# MarketStructure

4.75K

Luna_Star

#BitcoinBouncesBack

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

As of today, Bitcoin’s bounce feels more like a calculated response than an emotional relief rally. After a period of pressure and uncertainty, price action is showing signs of stabilization, suggesting that buyers are stepping in selectively rather than chasing momentum. This kind of rebound often reflects improving confidence, but not blind optimism.

What stands out is how the bounce is forming. Volume remains controlled, volatility is cooling, and panic selling appears to have faded. Historically, these conditions tend to favor short-term consolidation before the market

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

Thank you for the information🙏🙏🙏Altcoin Focus

Headline: SUI and ADA at Critical Levels: Opportunity or Risk? 📊

Body:

Both $SUI and $ADA A are testing major support zones, with daily RSI approaching oversold conditions.

Historically, long-term capital begins gradual accumulation during periods of elevated fear, not euphoria. That said, confirmation remains key.

This is a zone for strategy — not emotion.

#Altcoins #MarketStructure #SUI #Cardano

Headline: SUI and ADA at Critical Levels: Opportunity or Risk? 📊

Body:

Both $SUI and $ADA A are testing major support zones, with daily RSI approaching oversold conditions.

Historically, long-term capital begins gradual accumulation during periods of elevated fear, not euphoria. That said, confirmation remains key.

This is a zone for strategy — not emotion.

#Altcoins #MarketStructure #SUI #Cardano

- Reward

- like

- Comment

- Repost

- Share

📈# Top Coins Rising Against the Trend

In a market dominated by volatility and broad sell-offs, a few cryptocurrencies are standing firm — and even moving higher. While high-beta assets and tech stocks face pressure, these counter-trend coins are proving that not all markets move the same way.

💡 Why are these coins holding up?

🔹 Strong network fundamentals & real-world utility

🔹 Active developer ecosystems and growing adoption

🔹 Deep liquidity and healthier market structure

🔹 Loyal, engaged communities supporting long-term vision

📊 Market Insight

Coins with solid fundamentals and lower c

In a market dominated by volatility and broad sell-offs, a few cryptocurrencies are standing firm — and even moving higher. While high-beta assets and tech stocks face pressure, these counter-trend coins are proving that not all markets move the same way.

💡 Why are these coins holding up?

