#CryptoMarketPullback | Dragon Fly Official

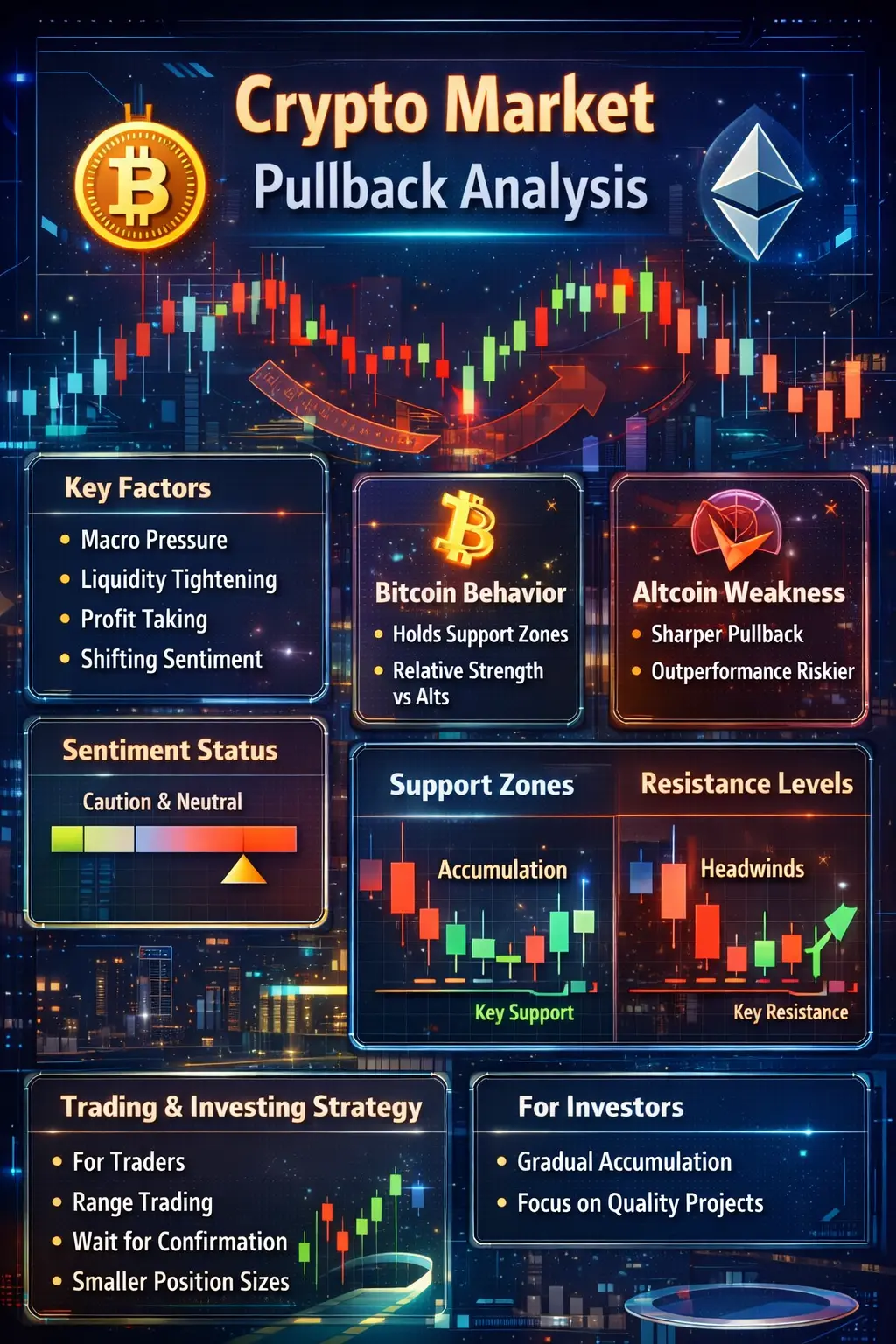

The crypto market just went through a sharp deleveraging wave. BTC slipping below $76K triggered synchronized selling across ETH, SOL, and major altcoins. When volatility expands this fast, the real game is no longer about chasing quick profits — it’s about **protecting capital and positioning smartly for the next move**.

Right now the structure looks like a classic liquidity reset. Forced liquidations cleared overheated leverage, and historically these phases often create **strong reaction zones** rather than instant trend reversals. The key level to watch on BTC is whether buyers defend the mid-$70K region. A stable hold here could lead to consolidation and a relief bounce, but failure opens the door to deeper testing of lower support bands.

From a strategy perspective, this is a market where **risk control beats aggression**. Gradual position sizing, partial hedging, and patience matter more than trying to catch the exact bottom. Emotional trading during fast drops is where most losses happen.

💬 My focus right now:

• Keeping positions lighter until volatility cools

• Watching volume behavior near support zones

• Waiting for confirmation before scaling back in

Markets move in cycles — sharp corrections often plant the seeds for the next opportunity. Survival and discipline today decide who benefits tomorrow.

#BTC #ETH #CryptoTrading #RiskManagement

The crypto market just went through a sharp deleveraging wave. BTC slipping below $76K triggered synchronized selling across ETH, SOL, and major altcoins. When volatility expands this fast, the real game is no longer about chasing quick profits — it’s about **protecting capital and positioning smartly for the next move**.

Right now the structure looks like a classic liquidity reset. Forced liquidations cleared overheated leverage, and historically these phases often create **strong reaction zones** rather than instant trend reversals. The key level to watch on BTC is whether buyers defend the mid-$70K region. A stable hold here could lead to consolidation and a relief bounce, but failure opens the door to deeper testing of lower support bands.

From a strategy perspective, this is a market where **risk control beats aggression**. Gradual position sizing, partial hedging, and patience matter more than trying to catch the exact bottom. Emotional trading during fast drops is where most losses happen.

💬 My focus right now:

• Keeping positions lighter until volatility cools

• Watching volume behavior near support zones

• Waiting for confirmation before scaling back in

Markets move in cycles — sharp corrections often plant the seeds for the next opportunity. Survival and discipline today decide who benefits tomorrow.

#BTC #ETH #CryptoTrading #RiskManagement