#BitwiseFilesforUNISpotETF

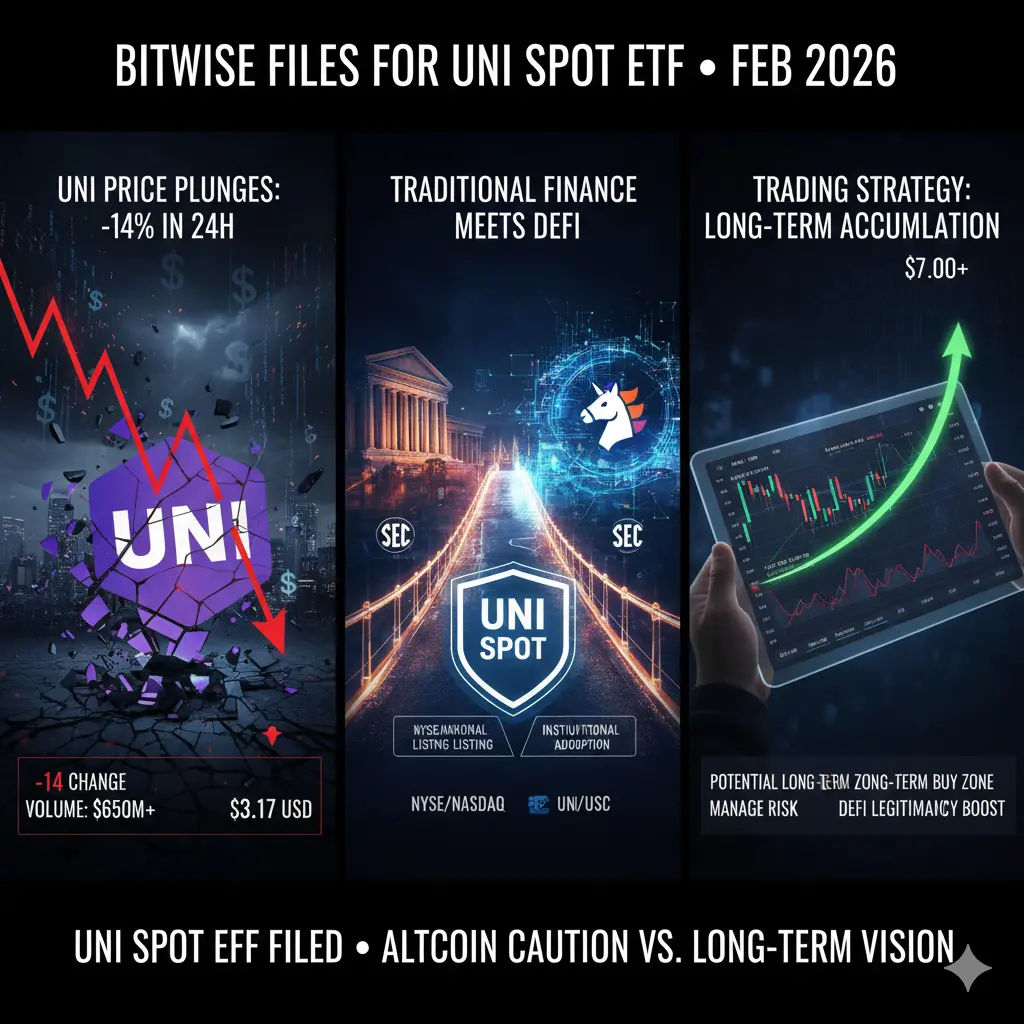

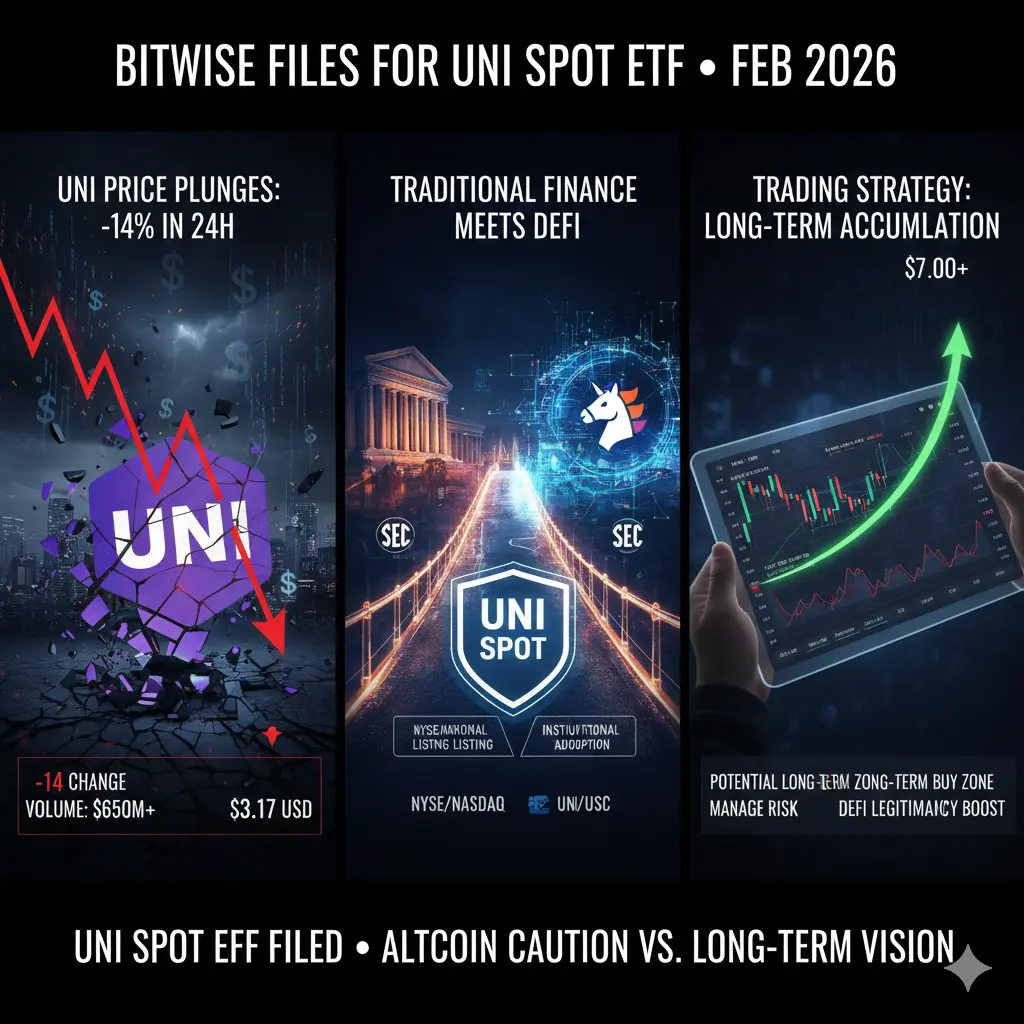

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in DeFi Grows – Coinbase Custody named as custodian; no staking in initial filing, but future additions possible.

Altcoin Caution Lingers – Filing boosts legitimacy, yet UNI down sharply from recent levels – "buy the dip" for institutions?

In Simple English:

Bitwise Asset Management filed an S-1 with the SEC for the Bitwise Uniswap ETF, a spot ETF that would hold actual UNI tokens. Investors could gain exposure through regular brokerage accounts on NYSE/Nasdaq – no crypto wallets needed. The ETF tracks UNI's spot price (minus fees), making DeFi accessible to institutions and traditional investors.

Current UNI Price Snapshot (as of February 6, 2026 – intraday/live data):

UNI Price: ~$3.17 – $3.22 USD (down 14–16% in the last 24 hours; briefly hit lows around $2.91–$3.14 in heavy selling).

24h Change: -14% to -16% (heavy pressure from broader altcoin sell-off).

Market Cap: ~$2.00B – $2.04B (ranked around #34–#39).

24h Trading Volume: $620M – $700M+ (elevated but not enough to reverse the downtrend).

Circulating Supply: ~630–634 million UNI.

Recent Context: UNI has fallen sharply (down 23%+ in past week, 47%+ in past month in some reports) – hitting multi-year lows amid risk-off sentiment, despite the positive ETF filing news.

Why This Matters – DeFi Milestone:

Opens Wall Street doors to Uniswap (leading DEX on Ethereum).

Boosts legitimacy for UNI and DeFi tokens.

Could drive future inflows if approved (similar to BTC/ETH ETFs).

Long-term bullish for DeFi adoption, but short-term price action remains weak.

Trading Strategy Discussion (Current Market View):

This is a high-volatility, risk-off environment – UNI is acting like a high-beta altcoin (correlated with broader crypto/tech weakness).

Short-Term (Next Days/Weeks):

Bearish Bias: UNI below key supports (~$3.50–$3.80 previously) – watch for further downside to $2.80–$3.00 if selling continues. Avoid aggressive longs until reversal signs (e.g., higher lows + volume spike).

Dip Buying Opportunity?: ETF filing is a major catalyst – some see this as "buy the news/dip" for long-term holders. Consider small positions if UNI holds $3.00+ and shows oversold bounce (RSI low ~25–30).