🔹 Strong network fundamentals & real-world utility

🔹 Active developer ecosystems and growing adoption

🔹 Deep liquidity and healthier market structure

🔹 Loyal, engaged communities supporting long-term vision

📊 Market Insight

Coins with solid fundamentals and lower c

- Reward

- 2

- Comment

- Repost

- Share

#CryptoSurvivalGuide

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

BTC-0,16%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoSurvivalGuide

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

BTC-0,16%

- Reward

- 2

- 2

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

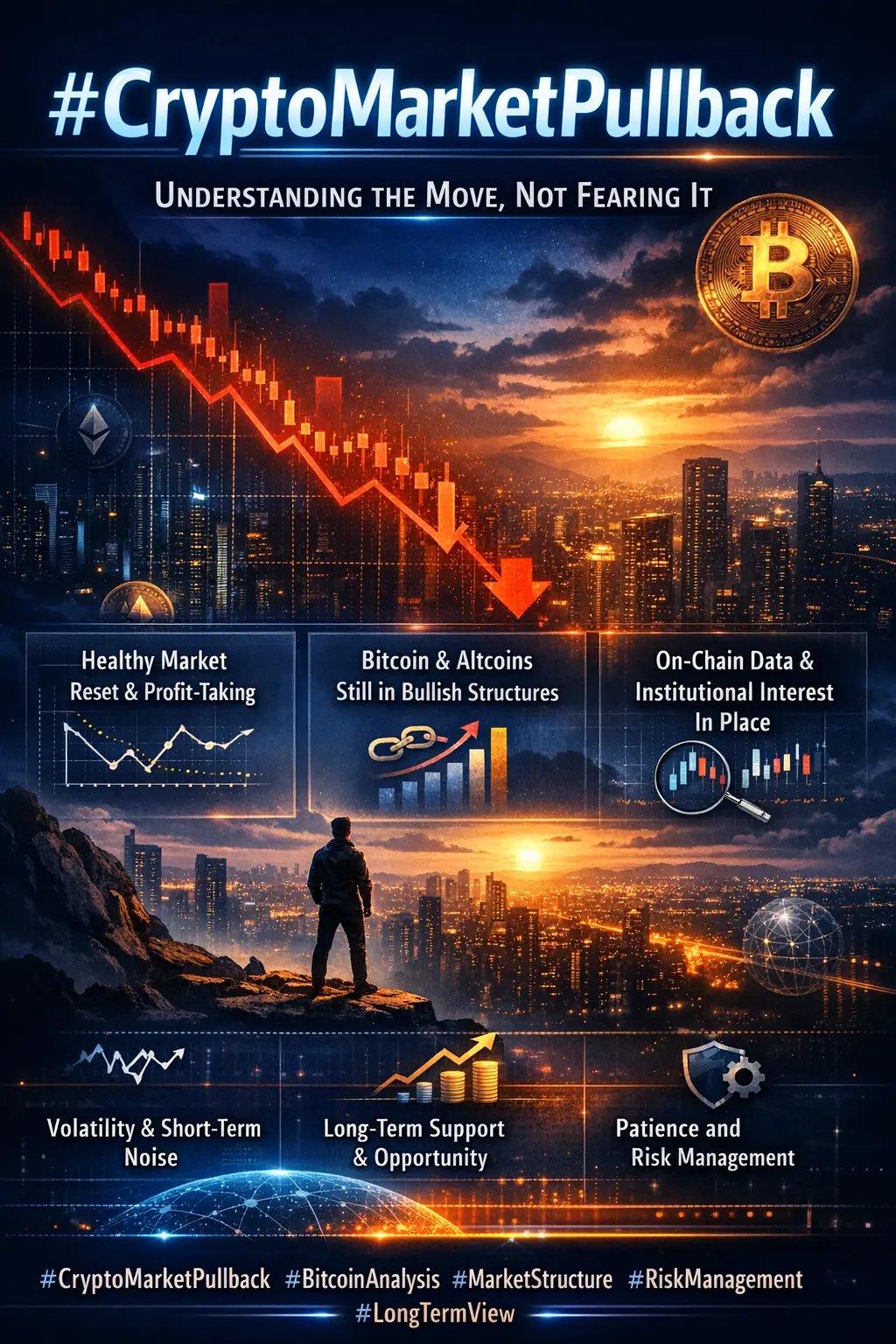

#CryptoMarketPullback 📉 | Shakeout or Setup?

The market just went through a brutal flush — but look closely.

BTC dipped toward $67.5K, swept liquidity, and has now rebounded back above $70K, currently trading near $70,280.

ETH followed the move, stabilizing near key support zones.

This wasn’t random panic.

It was a classic leverage reset.

📊 What happened? • Weak hands liquidated

• Over-leveraged longs wiped out

• Liquidity grabbed below support

• Strong bounce followed

Now the key level to watch: $70.8K–$71K

If BTC breaks and holds above $71K → momentum continuation toward $73K–$75K possible

The market just went through a brutal flush — but look closely.

BTC dipped toward $67.5K, swept liquidity, and has now rebounded back above $70K, currently trading near $70,280.

ETH followed the move, stabilizing near key support zones.

This wasn’t random panic.

It was a classic leverage reset.

