on nearly every major exchange, consistently remains the most liquid cryptocurrency, giving it a significant edge over altcoins in

BTC-2,3%

- Reward

- 10

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

😎 “Crypto community energy is unmatched 🔥”View More

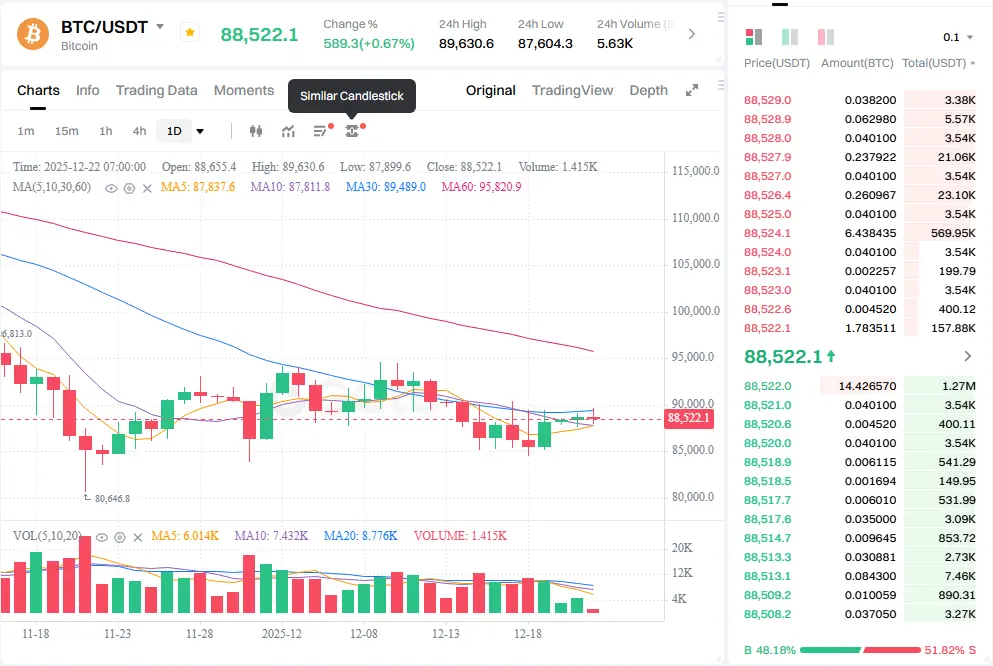

📈 Digital Financial Market Analysis December 22, 2025: Bitcoin Maintains Momentum, Ethereum Reclaims the Psychological Mark of $3K

The digital financial market entered the Christmas week with fairly positive movements. Optimism prevailed as major cryptocurrencies maintained important support levels.

💰 Bitcoin (BTC): Maintaining Stability Above $88K

Over the past 24 hours, Bitcoin continued to show its resilience, trading within the range of $87,000 to $89,000. This is a crucial accumulation zone, indicating that buyers are trying to protect the gains from previous growth spurts.

Current Stat

The digital financial market entered the Christmas week with fairly positive movements. Optimism prevailed as major cryptocurrencies maintained important support levels.

💰 Bitcoin (BTC): Maintaining Stability Above $88K

Over the past 24 hours, Bitcoin continued to show its resilience, trading within the range of $87,000 to $89,000. This is a crucial accumulation zone, indicating that buyers are trying to protect the gains from previous growth spurts.

Current Stat

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin Liquidity A Deep Dive into Market Depth, Capital Movement, and Its Role in Bitcoin’s Long-Term Market Strength

Bitcoin liquidity is one of the most important yet often misunderstood components of the digital asset market. As Bitcoin continues to grow beyond its early experimental phase and move further into mainstream financial discussions, liquidity has become a key measure of its maturity, efficiency, and overall market health. Strong liquidity allows Bitcoin to function not only as a speculative asset, but also as a reliable medium for trading, investment, and long-term value stor

Bitcoin liquidity is one of the most important yet often misunderstood components of the digital asset market. As Bitcoin continues to grow beyond its early experimental phase and move further into mainstream financial discussions, liquidity has become a key measure of its maturity, efficiency, and overall market health. Strong liquidity allows Bitcoin to function not only as a speculative asset, but also as a reliable medium for trading, investment, and long-term value stor

BTC-2,3%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Merry Christmas ⛄#CryptoMarketWatch #BitcoinLiquidity $BTC

Bitcoin is currently moving sideways near $88,000, with price action slowing as traders shift focus from short-term technicals to upcoming macroeconomic events. With a holiday-shortened week ahead, even small surprises could trigger outsized moves.

Market Snapshot

BTC Price: $88,072

Range: $87,800 – $88,575

Momentum indicators suggest neutrality: RSI near 48, MACD still slightly negative.

Key support sits near $85,200, while resistance begins around $89,600.

What’s Driving the Market Next Week?

🔹 Federal Reserve speculation

Markets are watching clo

Bitcoin is currently moving sideways near $88,000, with price action slowing as traders shift focus from short-term technicals to upcoming macroeconomic events. With a holiday-shortened week ahead, even small surprises could trigger outsized moves.

Market Snapshot

BTC Price: $88,072

Range: $87,800 – $88,575

Momentum indicators suggest neutrality: RSI near 48, MACD still slightly negative.

Key support sits near $85,200, while resistance begins around $89,600.

What’s Driving the Market Next Week?

🔹 Federal Reserve speculation

Markets are watching clo

BTC-2,3%

- Reward

- 7

- 7

- Repost

- Share

EagleEye :

:

🎄🎅✨Santa Claus is here! Holiday mood activated!View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

213.37K Popularity

8.17K Popularity

11.02K Popularity

11.17K Popularity

5.58K Popularity

60.81K Popularity

3.4K Popularity

5.03K Popularity

25.83K Popularity

2.33K Popularity

3.19K Popularity

13.46K Popularity

3.6K Popularity

19.83K Popularity

12.26K Popularity

News

View MoreData: 53.4 WBTC transferred from anonymous addresses, worth approximately $3,657,000.

1 h

Trump: Our interest rates should be 2 percentage points lower than they are now.

2 h

Trump says that if US-Iran negotiations fail, another aircraft carrier strike group may be sent to the Middle East

2 h

LayerZero launches ZERO blockchain, partners with ICE and DTCC

2 h

U.S. stock market closes with mixed gains and losses; Western Digital drops 8.1%

2 h

Pin