Risk Management: Use tight stops (e.g., below recent lows). Position size small (1–2% of portfolio) due to volatility.

Medium/Long-Term Outlook:

Bullish Case: If ETF gets traction/approval (months away), expect inflows + renewed DeFi interest. UNI could target $5–$7+ by end-2026 (per some forecasts) on supply burns, protocol growth, and institutional adoption.

Bearish Risks: Prolonged altcoin weakness, delayed SEC approval, or macro pressure could push UNI lower first.

Strategy Ideas:

Accumulate on Weakness: Dollar-cost average small buys below $3.50 if conviction high.

Wait for Confirmation: Look for breakout above $4.00–$4.50 with volume for entry.

Hedge: Pair with BTC/ETH exposure or stablecoins until clearer trend.

Bottom Line:

The Bitwise UNI Spot ETF filing is a huge step for DeFi legitimacy and could spark major adoption if approved. However, UNI's current price (~$3.20 range) reflects short-term pain – not yet translating to upside. Stay cautious, manage risk tightly, and view this as a potential long-term accumulation zone for believers in Uniswap/DeFi.

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in DeFi Grows – Coinbase Custody named as custodian; no staking in initial filing, but future additions possible.

Altcoin Caution Lingers – Filing boosts legitimacy, yet UNI down sharply from recent levels – "buy the dip" for institutions?

In Simple English:

Bitwise Asset Management filed an S-1 with the SEC for the Bitwise Uniswap ETF, a spot ETF that would hold actual UNI tokens. Investors could gain exposure through regular brokerage accounts on NYSE/Nasdaq – no crypto wallets needed. The ETF tracks UNI's spot price (minus fees), making DeFi accessible to institutions and traditional investors.

Current UNI Price Snapshot (as of February 6, 2026 – intraday/live data):

UNI Price: ~$3.17 – $3.22 USD (down 14–16% in the last 24 hours; briefly hit lows around $2.91–$3.14 in heavy selling).

24h Change: -14% to -16% (heavy pressure from broader altcoin sell-off).

Market Cap: ~$2.00B – $2.04B (ranked around #34–#39).

24h Trading Volume: $620M – $700M+ (elevated but not enough to reverse the downtrend).

Circulating Supply: ~630–634 million UNI.

Recent Context: UNI has fallen sharply (down 23%+ in past week, 47%+ in past month in some reports) – hitting multi-year lows amid risk-off sentiment, despite the positive ETF filing news.

Why This Matters – DeFi Milestone:

Opens Wall Street doors to Uniswap (leading DEX on Ethereum).

Boosts legitimacy for UNI and DeFi tokens.

Could drive future inflows if approved (similar to BTC/ETH ETFs).

Long-term bullish for DeFi adoption, but short-term price action remains weak.

Trading Strategy Discussion (Current Market View):

This is a high-volatility, risk-off environment – UNI is acting like a high-beta altcoin (correlated with broader crypto/tech weakness).

Short-Term (Next Days/Weeks):

Bearish Bias: UNI below key supports (~$3.50–$3.80 previously) – watch for further downside to $2.80–$3.00 if selling continues. Avoid aggressive longs until reversal signs (e.g., higher lows + volume spike).

Dip Buying Opportunity?: ETF filing is a major catalyst – some see this as "buy the news/dip" for long-term holders. Consider small positions if UNI holds $3.00+ and shows oversold bounce (RSI low ~25–30).

Risk Management: Use tight stops (e.g., below recent lows). Position size small (1–2% of portfolio) due to volatility.

Medium/Long-Term Outlook:

Bullish Case: If ETF gets traction/approval (months away), expect inflows + renewed DeFi interest. UNI could target $5–$7+ by end-2026 (per some forecasts) on supply burns, protocol growth, and institutional adoption.

Bearish Risks: Prolonged altcoin weakness, delayed SEC approval, or macro pressure could push UNI lower first.

Strategy Ideas:

Accumulate on Weakness: Dollar-cost average small buys below $3.50 if conviction high.

Wait for Confirmation: Look for breakout above $4.00–$4.50 with volume for entry.

Hedge: Pair with BTC/ETH exposure or stablecoins until clearer trend.

Bottom Line:

The Bitwise UNI Spot ETF filing is a huge step for DeFi legitimacy and could spark major adoption if approved. However, UNI's current price (~$3.20 range) reflects short-term pain – not yet translating to upside. Stay cautious, manage risk tightly, and view this as a potential long-term accumulation zone for believers in Uniswap/DeFi.