📊 What happened? • Weak hands liquidated

• Over-leveraged longs wiped out

• Liquidity grabbed below support

• Strong bounce followed

Now the key level to watch: $70.8K–$71K

If BTC breaks and holds above $71K → momentum continuation toward $73K–$75K possible

- Reward

- 9

- 12

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

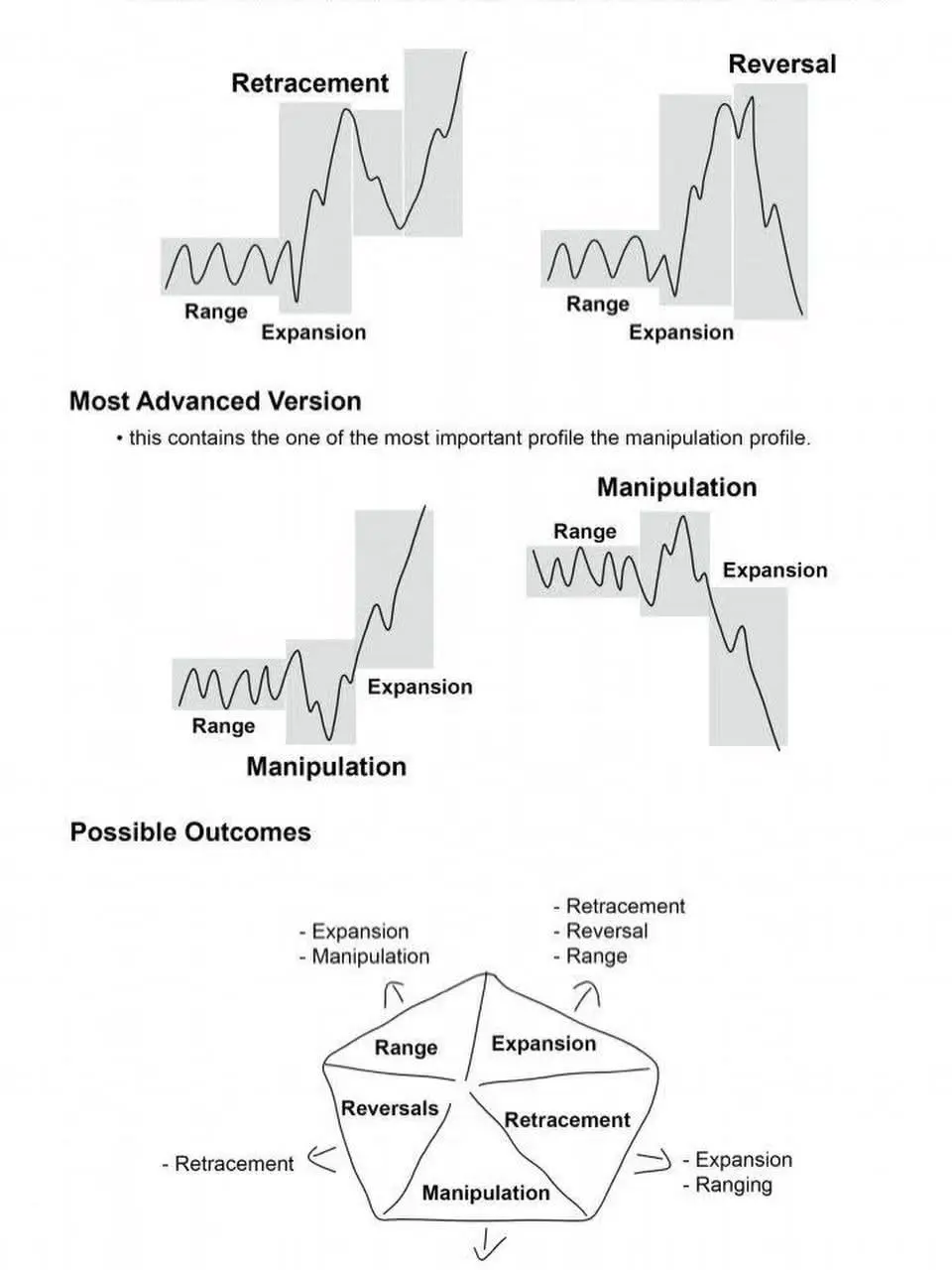

📈 Market Structure: The Cycle That Repeats Every Single Time 🔄**

Markets don't move randomly.

They follow **repeating cycles.**

.

**THE 4 PHASES:**

**1. Range** → Consolidation, indecision

**2. Expansion** → Strong trend move

**3. Retracement/Reversal** → Pullback or trend change

**4. Manipulation** → False moves before real breaks

.

**🧠 HERE'S THE EDGE:**

Most traders see patterns.

Pro traders see **phases.**

Know the phase = Know your move. 💡

.

**🎯 HOW IT WORKS:**

**Range Phase:**

Price trapped between support/resistance.

Smart money accumulating.

Retail thinks "it's stuck

Markets don't move randomly.

They follow **repeating cycles.**

.

**THE 4 PHASES:**

**1. Range** → Consolidation, indecision

**2. Expansion** → Strong trend move

**3. Retracement/Reversal** → Pullback or trend change

**4. Manipulation** → False moves before real breaks

.

**🧠 HERE'S THE EDGE:**

Most traders see patterns.

Pro traders see **phases.**

Know the phase = Know your move. 💡

.

**🎯 HOW IT WORKS:**

**Range Phase:**

Price trapped between support/resistance.

Smart money accumulating.

Retail thinks "it's stuck

- Reward

- like

- Comment

- Repost

- Share

Bitcoin doesn’t move randomly — it moves in seasons.

Data tells the story 👇

• Q1: Mixed, often volatile

• Q2: Momentum-building phase

• Q3: Mostly consolidation

• Q4: Historically the strongest quarter 🚀

Patience gets tested early.

Discipline gets rewarded later.

Smart money watches the calendar, not the noise.

$BTC #Bitcoin #CryptoCycles #MarketStructure

Data tells the story 👇

• Q1: Mixed, often volatile

• Q2: Momentum-building phase

• Q3: Mostly consolidation

• Q4: Historically the strongest quarter 🚀

Patience gets tested early.

Discipline gets rewarded later.

Smart money watches the calendar, not the noise.

$BTC #Bitcoin #CryptoCycles #MarketStructure

BTC-0,16%

- Reward

- like

- Comment

- Repost

- Share

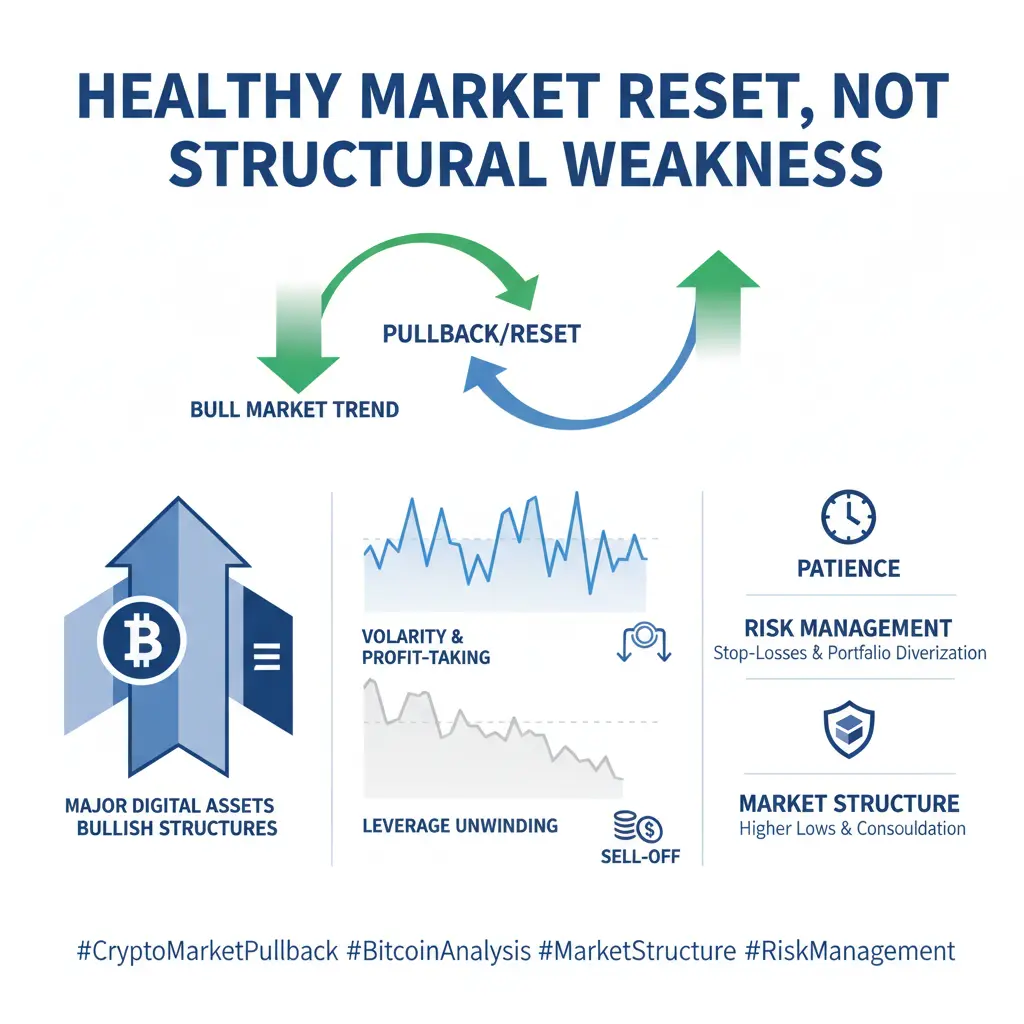

#CryptoMarketPullback — Understanding the Move, Not Fearing It

The recent crypto market pullback has unsettled many participants, but viewed through a professional lens, this phase reflects a healthy market reset rather than structural weakness. After an extended period of strong upside and elevated leverage, cooling-off periods are both normal and necessary. Short-term volatility is being driven by macro uncertainty, profit-taking from recent highs, and the unwinding of overleveraged positions — not a breakdown of long-term fundamentals.

Bitcoin and major digital assets continue to trade with

The recent crypto market pullback has unsettled many participants, but viewed through a professional lens, this phase reflects a healthy market reset rather than structural weakness. After an extended period of strong upside and elevated leverage, cooling-off periods are both normal and necessary. Short-term volatility is being driven by macro uncertainty, profit-taking from recent highs, and the unwinding of overleveraged positions — not a breakdown of long-term fundamentals.

Bitcoin and major digital assets continue to trade with

BTC-0,16%

- Reward

- 7

- 12

- Repost

- Share

NovaCryptoGirl :

:

Happy New Year! 🤑View More

$XRP stands out for how it contrasts with DeFi-native assets while still shaping broader market behavior. Its focus on payments, liquidity, and institutional rails sets a high standard for efficiency a benchmark that decentralized systems often reference, even when their architectures differ.

On $TON , STONfi embodies a similar efficiency-driven philosophy at the application layer. It isn’t a payments protocol, but it emphasizes the same priorities: speed, predictability, and reliable execution. For users navigating multiple ecosystems, STONfi creates a practical bridge, allowing capital

On $TON , STONfi embodies a similar efficiency-driven philosophy at the application layer. It isn’t a payments protocol, but it emphasizes the same priorities: speed, predictability, and reliable execution. For users navigating multiple ecosystems, STONfi creates a practical bridge, allowing capital

- Reward

- 4

- 6

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

204.15K Popularity

3.84K Popularity

5.15K Popularity

8.4K Popularity

3.17K Popularity

44.41K Popularity

1.16K Popularity

2.49K Popularity

22.24K Popularity

1.06K Popularity

1.73K Popularity

11.85K Popularity

1.57K Popularity

18.38K Popularity

10.52K Popularity

News

View MoreSolana's ultra-low transaction fees comparison released: surpassing Base, BNB, and Polygon, becoming the preferred execution layer for high-frequency DeFi.

1 m

U.S. Treasury yields decline as the market focuses on the upcoming non-farm employment report

2 m

Nitro staking Monad ecosystem: up to $500,000 per project, execution capability becoming the new threshold for funding

3 m

Sam Altman's "Eye Scan" company executives resign en masse, Orb project faces another trust crisis

4 m

Solana Treasury Strategy Fails? US-listed Companies Hold SOL with Over $1.5 Billion Unrealized Loss

6 m

Pin